10/07/2023

The economic downturn and high capital costs have created a challenge for most companies. Markets are unforgiving to public companies that fail to deliver on expectations. Many failed attempts to realise a company’s ambitions can be traced to weak and inadequate implementation of its customer facing efforts. On June 7th and 8th, Guerdon Associates hosted Director and Management Briefing webinars on growth strategies and sales incentives.

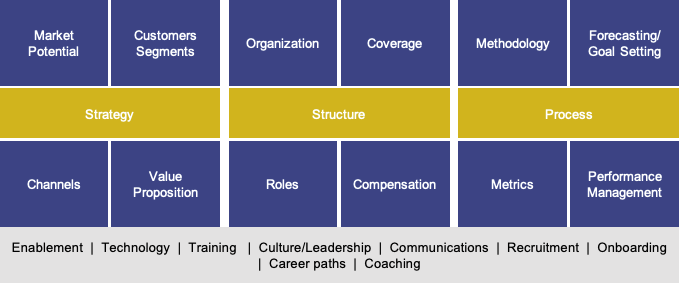

Each of the following elements influence the effectiveness of a customer facing organisation.

Compensation is but one of many drivers and not necessarily the most important one. If any of these other elements are mis-aligned, even a well designed sales incentive plan will fail to achieve desired results. No compensation plan is a substitute for effective performance management. We have observed this on occasion when we are commissioned to assist on sales incentives, only to find it is one of more of these other elements that also need to be addressed.

The briefing focused on a few key elements.

Market Potential

Most companies today are finding it increasingly challenging estimating how large their total market is. While this is typically the province of marketing, many times sales is tasked with approximating this size. Determining market potential is critical to setting realistic and achievable objectives, upon which incentive payments are calculated.

Companies can ask the following questions about their businesses market potential:

- How large is the Total Addressable Market (TAM)?

- What portion of it is serviceable with their offerings (SAM)?

- What portion can we actually obtain given our value proposition and competitive position (SOM)?

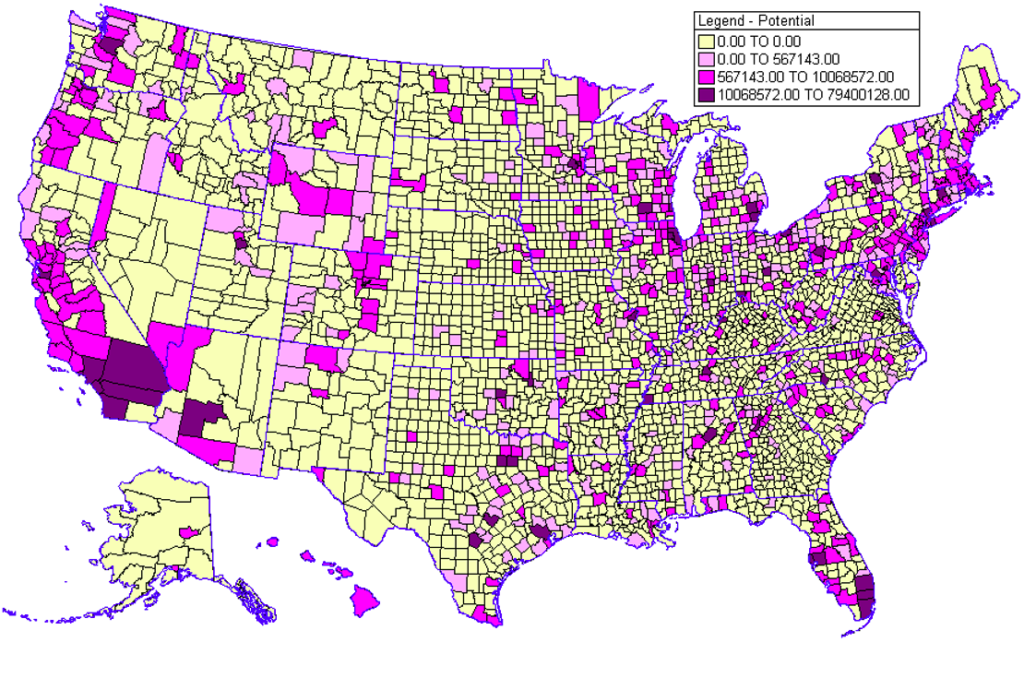

The following map is an example of where the greatest opportunities exist. The greatest opportunities are highlighted by the dark purple areas. The least potential is indicated in the yellow highlighted areas.

Value Proposition

In most industries, competition has become fierce with endless alternatives all competing for the same limited dollars. Poorly designed value propositions leave sales representatives with no alternatives but to craft their own or sell based on price. This can potentially erode the brand and the price premium it could command.

Companies can ask the following questions about your businesses value proposition:

- What are my business’ unique offerings for each customer segment and channel partner and how are they different by that segment or channel partner?

- Does my business have different positioning/pricing for different segments and competitive situations?

Some examples of value propositions are:

- CrazyEgg – “Website Behaviour Tracking at an Unbeatable Price”

- LessAccounting – “Bookkeeping, Without the Hassle”

- Uber – “The Smartest Way to Get Around”

Selling & Service Roles

An ongoing and common issue is maintaining clarity around roles, especially as business models and the underlying strategy continues to evolve. Traditional transactional sales roles are fast being replaced with more consultative models requiring a different skill set and having implications on sales incentive frameworks. Long-established commission plans are less effective in more complex, longer sales cycles.

Companies can ask the following questions about their businesses selling and service roles:

- What unique roles are required to cover each customer/prospect segment or channel?

- Are the sales and service roles clear?

- What type of sales person is required?

- Do they work with new or existing clients or a mix?

- What is their sales cycle?

- What is the size of the deals they make?

- What channel do they sell through?

- Etc.

Coverage Model

A sales representative’s territory can have a dramatic effect on their earning potential. Depending on how the company configures their territories, sale representatives on a commission plan could have vastly different earning potential. Representatives with larger areas with more opportunity will have more earnings than representatives with smaller areas and less opportunities. It is vitally important to consider both how territories are assigned as well as whether a commission or a bonus plan is more appropriate.

Companies can ask the following questions about their businesses coverage model:

- How will you configure territories (or account assignments) to cover your company’s projected sales opportunities?

- What are the resources required to sell and service different customer segments.

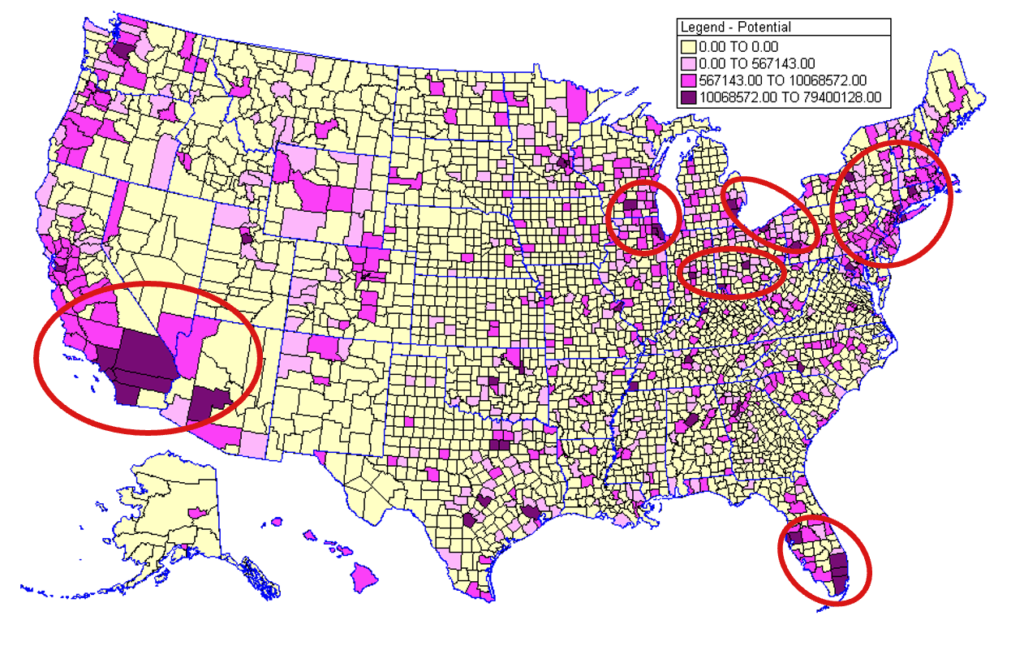

Like the previous map, this highlights the greatest areas of market potential, and where sales representatives would best be placed to exploit those opportunities.

Forecasting & Goal Setting

Goal setting is becoming increasingly challenging in a high inflation environment. Commission plans calculated on price can become especially expensive during inflationary times, even when productivity has not improved. This may result in a requirement to reduce commission amounts, which is perceived as a take away with sales personnel. Bonus plans based on target setting are more appropriate during this time.

Companies can ask the following questions about their businesses forecasting and goal setting:

- What sales goal or quota should be assigned?

- Is it consistent with an individual’s market opportunity?

- Can it be set for a full year or must we make adjustments periodically to reflect a changing business landscape?

Compensation

Pay mix is the most critical element in sales remuneration design. It reflects the nature of a position. The more at risk the more a participant has to gain or lose, which is more suitable for a role with a shorter sales cycle or that is generating new clients/customers.

Companies can ask the following questions about their businesses compensation:

- What pay mix, metrics , weights, leverage and timing is appropriate to drive the behaviours needed to execute strategy?

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter