12/02/2024

It is once again time for Guerdon Associates’ annual review of remuneration changes for Chief Executive Officers (CEOs) and Managing Directors (MDs) who led ASX 300 companies in the past 2 annual reporting periods.

Summary

The executives that we consider in our sample (n=144) consist of all ASX 300 CEOs and MDs who served two full years over the FY2022-FY2023 reporting periods without changing positions. Remuneration data was sourced from GuerdonData® and the ASX 300 companies’ annual reports. Data for total shareholder return (TSR) was sourced from LSEG (formerly Refinitiv®).

The median CEO total remuneration (TR) increased by 2.92%. This can be largely attributed to median increases in total fixed remuneration (TFR) and long-term incentives (LTIs) of 3.1% and 8.5%, respectively.

Consistent with most years since the GFC in 2009, ASX 300 CEO fixed remuneration increases were smaller than increases for the general population. The median increase in CEO total fixed remuneration (TFR) was 3.1% over the 2023 financial year, whereas the Australian Bureau of Statistics Wage Price Index rose by 4.0% over the year to September 2023.

This year saw a median TR increase of 2.92%, in contrast to the larger increase of 13.29% seen last year. The median TSR outcome of 13.8% was also unlike the negative outcome (-16.1%) seen previously.

Longitudinal Trends

Total remuneration (TR) is the sum of total fixed remuneration (TFR), short-term incentives (STI), and long-term incentives (LTI). Both STI and LTI reflect statutory disclosures, which includes the amortised value of deferred compensation and share-based payments expense when incentives are delivered as equity instruments.

During FY22-23, half of the ASX300 CEOs in our sample experienced a TR increase of over 2.92%. As shown in Figure 1, this is markedly lower than the median increases observed in the two preceding annual reports (13.29% and 15.77% in FY21-22 and FY20-21, respectively).

Figure 1: Median % change in total remuneration for all CEOs, during each two-year period since FY16-17.

Table 1 displays the median year-on-year change in each remuneration component over the 3 most recent two-year periods; for further details, refer to Guerdon Associates’ annual reviews of executive remuneration changes for FY21-22 and FY20-21.

Table 1: Median % change in each remuneration component for all CEOs, over the last 3 years.

|

Reporting Periods |

TFR |

STI |

LTI |

TR |

|

FY22-23 |

3.1% |

-3.8% |

8.5% |

2.92% |

|

FY21-22 |

4.5% |

6.1% |

14.7% |

13.3% |

|

FY20-21 |

0.9% |

24.6% |

19.4% |

15.8% |

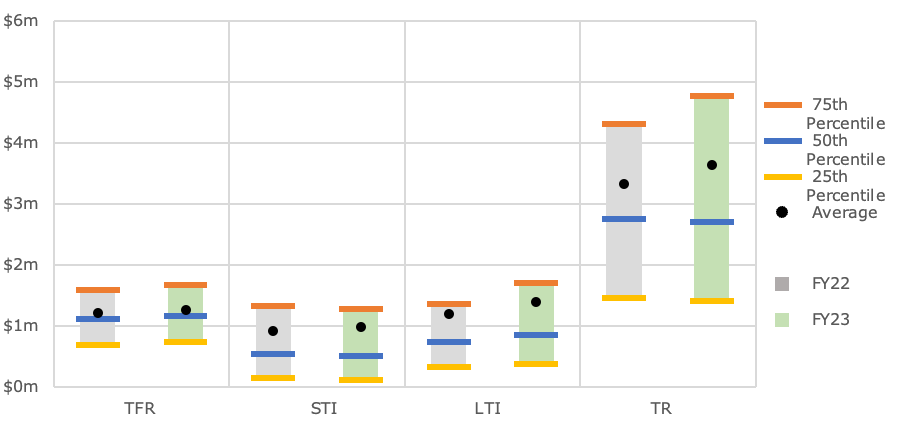

Figure 2 visualises the change in CEO remuneration over the past two reporting periods by comparing the averages and quartiles of each remuneration component for FY22 and FY23, in millions of Australian dollars.

Figure 2: Comparison of FY22 and FY23 remuneration (in $m) for all CEOs, by each remuneration component

The remuneration component averages saw increases across the board, with LTI increasing the most. TFR and LTI both saw a median increase, whilst STI saw a median decline, resulting in a median decline for TR.

Both LTI and TR exhibited an broader spread this year, as indicated by the increased interquartile ranges from FY22 to FY23. The spreads for TFR and STI remained relatively unchanged.

Component Changes

Figure 3 shows the proportion of CEOs that saw a year-on-year increase or decrease in each remuneration component by more than 1%, or a relatively insignificant change of at most 1%.

Figure 3: Percentage change in each remuneration component for all CEOs, grouped by substantial increase (>1%), minor/no change (within 1% of zero), and substantial decrease (<-1%).

Sixty-five percent of the sample experienced a notable increase in TFR. This resembles the prior year where 69% of sampled CEOs experienced an increase in TFR. Thirteen percent of CEOs saw a decrease in TFR, compared to 7% in the previous year; moreover, 22% of the CEOs’ TFR remained unchanged, compared to 24% previously.

Less than half (44%) of CEOs saw an increase in STI, a drop from 55% in the prior year. Decreases in STI went up from 40% previously, to 55% this year. The majority (58%) of CEOs saw an increase in LTI, like last year (60%). The percentage of CEOs who saw an LTI decline (38%) also resembled last year (35%).

Fifty-seven percent of CEOs saw an increase in their total remuneration and 37% saw a decrease this year. This differs from last year which saw 67% experience an increase in total remuneration and 28% experience a decrease.

In summary, both variable and fixed CEO income have tended to decline more during FY22-23 than in the previous period (FY21-22), though 57% of CEOs have still seen increased income overall.

By Company Size

Table 2 shows the median change in remuneration and TSR for each of the 30-day market capitalisation quartiles, as of 30 Sep 2023. The TSR is recorded over a 1-year period ending on the same date. These quartiles may be seen as reflecting large companies (over $7.9b), mid-large companies ($2.5b to $7.9b), mid-small companies ($1064m to $2.5b), and small companies (below $1064m).

Table 2: Median TSR and % change in remuneration components for all CEOs, by market capitalisation quartiles.

|

Market Capitalisation |

TFR |

STI |

LTI |

TR |

TSR |

|

Overall |

3.1% |

-3.8% |

8.5% |

2.9% |

13.8% |

|

Below $1064m |

3.8% |

-33.3% |

-5.6% |

1.0% |

-15.0% |

|

$1064m to $2.5b |

4.5% |

-15.3% |

9.0% |

7.6% |

11.5% |

|

$2.5b to $7.9b |

2.9% |

-3.3% |

5.3% |

2.2% |

21.7% |

|

Above $7.9b |

0.9% |

14.8% |

23.0% |

5.8% |

23.5% |

CEOs of small and mid-small companies saw the most notable median TFR increases, of 3.8% and 4.5% respectively. The increase for small companies resembles what we observed in last year (4.2%), though the increase for mid-small companies is markedly reduced from last year (11.6%). Larger companies’ median TFR changes (2.9% and 0.9%) are like those seen last year (3.1% and 1.5%).

Large-company CEOs also saw the largest median LTI increase at 23.0%. In contrast, small-company CEOs were the only ones to observe a median LTI decrease at -5.6%.

The smallest median TR increases were observed for small (1.0%) and mid-large (2.2%) companies, whereas the largest increase occurred in the second market cap quartile at 7.6%.

For total shareholder return (TSR), only bottom-quartile companies saw a negative return this year (-15%), which was associated with the worst outcome for median incentive changes.

Top-quartile companies performed relatively well on both incentive increases and TSR, while seeing the least appreciation in TFR.

By Sector

Table 3 shows the median change in remuneration and TSR across the different market sectors, using the Global Industry Classification Standard (GICS).

Table 3: Median TSR and % change in remuneration components for all CEOs, by GICS market sector.

|

Sector (Number of companies) |

TFR |

STI |

LTI |

TR |

TSR |

|

Overall (144) |

3.1% |

-3.8% |

8.5% |

2.9% |

13.8% |

|

Communication Services (8) |

1.6% |

-44.6% |

38.9% |

3.2% |

22.0% |

|

Consumer Discretionary (19) |

3.3% |

-13.3% |

4.6% |

2.8% |

28.3% |

|

Consumer Staples (6) |

2.0% |

-6.8% |

5.6% |

2.9% |

-1.2% |

|

Energy (6) |

8.0% |

19.3% |

35.3% |

32.0% |

54.0% |

|

Financials (25) |

2.1% |

6.4% |

6.6% |

4.4% |

8.8% |

|

Health Care (10) |

0.2% |

-23.6% |

32.6% |

29.5% |

-3.8% |

|

Industrials (18) |

2.2% |

12.5% |

-8.6% |

0.8% |

13.4% |

|

Information Technology (7) |

1.5% |

12.0% |

44.4% |

10.0% |

41.8% |

|

Materials (30) |

6.2% |

-3.8% |

0.8% |

2.6% |

6.5% |

|

Real Estate (14) |

2.5% |

-16.9% |

13.7% |

-1.4% |

1.6% |

|

Utilities (1) |

3.9% |

-10.6% |

23.0% |

5.0% |

77.5% |

All sectors saw a median increase in TR, except for Real Estate (-1.4%). Fixed remuneration increased across the board, and LTI only saw a median decline for Industrials (-8.6%).

The Energy sector saw the largest median increases in TFR (8.0%), STI (19.3%) and TR (32.0%). The sector also experienced the third-highest median LTI increase (35.3%).

Real Estate saw a slight decrease in TR (-1.4%) due to a median STI decrease of 16.9%. The sector also had the third-lowest median TSR of 1.6%. This is unlike last year, when Real Estate saw a median increase of 21.2% in STI and 17.8% in TR despite a negative TSR of -24.2%.

Market Averages

To reduce the disproportionate effect of outliers, we report averages of the data set truncated at the 5th and 95th percentiles for each remuneration component, giving the middle 90%. Table 4 shows the truncated average change for each component, with quartiles reported based on the full data set.

Table 4: TSR and % remuneration change averages (arithmetic mean) and quartiles, for all CEOs. Averages are based on truncated data (middle 90%).

|

Statistic |

TFR |

STI |

LTI |

TR |

TSR |

|

Average |

5.0% |

-8.2% |

22.0% |

9.7% |

13.9% |

|

25th percentile |

0.0% |

-32.6% |

-14.5% |

-7.8% |

-3.4% |

|

50th percentile |

3.1% |

-3.8% |

8.5% |

2.9% |

13.8% |

|

75th percentile |

8.2% |

27.1% |

49.6% |

28.2% |

33.5% |

Several methods can be used to calculate “average” remuneration movement.

A standard average across the ASX 300 CEOs weighs each incumbent equally. We call this an incumbent weighted average. This approach can be skewed by lower-paid CEOs in the sample who may have highly volatile changes in pay due to:

- Greater growth prospects and re-adjustment of pay to reflect growth in company size and scope; or

- Significant changes in remuneration outcomes, as companies entering the ASX 300 are subject to greater investor scrutiny.

To address this, two other weighted averages were also calculated:

- A total-remuneration weighted average, where the change in pay for each CEO is weighted by their corresponding average TR (in $) over FY22-23.

- A remuneration-component weighted average, where the change in each remuneration component (TFR/STI/LTI) for each CEO is weighted by the corresponding average TFR/STI/LTI (in $) for that CEO over FY22-23.

The average movements in each remuneration component are shown in Table 5. The remuneration-component weighted average provides a better depiction of changes in each component, since it accounts for the differing incentive composition of CEOs. This reflects the varying remuneration policies across companies; e.g., some companies may confer high TFR but lower STI/LTI opportunity, whilst other companies may provide more pay via bonuses than TFR.

Table 5: Average % remuneration change for all CEOs, using different weighted-averaging methods (weighting equally, by TR, and by component).

|

|

TFR |

STI |

LTI |

TR |

|

Incumbent Weighted Average |

5.0% |

-8.2% |

22.0% |

9.7% |

|

Total-Remuneration Weighted Average |

3.2% |

-0.9% |

21.6% |

9.2% |

|

Remuneration-Component Weighted Average |

3.7% |

4.7% |

22.9% |

9.2% |

Economic Factors Impacting Remuneration

Figure 4 compares the change in TFR during FY22-23 for each CEO against the 1-year TSR (total shareholder return) of the CEOs’ companies for the period 30 Sep 2022-23. TSR is measured over this time frame due to the ASX rebalancing on 30 Sep.

Figure 4: Percentage change in TFR over FY22-23 compared against the 1-year TSR to 30 Sep 2023, with least-squares line of best fit superimposed (R2=0.0000, r=0.0016, p=0.9846).

The ASX 300 CEOs tended to experience elevated TFR in FY23 relative to FY22, irrespective of their companies’ TSR. The companies tended to yield positive shareholder returns in the year ending 30 Sep 2023. There does not appear to be an association between TSR and TFR change, as reinforced by simple linear regression (SLR) (p=0.9846).

Log transformations are applied to the dependent and independent variables in Figures 5 and 6. This renders the data more visually interpretable in the presence of outliers, while maintaining the order of values. Inferred directions of associations remain true for the original untransformed variables.

Figure 5 compares the CEOs’ log TR against the log market capitalisation of their companies. From SLR, there appears to be a positive association between market capitalisation and TR at the 5% significance level (p<0.001).

Figure 6 compares the CEOs’ log TR against the log (total) assets of their companies. From SLR, there again appears to be a positive association between assets and TR at the 5% significance level (p<0.001).

Both market capitalisation and total assets represent company size, so it can be inferred that larger companies tended to have higher-paid CEOs.

Figure 5: Log TR compared against log market capitalisation, with least-squares line of best fit superimposed (R2=0.4630, r=0.6804, p<0.001).

Figure 6: Log TR compared against log total assets, with least-squares line of best fit superimposed (R2=0.4252, r=0.6521, p<0.001).

Methodology

The ASX 300 incumbents and market data were taken after the September 2023 index rebalancing from LSEG (formerly Refinitiv®). Remuneration figures for the CEOs were obtained from GuerdonData®, a database of remuneration information sourced from the statutory disclosures present in company annual reports.

Companies that have not disclosed their 2023 annual reports at the time of analysis were removed from the sample. Companies that floated on the ASX in FY22 or FY23 were removed, since they have no remuneration disclosures available prior to their listing. Externally managed entities and companies incorporated outside of Australia which do not disclose remuneration in accordance with Australian accounting standards (i.e., AASB) were also removed.

CEOs who changed position over the FY22-23 period or served a part-year term were excluded from the analysis. Termination benefits were removed from CEOs leaving at the end of the FY22-23 period.

Quartiles are calculated on the full sample of CEOs (n=144). To reduce the disproportionate effect of outliers on the average, the data set was truncated at the 5th percentile and 95th percentile for each remuneration component to give the middle 90% of data. These truncated data were then used to compute averages for each component.

Disclaimers:

The segmentation of results into multiple sectors introduces large variability in the observed values due to small sample sizes.

Some results may be reflective of data-mining effects rather than underlying causal factors, due to the limited sample size of 144.

The selection criteria introduce sampling bias due to rebalancing of the ASX 300 index: companies listed on the ASX 300 at a particular time exclude those which have already left the index, and so recently added companies must be considered in their place instead. This may cause a positive bias in reported remuneration figures if there is a positive correlation between share price performance (e.g., TSR) and remuneration, or between market capitalisation and remuneration.

The following abbreviations have been used:

- TFR: Total Fixed Remuneration including cash salary, fringe benefits, and superannuation.

- STI: Short Term Incentives, which is pay contingent on performance measured within a 1-year period.

- LTI: Long Term Incentives, which is pay contingent on performance over a period greater than 12 months (typically 3 or more years).

- TR: Total Remuneration, which is the sum of TFR, STI, and LTI.

- TSR: Total Shareholder Return.

- FY: Financial Year.

- FYE: Financial Year End.

- SLR: Simple Linear Regression.

- AASB: Australian Accounting Standards Board.

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter