09/08/2021

The Australian Council of Superannuation Investors (ACSI) has released its latest survey of CEO remuneration based on FY20 disclosures. These include companies with 31 December financial year ends. The ACSI review is a useful complement to Guerdon Associates’ FY20 executive remuneration review published in February, which did not include 31 December disclosures (see HERE).

The main points arising from ACSI’s FY20 report are:

- COVID-19 impacted CEO pay in a significant way. More CEOs in the ASX 100 received zero annual incentives – more than double the number of zero outcomes in the FY19 survey.

- The median annual incentive outcome as a percentage of maximum for ASX 100 CEOs fell from 60% in FY19 to 31% in FY20.

- Median reported pay of ASX 100 CEOs (i.e., statutory reporting) fell 18.6% to the lowest level since 2006.

- FY20 median realised pay for ASX 100 CEOs fell 3.6% from FY19.

- No “big four” bank CEO made the highest realised or reported pay rankings.

- Annual incentive outcomes for CEOs in the ASX 101-200 fell from 60% of maximum to 50% of maximum.

Here is a summary of ACSI’s findings.

Fixed Remuneration

Median fixed pay for the ASX 100 CEOs declined from FY19 to FY20 by 5.1% to $1.68m, a value not seen since 2007. ACSI’s study attributed this decline to flat wages among the 68 incumbent CEOs in the sample, as well as new CEOs starting at lower levels of pay.

While not specifically stated, it appears ACSI has used the disclosed fixed remuneration that was widely subject to temporary reductions at the commencement of COVID-19. On this basis, it would be expected there would be a reduction and the 5.1% reduction was indicative of the effect of the temporary adjustments to CEO fixed pay.

Only a handful of CEOs received pay rises and ACSI noted that ANZ’s CEO fixed pay rose 20% from the start of FY20.

ASX101-200 CEOs fared better than their large cap counterparts.

- Median fixed pay for ASX101-200 CEOs rose to above $1m and rose 7.8% from FY19 to FY20.

- Average fixed pay also rose, at a rate of 3.9% over last year.

- Incumbent ASX101-200 CEOs’ fixed pay saw a median increase of 8% over last year, with an average of 5.9%.

ACSI compared CEO fixed pay changes to the consumer price index to get a sense of these movements against inflation over time.

- For ASX100 CEOs, fixed pay outpaced inflation growth over FY01 to FY12, at which point inflation outpaced fixed pay to FY20. ACSI believes that the decline is due to the number of changes in CEOs and associated lower levels of pay.

- For ASX101-200 CEOs, fixed pay has outpaced inflation, with a 25% increase between FY11 and FY20, compared to CPI of 15.3%.

Realised pay

Again, this year ACSI’s definition of “realised pay” would best be described as a composite of realised pay and realisable pay. The former is the outcome from when an executive decides to exercise a right. This could be years after vesting. Realisable pay is the market value of a share on the day the share or share right vested. ACSI uses realised value for options, and realisable value for share rights (ZEPOs).

Nevertheless, ACSI’s analysis supports the hypothesis that executive pay is variable with market value and investor returns.

The pandemic had little effect on realised pay of the ASX100 CEOs.

- Median realised pay declined 3.6% from FY19.

- Average realised pay for the ASX 100 CEOs rose 11.5% over FY19. The higher average was due to some realised pay outliers received by the CEOs of CSL and Northern Star.

The perceived lack of pandemic impact can be explained by the vesting timeframes of the majority of the companies in the sample, with financial year ends of 30 June. It appeared that most incentives vested in the final quarter of the 2019 calendar year, long before the severity of the pandemic was to be realised only a few months later.

Among the ASX 101-200 CEOs, median and average realised pay also declined.

Foreign CEOs

For the first time, ACSI reported on twelve CEOs of Australian-listed companies domiciled outside of Australia and compared realised pay of the ASX 200 including and excluding these CEOs. The differences were stark – median realised pay of local CEOs was $2.6m while the median realised pay of foreign based CEOs was $3.66m.

One observation was the higher realised pay outcomes for CEOs based in the United States reflects the “US approach” to pay with large equity incentive allocations. Two of three US-based CEOs saw realised pay of more than $35m, while the five New Zealand CEOs in the sample saw a collective realised pay outcome of only $9.28m.

It clearly pays to go west.

Reported pay

COVID-19 had a major impact on reported pay across the ASX 100 CEOs.

- Median reported pay declined 18.6% from FY19 to FY20

- Average reported pay declined 14.4% from FY19 to FY20

- These declines were largely due to evident pay restraint, a decline in annual incentives and further deferral into equity.

Among ASX101-200 CEOs,

- Median reported pay was flat, with a decline of only 0.5% from FY19 to FY20

- Average reported pay declined by 7.6% from FY19 to FY20.

Short term incentives

As with previous years, ACSI labels STIs as “bonuses”. Technically, a bonus is a payment for an ex-post assessment of performance not subject to pre-defined performance objectives.

Among ASX 100 CEOs:

- FY20 saw a decline in median STI to 31% of maximum from 60% of maximum in FY19.

- 31% of CEOs eligible for an STI were awarded zero STI. The non-payment was largely attributed to the pandemic.

- The median STI awarded in FY20 declined 31.1% from FY19.

- Average awarded STI in FY20 declined 11.8% from FY19.

- Only 40 CEOs received a cash STI in FY20, compared to 66 in FY19. This is a result of many boards responding to the pandemic by deferring more STI awards into equity.

- The median cash STI in FY20 was $660,000, compared to $939,593 in FY19.

Among ASX101-200 CEOs:

- Median STI declined to 50% of maximum in FY20, from 60% of maximum in FY19.

- 21% of these CEOs received zero STI.

- The pandemic had very little effect on STI awarded, with median awards in FY20 rising marginally at 1.3% compared to FY19.

Seven CEOs received maximum STI in FY20, down from ten in FY19. Of the seven, three were also in the list in FY19.

Termination payments

Key observations were:

- There were sixteen termination payments in FY20 compared to 14 in FY19. Ten of these payments were over the $1m mark.

- In FY20, there were 10 instances of payments over $1m, compared to 6 in FY19. All except one of those payments were to ASX 100 CEOs.

- Overall, termination payments to all CEOs totalled $29.92m in FY20, the highest since FY11.

As pointed out previously, ACSI continues to think that a termination payment is remuneration received by a KMP after stepping down from the position but being retained in a non-KMP capacity. Some may disagree, as they would view their retention in an advisory, consultative capacity valid for commercial reasons, helping with the transition of the new CEO.

Same incumbent pay

As per the previous report, ACSI’s analysis includes a full population of CEOs i.e., they were included even if they were new to the position in the year. In FY20, there were 82 ASX 100 CEOs (compared with 83 in FY19) and 79 ASX 101-200 CEOs (compared with 73 in FY19). While this captures the state of the market, it does not indicate the remuneration of an individual CEO who has stayed in his or her position. This is captured in same incumbent data.

In FY20 there were 68 ASX 100 incumbents (compared with 66 in FY19) and 54 ASX 101-200 CEOs (compared with 52 in FY19).

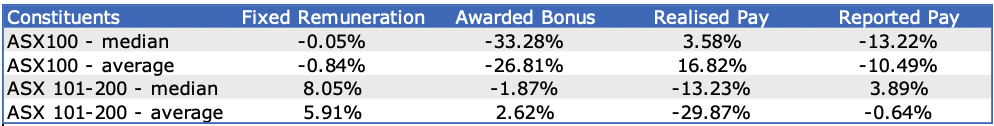

The data on a same incumbent basis is summarised in Table 1 below.

Table 1: ASX 200 2-year CEO same incumbent data

The effects of the pandemic on pay are clearly seen in the reduced outcomes of the ASX 100 CEOs, although realised pay has increased. Fixed remuneration improved for CEOs in the ASX 101-200, while realised pay decreased.

To view ACSI’s full report, see HERE.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter