11/11/2019

Employee share options typically have an exercise period following vesting, giving employees the choice to exercise their options over a number of years.

Under the accounting standards, employee share options are required to be expensed at fair market value calculated using standard option pricing models. Companies need to estimate some of the inputs in the pricing models, including the expected time to exercise as this will have an impact on the option value. Employees who hold options face risks which cannot be hedged, and they usually choose to exercise early rather than hold the options to expiry.

One approach is to use the option’s estimated expected life as an input to the standard option valuation model, the Black -Scholes-Merton formula.

In a paper funded by the Society of Actuaries (see HERE), J. Carpenter, R. Stanton and N .Wallace developed an empirical model of employee share option exercise behaviour suitable for valuation purposes.

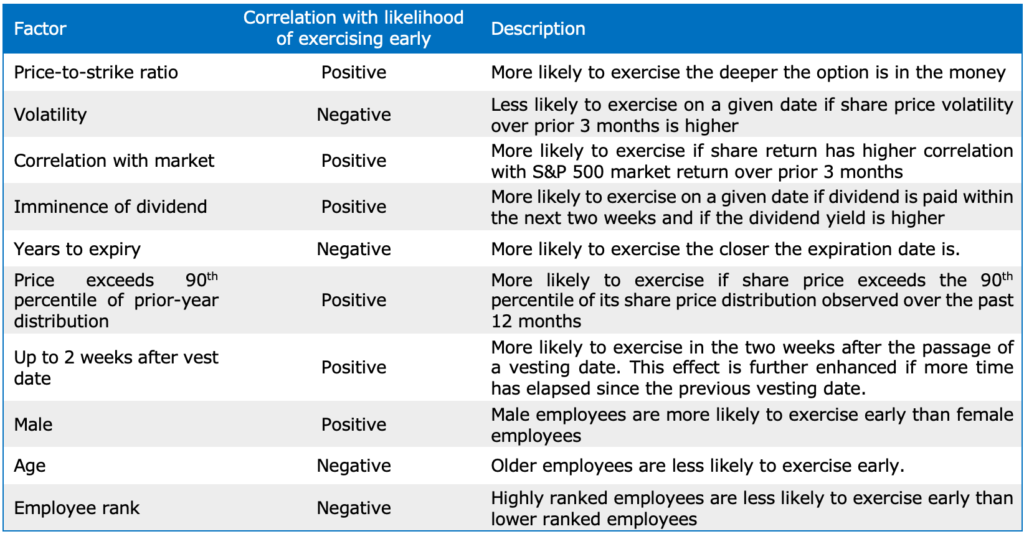

The table below shows the model factors influencing employee exercise:

Table 1: Option exercise factors

The paper also compared the option fair value using the empirical model to the standard practice of valuing options using Black-Scholes-Merton with an expected life calculated as the average of the vesting date and expiry date (i.e. midpoint of remaining life).

For typical at-the-money options with vesting at 2 years and expiry at 10 years after grant date, the fair values from both methods were generally within 10% of each other under different assumptions for volatility, dividend yields, time remaining and termination rates.

There were two scenarios where the fair values for both models differed significantly. When the vesting schedule was changed to monthly vesting over 4 years, which is a common vesting schedule in the US, the Black-Scholes-Merton approach overestimated the fair value by 24%. For an option with 8 years to maturity and exercise price set to twice the share price, the Black-Scholes-Merton approach underestimates the fair value by 33%.

Methodology

The empirical model predicts the expected proportion of options that will be exercised by the employee on a given day. The decision to exercise on each day will be influenced by the variables described in Table 1.

The fair value for an option can be calculated using a Monte Carlo model, simulating the share price movement and incorporating the exercise decisions from the empirical model.

The paper examined the complete history of over 800,000 option grants from 1981 to 2009. A total of 561,073 option exercise events from 290,052 employees who received these grants from 88 publicly-traded US companies were observed. Together, they provide a sample of over 378 million employee-grant-day observations of vested in-the-money options that could potentially be exercised voluntarily.

Across the sample, the typical option plan vests annually over 3 or 4 years and the options expire 10 years after grant.

Guerdon Associates comments

The main advantage of the Black-Scholes-Merton midpoint approach is in its simplicity. The assumption is in line with observed median time to exercise before expiry in academic research.

The simple approach may be valid for some companies, and it is useful to determine the number of options to allocate in many situations. However, in our valuation work we find it fails to properly account for factors other than time when it comes to how employee exercise behaviour is influenced.

It would be worthwhile to examine the option exercise behaviour of your employees to see if they are exercising earlier than expected. Using a more sophisticated model to calculate the expected option life can result in a more valid valuation and an improved bottom-line.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter