04/03/2019

What should be the performance measures for the managers of superannuation?

A recent paper released by Gordon L Clark and Ashby Monk from the University of Oxford and Stanford University respectively, concludes that current measurement metrics are unsuitable. This brings into question the current incentive plan for the management of these institutions. The Productivity Commission report on Superannuation was referenced.

The paper suggests that current incentives and metrics for long-term investors such as superannuation funds are short sighted, despite investing over long-term horizons. This leads to a misalignment of objectives between long-term investors and stakeholders. They argue that “absolute return benchmarks are problematic”. The measures can be gamed.

Instead, they have followed the five ‘golden rules’ to create more effective metrics. They are consistency, relevancy, transparency, mutual exclusivity and flexibility.

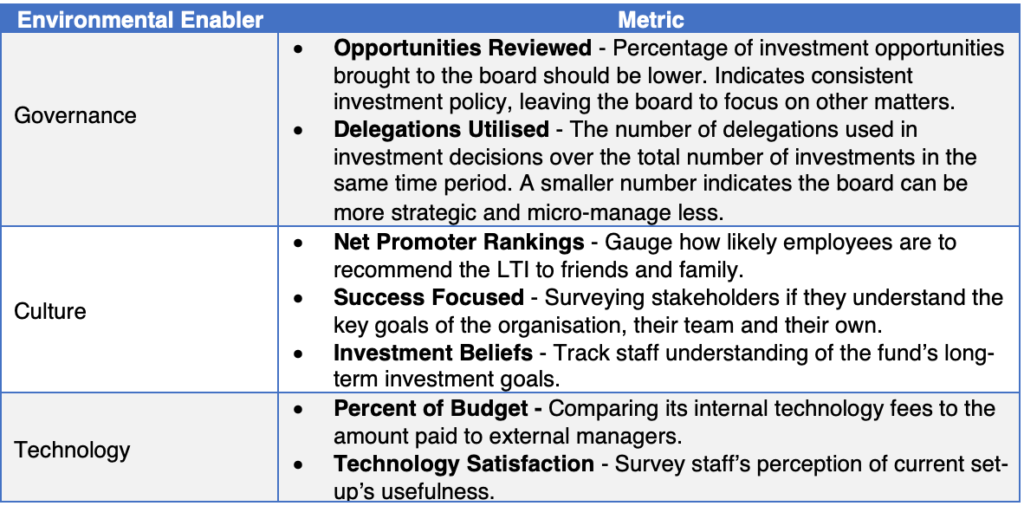

Environmental enablers have been traced to have an impact on “the quality of any organization’s investment performance”. Clark and Monk see governance, culture and technology as the key to creating the change that organizations would like to see. This needs to be aligned with the goals of the long-term investors if they ever desire to “alter the quality and combination of its production inputs to create better outputs”. They present metrics on how they can be measured relative to desired performance and these are summarised in the table below.

Table 1: Environmental Enablers

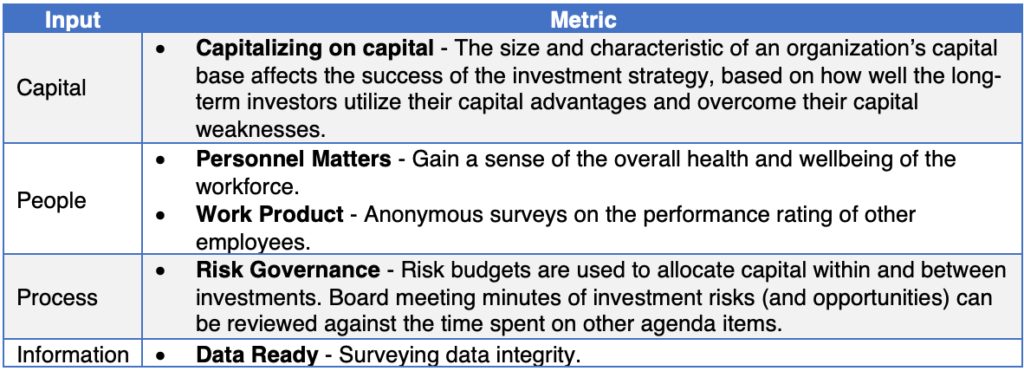

While the environmental enablers are a long-term measurement, production inputs are seen to be short-term changes that can be affected by management. The inputs proposed by the authors are the conventional factors of production. See Table 2.

Table 2: Inputs

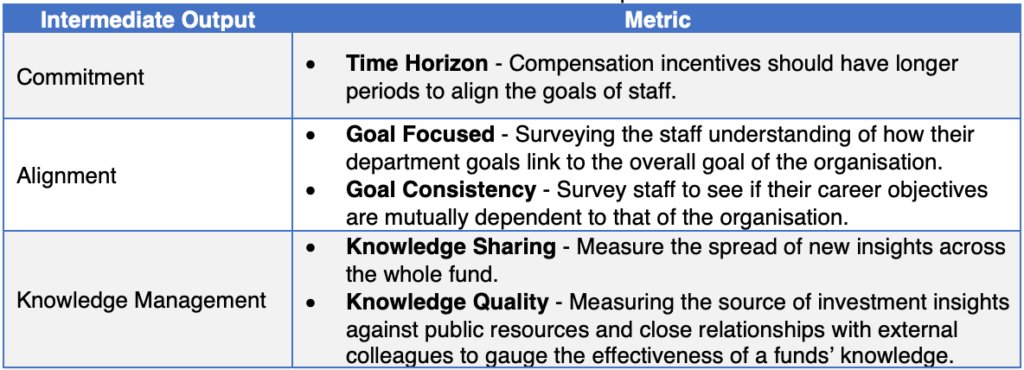

Given the long-term view that long-term investors are expected to adopt, the paper saw “developing performance metrics that offer reliable insights as to the short-term progress towards a long-term goal is challenging (but not impossible)”. A way to measure the progress of the companies on their “onward journey to the long term-goal” is needed. Three ‘intermediate’ outputs have been created to bridge the short-term and long-term goals. These are summarised in the table below.

Table 3: Intermediate Outputs

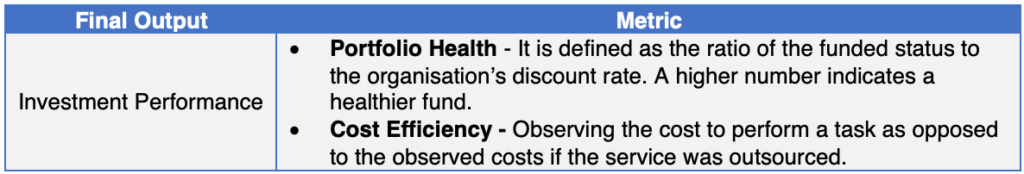

Clark and Monk have changed the metrics measuring final investment results. They have eliminated conventional metrics such as “long-term risk-adjusted rate of net return”. Based on the study, they suggest the metric to still have links with investment performance and have the benefits align with the intermediate goals.

Table 4: Final Outputs

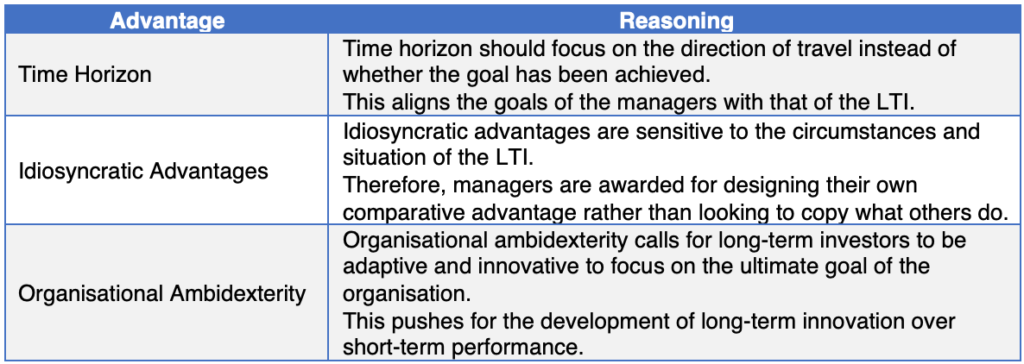

Given evidence that ineffective or inconsistent metrics can adversely affect organisational performance, the paper has put forward metrics which are “chosen as to enhance the advantages of long-term investors over third-party service providers”. These advantageous metrics are time horizon, idiosyncratic advantages and organizational ambidexterity.

Table 5: Advantages of New Production Function

GA Comments

It would be interesting to adapt these towards the remuneration incentives of management in superannuation funds and other long-term investors in Australia. Given the enormous change being wrought upon superannuation fund governance arising from the Hayne Royal Commission and Productivity Commission reports the opportunity may soon arise.

From the paper, future incentive plans should be based around bridging the gap between short-term and long-term goals. The intermediate output metrics would not appear to be a reliable form of incentive measurement but do inform what an effective manager should be doing. However, the culture metrics present an interesting test to those that base parts of their STIs on non-financial measures. For the long-term incentives, the profits of the long-term investor is ultimately determined by the decisions made by the managers. Hence, the final output metrics would serve as a different way to determine its success.

The paper can be found HERE

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter