09/08/2021

In recent news, the Australian Treasury proposed regulation of proxy advisers. Guerdon Associates’ submission (see HERE) identified a number of issues with the Australian Treasury’s proposed regulation of proxy advisers.

One aspect that the Treasury brief did not canvas was a code of conduct. This already exists. Based on a recent independent review it provides a basis for assessment, although more work needs to be undertaken to achieve consistency in standards across proxy advisors.

The Best Practice Principles Group (BPPG) was formed in February 2013 to promote greater understanding of the corporate governance or ESG research and support services provided to professional investors and other capital markets participants.

The current proxy firm signatories to the Best Practice Principles for Shareholder Voting Research Providers are:

- Glass Lewis

- ISS

- Minerva Analytics (UK provider of corporate governance and shareholder voting services)

- PIRC (Pensions & Investment Research Consultants, an independent European shareholder advisory service)

- Proxinvest (a French independent proxy firm)

- EOS at Federated Hermes (an American stewardship service provider)

Each proxy firm signatory provides annual self-reported compliance statements based on three main principles for proxy adviser best practices:

- Principle 1: Service Quality – Signatories provide services that are delivered in accordance with agreed client specifications. Signatories should have and publicly disclose their research methodology and, if applicable, “house” voting policies.

- Principle 2: Conflicts of Interest Avoidance or Management – Signatories should have and publicly disclose a conflicts-of-interest policy that details their procedures for addressing potential or actual conflicts of interest that may arise in connection with the provisions of services.

- Principle 3: Communications Policy – Signatories should provide high-quality research that enables investor clients to review the research and/or analysis sufficiently in advance of the vote deadline ahead of a general meeting.

In 2019, the BPPG established an Independent Oversight Committee (IOC) to provide an annual review of the Best Practice Principles and the public compliance statements of each signatory.

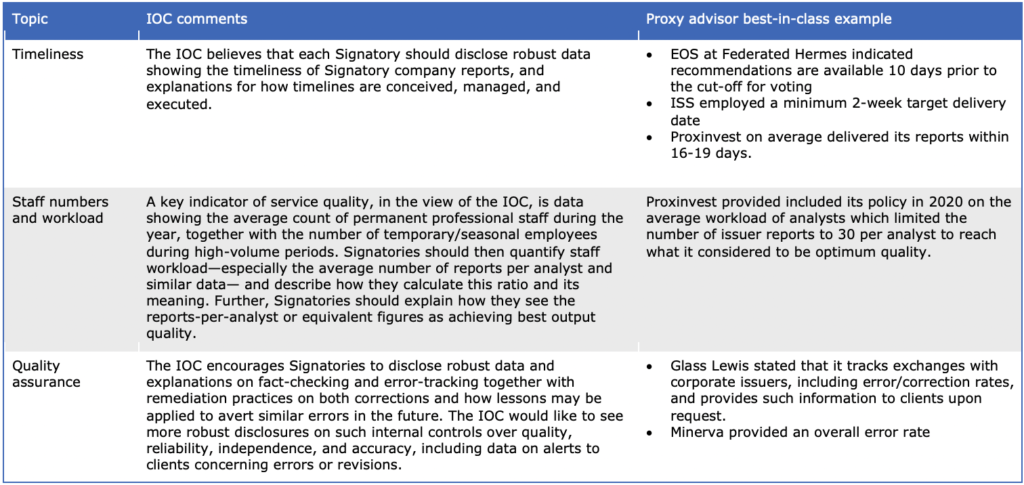

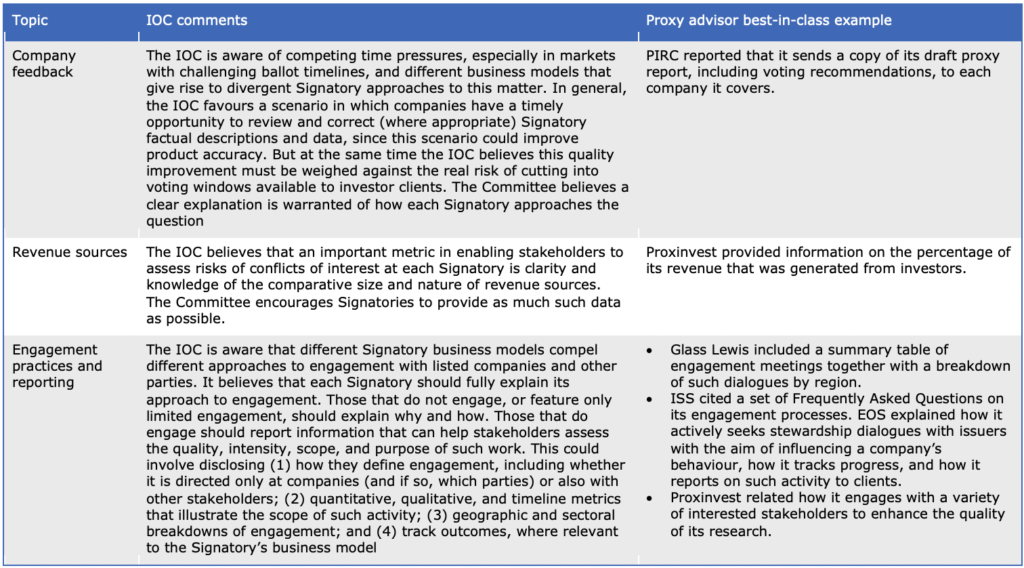

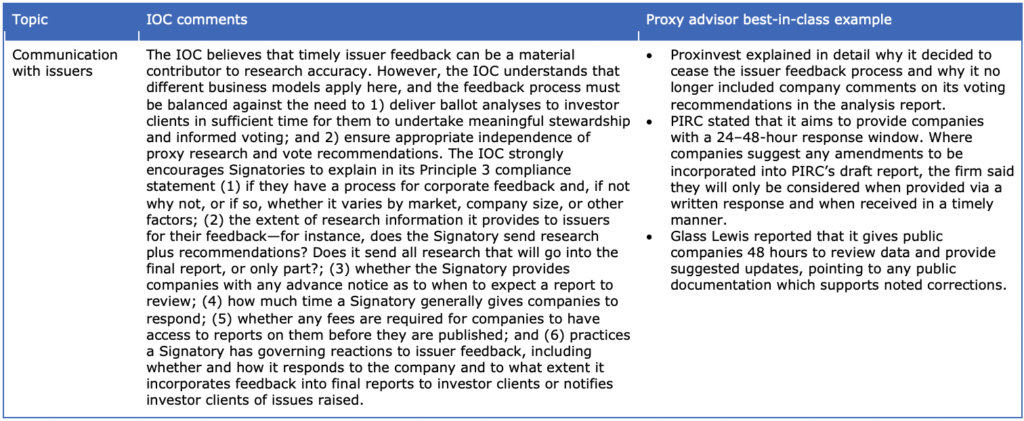

In its first report published in July 2021, the IOC found all six proxy firms had met the standards established by the BPPG. However, there were a number of topics where signatory reporting could be improved upon with some best-in-class proxy disclosures identified. The table summarises some of the key topics, particularly relevant to the Australian Treasury’s proposed regulation, based on the IOC’s review of 2020 compliance statements.

© Guerdon Associates 2024

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter