10/05/2021

A consultation paper by the UK’s Financial Conduct Authority (FCA) on 19 April 2021 proposed new remuneration requirements under the UK Investment Firm Prudential Regime (IFPR).

Firms would need to apply the new rules from the start of their next performance year beginning on or after 1 January 2022. It has implications for a few Australian financial services companies that have more than branch operations in the UK.

The proposed UK standards (see details below) do not apply to banks, insurers or pension funds unless they provide 3rd party investment services or advice. They would apply to asset managers. Nevertheless, the UK regulation shares similar principles to the APRA CPS 511 draft regulations and provide a number of solutions, similar to those suggested by Guerdon Associates, for issues faced by APRA (see HERE):

- The term “balanced” is used to assess appropriate fixed vs variable remuneration, and financial vs non-financial criteria. This approach is more appropriate than “material” as it takes into context the responsibilities of the specified position and organisational context.

- Fixed and variable remuneration are defined by the company’s remuneration policy based on the quality and purpose of the component. Compared to APRA’s prescriptive approach, this provides more flexibility for non-traditional incentive framework.

- Remuneration of senior staff in risk management and compliance functions is directly overseen by the management body in its supervisory function or remuneration committee. This mitigates the conflict of interest associated with reliance on management review of their own remuneration.

Therefore there are some aspects in the UK regulation that one may have wished for in APRA’s regulation. While the horse has not bolted, it is well and truly out of the stable. Pity.

For material risk takers at larger firms, the UK prescribed requirements for variable remuneration include:

- Minimum 40% (60% for variable remuneration above £500k) deferred for 3 years.

- 50% of the variable remuneration must be paid in equity-based instruments.

- Vesting may not be faster than pro-rata. The first vesting point must be a more than a year after the start of the deferral period.

- No interests or dividends can be received from the deferred instrument during the deferral period.

Overview

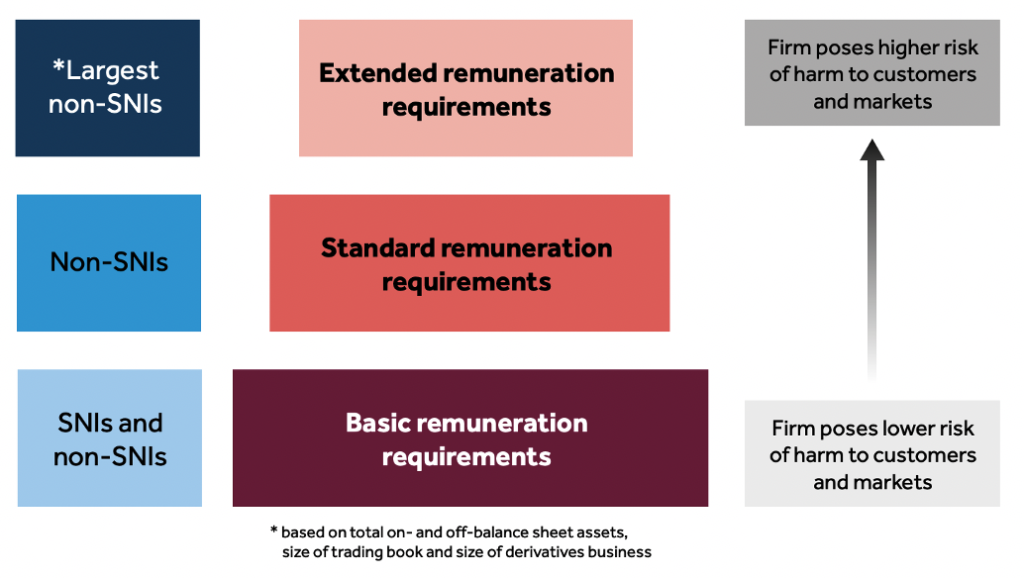

A proportionality framework was introduced with three levels of remuneration requirements. The categorisation depends on the firm’s potential or scale of activities that would cause significant harm to its customers or markets in which it operates. The lowest level includes small and non-interconnected investment (SNI) firms (generally have a balance sheet total under £100m) which are only subject to the basic remuneration requirements. The figure overleaf summarises the proportionality framework.

Figure 1: Overview of application of remuneration requirements

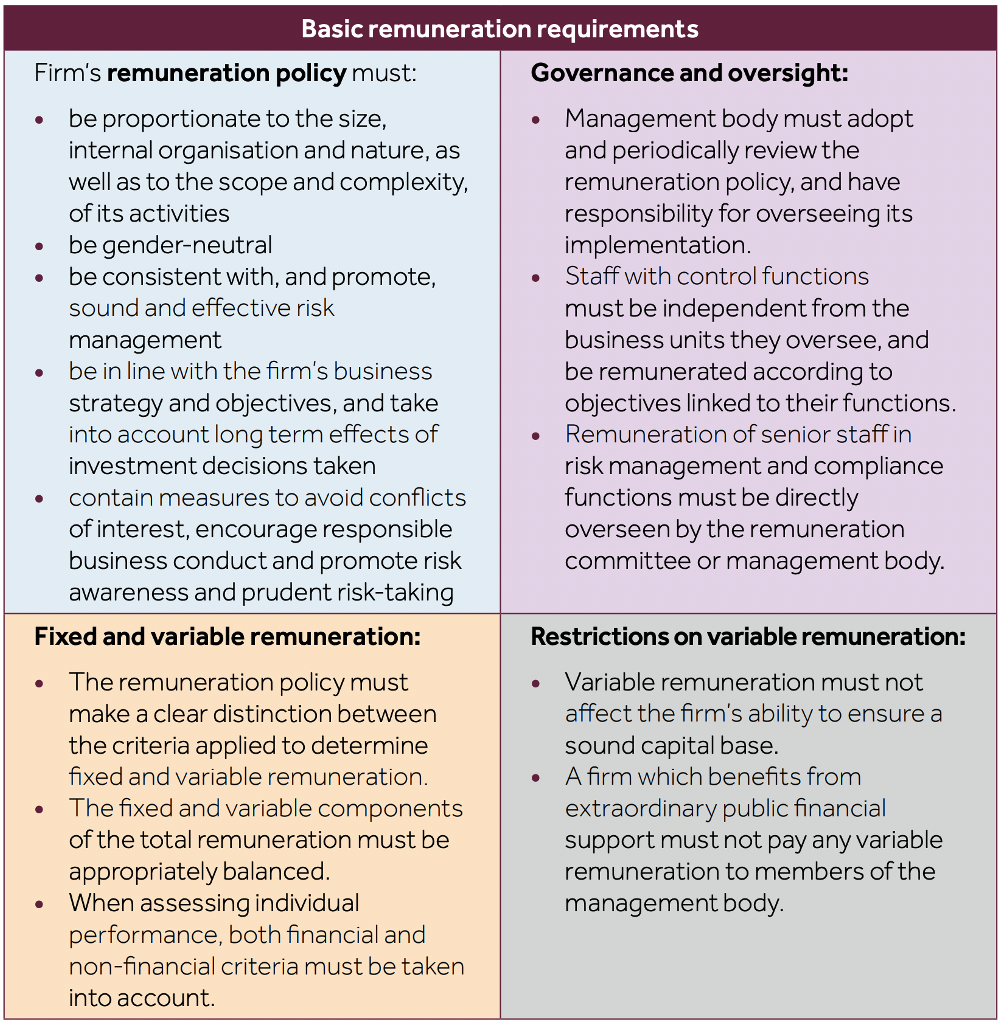

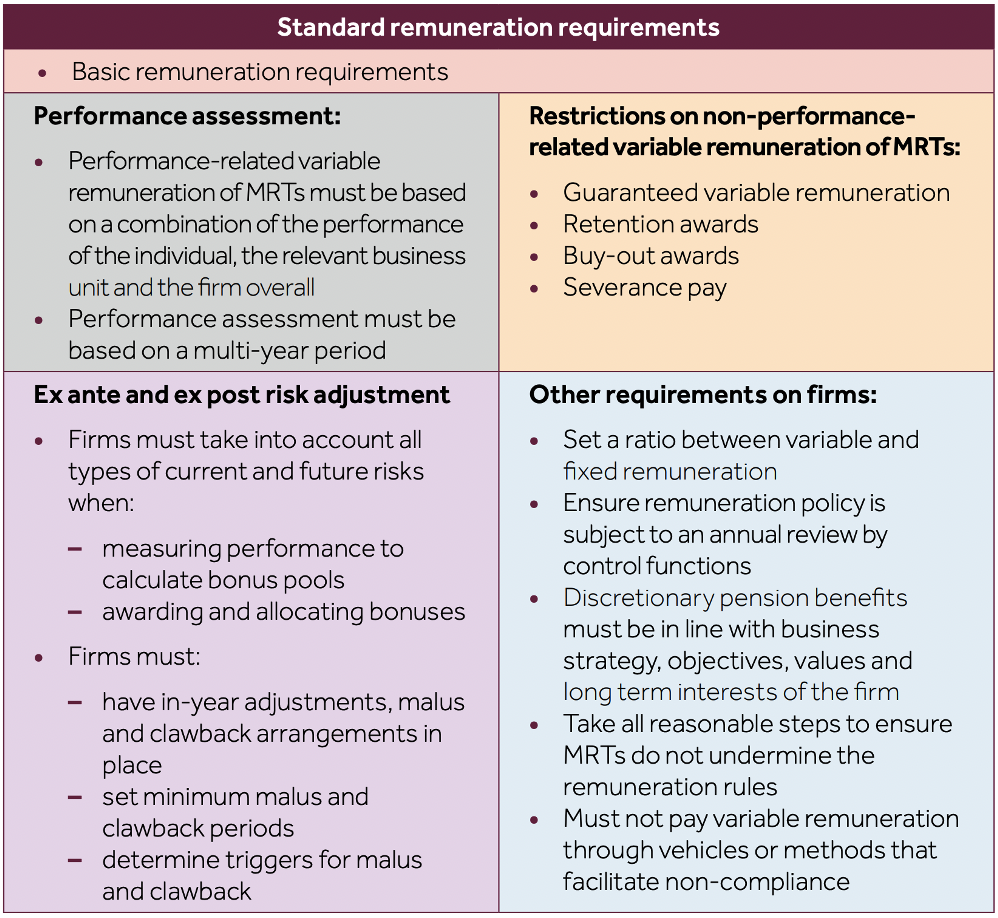

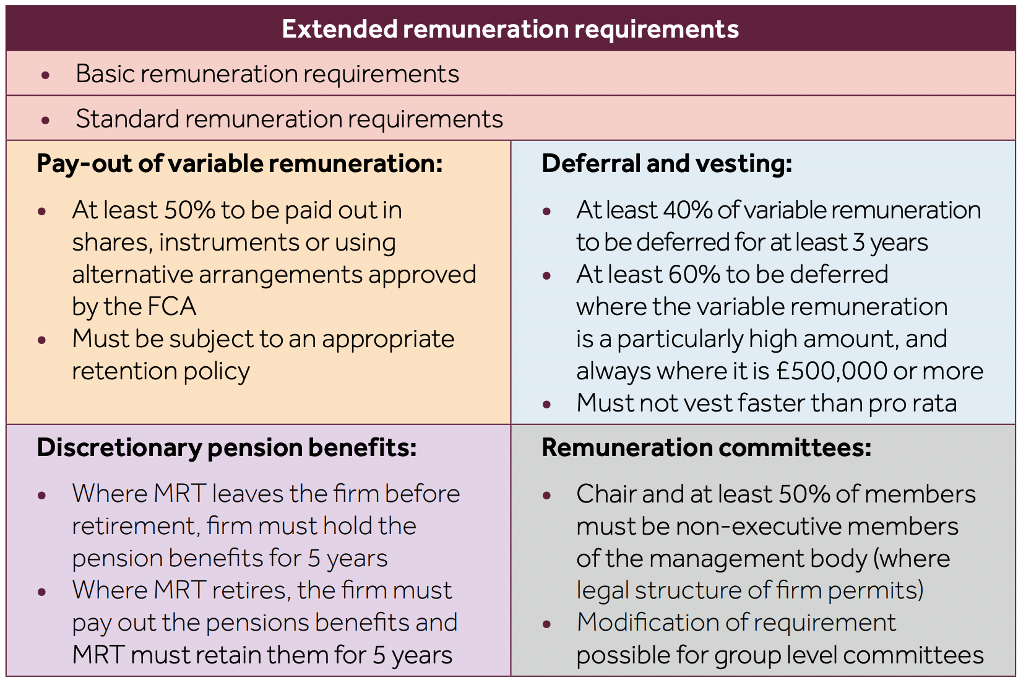

The tables (adapted from the Consultation Paper) summarises the remuneration requirements for three levels followed by a detailed discussion and Guerdon Associates observations.

Figure 2: Overview of basic remuneration requirements

Figure 3: Overview of standard remuneration requirements

Figure 4: Overview of extended remuneration requirements

Gender neutrality

UK employers are already required to have gender neutral remuneration policies under the UK Equality Act 2010. The FCA proposed to include the requirement as a reminder to firms of their existing obligations and allow for supervision of the extent to which firms are meeting the standard.

Governance and oversight

Each firm must adopt and periodically review the remuneration policy. The development and review should be supported by control function and business units. For non-SNIs, there must be an independent, internal review (by the internal audit function, where one exists) at least annually.

To mitigate any conflict of interests in determining remuneration outcome:

- The remuneration of senior staff in risk management and compliance functions is directly overseen by the management body in its supervisory function or remuneration committee.

- All staff with control functions are independent from the business units they oversee, have appropriate authority, and are remunerated according to objectives linked to their functions (independent of the performance of the business areas they control).

The FCA addresses the potential risk and conflict of interest associated with reliance on management review of their own remuneration. Similar to our criticisms of APRA’s CPS 511 draft, the absence of an independent third-party review means the issue of boards only receiving conflicted advice is not sufficiently addressed.

Defining fixed and variable remuneration

All investment firms are required to have remuneration policies which clearly define fixed and variable remuneration based on the quality and purpose of the component. The FCA-suggested definitions are:

- Fixed remuneration should be permanent, pre-determined, non-discretionary, non-revocable and not dependent on performance.

- Variable remuneration should be based on performance or, in exceptional cases, other conditions; it includes discretionary pension benefits.

The term ‘non-revocable’ for fixed remuneration would include cash salary but likely exclude any time or service contingent remuneration subject to malus. APRA’s CPS 511 drafts have tried to finesse their prescriptive definition of ‘variable remuneration’ to account for non-traditional incentive plans. The FCA approach provides more flexibility for the company to make their own determinations which will depend on the structure of their remuneration framework.

Balanced remuneration and non-financial criteria

The mix of fixed and variable components of an individual’s total remuneration must be “appropriately balanced”. Firms must also take into account both financial and non-financial criteria when assessing the individual performance of their staff. To ensure the overall outcome of the individual performance assessment is appropriate, there should be a balance between financial and non-financial criteria. The term “balance” includes consideration of the firm’s business activities, role of the individual and their exposure to risk.

We have continued to suggest for APRA to adopt the term “balanced” instead of “material” for non-financial measures in their CPS 511 draft. The suggested approach would consider what is appropriate for non-financial measures taking into account the responsibilities of the specified position and organisational context.

Performance assessment

Non-SNI firms should ensure that performance-related variable remuneration for material risk takers (MRTs) are based on a combination of the performance of the individual, relevant business and firm overall. It must be assessed on a multi-year period which takes into account the business cycle of the firm and its risks.

Risk adjustment

Non-SNI firms must consider financial and non-financial ex-ante risk adjustments when awarding and allocating variable remuneration.

They must also have mechanisms for ex-post risk adjustments including in-year adjustments and malus and clawback provisions. Malus provisions must be applicable until the award has vested in its entirety, and the clawback period must be greater than the deferral plus retention (restriction) period.

Deferral for largest non-SNIs

The extended remuneration requirements prescribe deferral requirements for MRTs at the largest non-SNIs.

- At least 40% (60% if VR is above £500k) must be deferred for at least 3 years.

- 50% of the VR must be payable in equity-based instruments

- Vesting may not be faster than pro-rata. The first vesting point must be a more than a year after the start of the deferral period.

- No interests or dividends can be received from the deferred instrument during the deferral period.

Although the FCA expects a greater deferral period for 3 years for some positions (probably the CEO), the prescribed minimum is much shorter than APRA’s CPS 511 draft which prescribes a minimum deferral period of 6 years for the CEO and 5 years for senior executives. It will be significantly more difficult for Australian banks and super funds to attract any quality recruits from UK given the minimum deferral period is almost doubled.

While dividend equivalent payments paid on vesting remain viable under the FCA proposals, changes would be required for companies paying deferred STIs as restricted shares with dividends payable during the deferral period.

See the full consultation paper HERE.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter