09/11/2020

Our GECN Group research study explored Environmental, Social and Governance (ESG) measures in global executive remuneration. The sector breakdown (see HERE) showed 89% of global leading energy companies incorporated ESG metrics in their incentive plans. The energy sector was the second most prevalent in terms of featuring ESG incentive metrics, and only lagged behind the utilities sector which had 91% of companies featuring ESG metrics in incentives.

Pay impact of ESG metrics across sectors

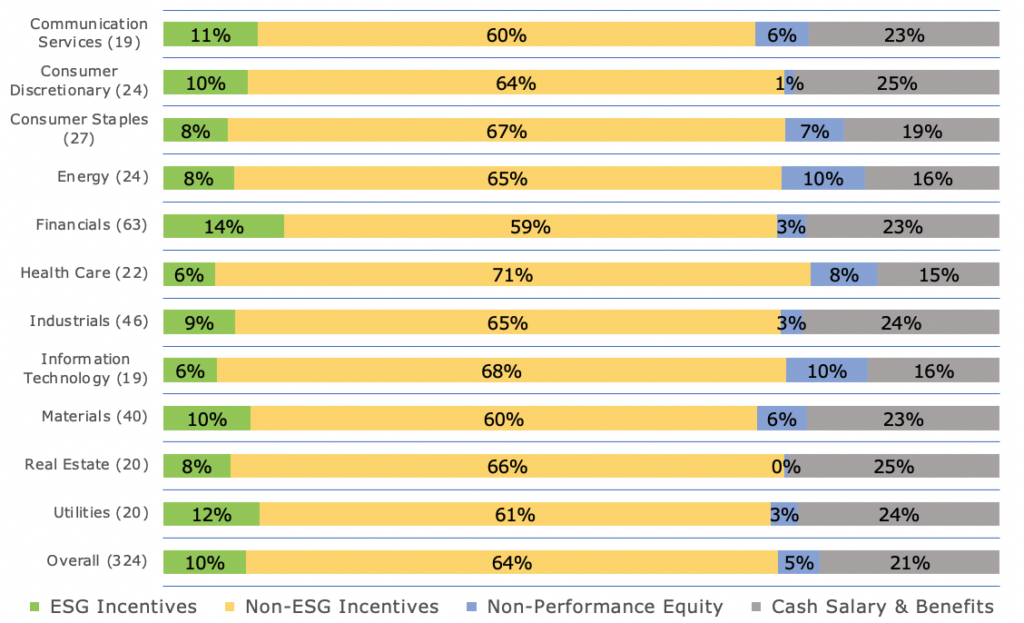

Figure 1 shows the aggregate weighting of ESG metrics within the maximum remuneration opportunity for CEOs, averaged across each sector.

Figure 1: Maximum remuneration opportunity mix of CEOs with ESG metrics, by sector

While energy company CEOs were more likely to have ESG metrics in their incentive plans compared to other sectors, only 8% of the average CEO’s maximum remuneration opportunity were contingent of achieving ESG outcomes. This is lower than the global average of 10%. The energy sector falls behind the utilities (12%) and financials sectors (14%), which have also experienced shareholder activism on ESG matters.

Regional pay impact among energy companies

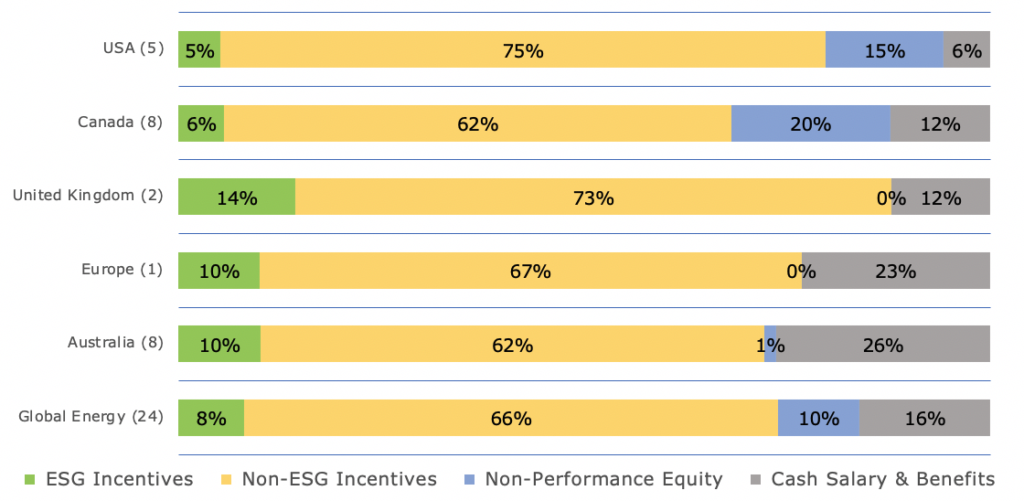

Figure 2 shows the aggregate weighting of ESG metrics in the maximum remuneration opportunity for CEOs within the energy sector, averaged across each region.

Figure 2: Maximum remuneration opportunity mix of CEOs in energy companies with ESG metrics, by region

Australian energy company CEOs have a greater weighting on ESG metrics within their overall maximum remuneration package relative to North American energy peers. While the overall energy sector is below the global average across all sectors in terms of ESG weighting, this is largely due to North American peers, while the Australian energy sector is more in line with the rest of the world.

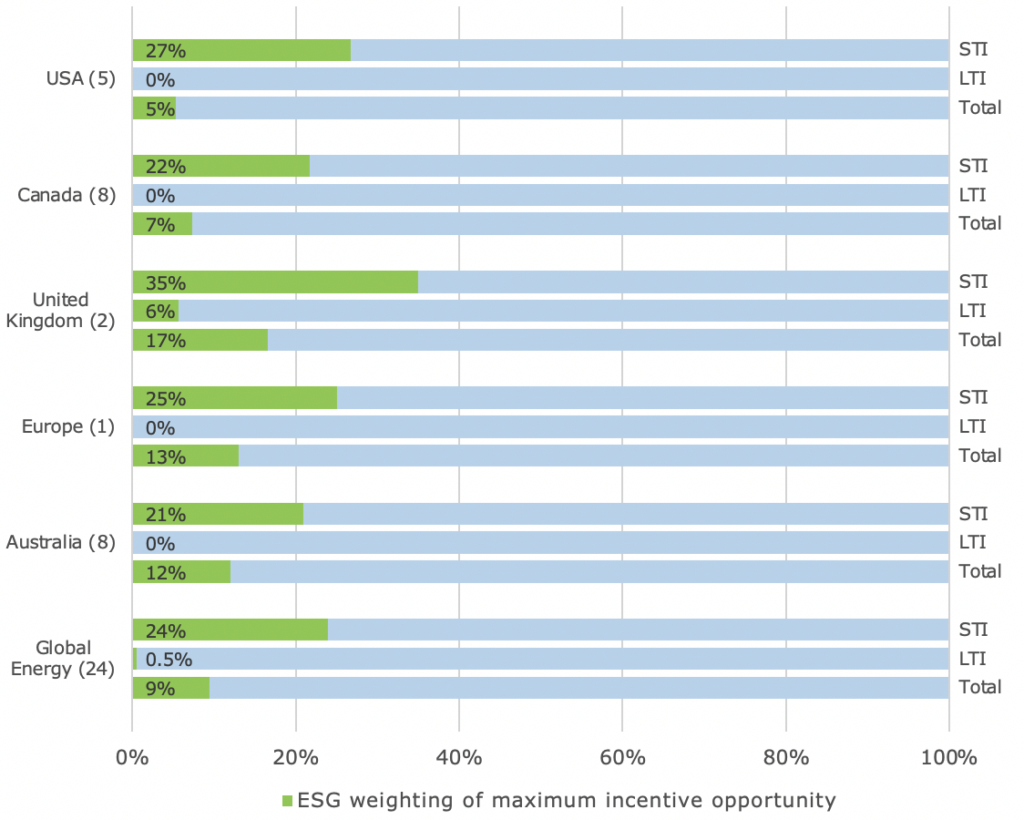

Figure 3 shows the weighting of ESG metrics within the maximum short-term incentive (STI) opportunity, long-term incentive (LTI) opportunity and total incentive opportunity for CEOs within the energy sector, averaged across regions.

Figure 3: ESG weighting of maximum incentive opportunity for CEOs in energy companies with ESG metrics, by region

Australian and North American energy companies only incorporate ESG within short-term incentive metrics, despite the longer term material risks associated with ESG factors. Only two energy companies, BP and Royal Dutch Shell, have incorporated ESG metrics within their CEOs’ long-term incentives.

Australian energy CEOs have a lower weighting on ESG metrics in their maximum STI opportunity compared to North American energy peers. However, because North American peers have much higher incentive opportunities, and these are heavily weighted to LTIs without ESG metrics, Australian companies have an overall higher weighting to ESG outcomes.

Conclusion

While the energy sector leads in terms of incorporating ESG measures in incentive plans, the weighting placed on ESG metrics lags behind other sectors.

Australian and North American energy companies only incorporate ESG metrics within their STI, with North America placing a greater weighting on ESG metrics compared to Australian energy CEOs. However, North American CEOs typically receive a greater proportion of their overall remuneration package as long-term incentives. As a result, the overall weighting of ESG metrics within the total remuneration package is higher for Australian energy CEOs compared to North American energy peers.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter