07/09/2020

With COVID-19 induced dividend reductions, employee layoffs and key management personnel remuneration adjustments, many ASX 200 companies have also availed themselves of government handouts. The nature and extent of government support, and executive pay, is a sensitive topic for investors this proxy season.

We performed a hypothesis test to see whether ASX 200 companies with COVID-19 remuneration adjustments are accessing larger government subsidy grants compared to companies without a remuneration adjustment. Are those accessing government funding in need of financial help or are they simply chasing a free meal? If it is the latter, is it a function of companies maximising shareholder outcomes, just as they would from pocketing diesel fuel tax credits in mining or agribusiness companies in more normal times, and ok to be rewarded for it?

To account for the size of different companies taking on government funding, we utilised the ratio of government funding to the company’s 30-day market capitalisation up to the 31st of August.

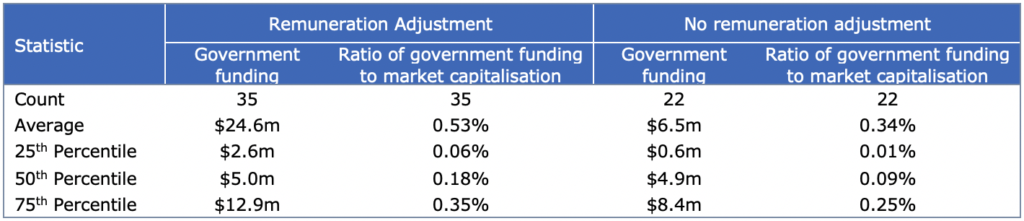

Table 1 below shows that the COVID-19 sample (i.e. announced remuneration adjustments) received larger amounts of government funding. The ratio is also higher for the COVID-19 sample for all statistics.

Table 1: ASX 200 Government Funding

A T-test was used to determine if there was a statistically significant difference between the two groups. This hypothesis test examines if the means of 2 samples are equal. The test was conducted using the ratio of government funding to the natural logarithm of the company’s 30-day market capitalisation. The natural logarithm was used to normalise the market capitalisation data.

At a 95% confidence level the means of the 2 samples are unequal. This result is statistically significant which means there is less than a 5% chance that the conclusion of the means not being equal is wrong.

In plain English, companies receiving government support are more likely to adjust executive pay. But not all, as it depends on the materiality of the support to company value.

Further, if the government funding received is more than 0.18% of the market capitalisation, and no remuneration adjustment was made, the company would be an outlier. Directors better get out those calculators. Or, just call us.

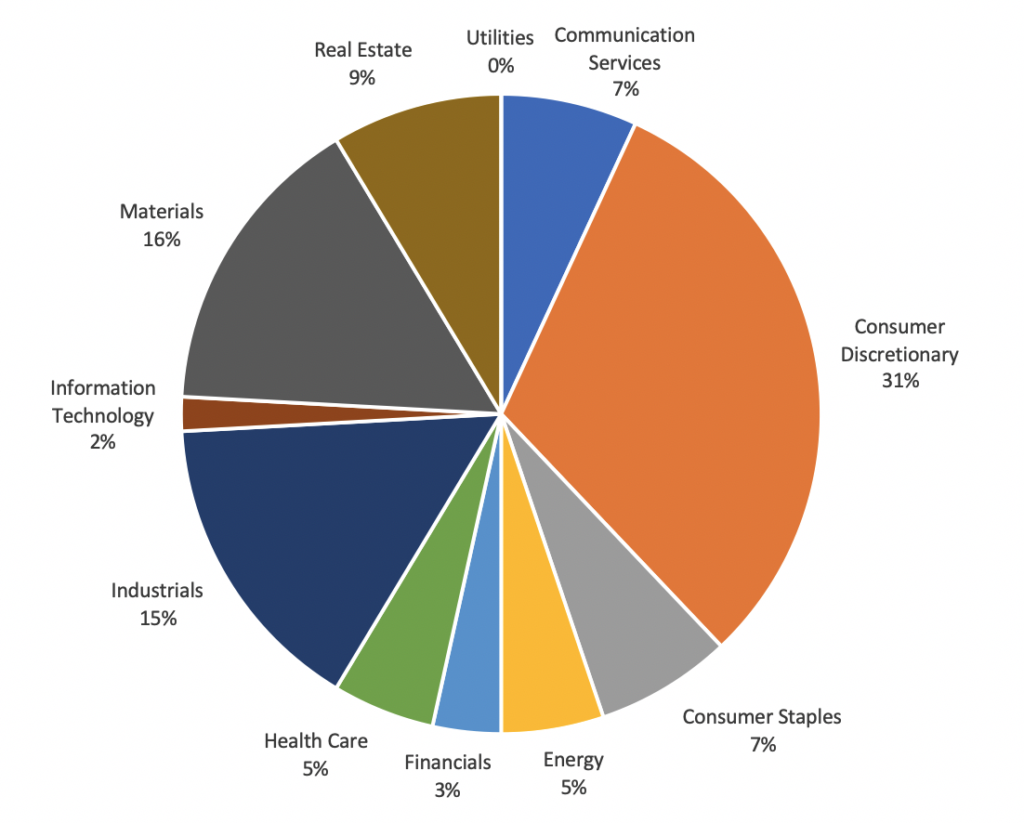

We also took a look at the GICS sector breakdown of companies accessing government funding.

Figure 1: ASX 200 government funding GICS sector breakdown

The Consumer Discretionary, Industrials and Materials sectors make up over half of the companies accessing government subsidy programs. It is hardly a surprise, then, that the Consumer Discretionary and Industrials sectors make up 41% of the 77 ASX 200 COVID-19 remuneration adjustments.

For data analysis on the 77 COVID-19 remuneration adjustments including the timing, size, GICS breakdown and which KMP are affected click HERE.

Alternatively, click HERE to view our database with all COVID 19 remuneration adjustments for ASX200 companies.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter