07/12/2020

Guerdon Associates reviewed the remuneration framework of listed significant financial institutions (SFIs) relative to the CPS 511 revised requirements published November 2020 (see HERE).

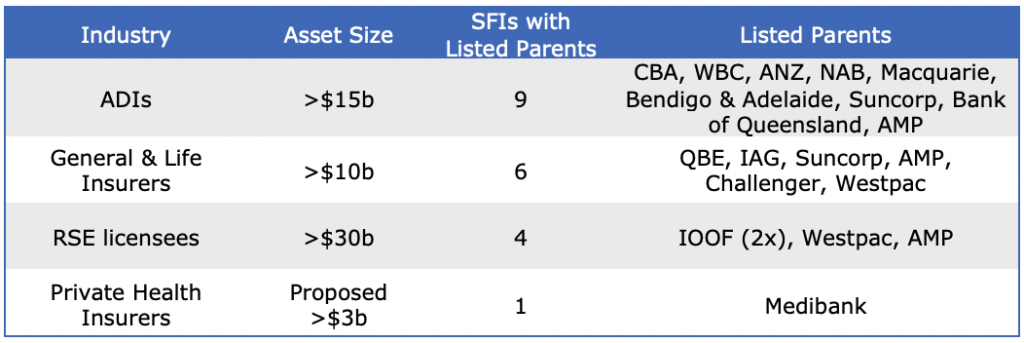

The proposed approach for identifying SFIs in CPS 511 includes an asset size threshold for each industry (ADIs, insurers and super funds). This is the basis that on which Guerdon Associates has identified ASX listed SFIs for this study. The table below displays a list of SFIs along with the ASX listed parents. In total, there are 14 unique listed parents classified as SFIs. Remuneration data was taken from the most recent public disclosures.

Table 1: Industry breakdown of SFIs

SFIs lagging implementation of deferral requirements

The CPS 511 proposal specifies the variable remuneration deferral requirement for SFI CEOs:

- At least 60% of variable remuneration is required to be deferred for a minimum of 6 years;

- Vesting can start from the end of year 4; and

- Vesting can be no faster than on a pro-rata basis

The “deferral period” defined in the CPS 511 draft includes the period that covers performance, required service, retention and holding periods.

“Variable remuneration” is defined in CPS 511 as the “total remuneration that is conditional on objectives, which include performance criteria, service requirements or the passage of time”. Though this definition technically includes fixed remuneration (as it is based on service), we understand the intention is to (somehow) only include Short-Term Incentives (STI), Long-Term Incentives (LTI), Long-Term Equity (LTE- Equity vests contingent on service only) and other retention incentives.

Based on maximum remuneration incentives, two of the 13 SFIs listed in the table above are compliant with the CPS 511 deferral requirements. The 14th SFI, Macquarie Group, is not included in the analysis as their profit share plan is uncapped.

Most SFI CEO STIs have a deferral period of three years (including the 12-month performance period, consistent with the CPS 511 definition). Most SFI CEO LTIs have a deferral period of 4 years. Only two SFI CEOs have an LTI deferral period that extends to 6 years or more. These are the two peers who meet the deferral requirements.

For senior managers and executive directors other than the CEO, CPS 511 proposes:

- At least 40% of variable remuneration to be deferred for a minimum period of 5 years;

- Vesting can start from the end of year 4; and

- Vesting can be no faster than on a pro-rata basis

Four of 13 SFIs met the 40% deferral for a minimum of 5 years criteria. Only one of the four met the pro-rata criteria.

Most SFI executive STIs have a deferral period of three years (including the 12-month performance period). Most SFI executive LTIs have a deferral period of four years.

Non-Financial measures given material weighting

The revised CPS 511 proposal revoked the initial proposal that financial measures should not exceed 50% of total performance used to determine variable remuneration. It has been revised so that SFIs should “give material weight to non-financial measures, where the remuneration is performance related”.

Of the 14 SFI CEOs, the range from the lowest to the highest STI non-financial weighting over total STI was 35% to 82.5% for CEOs and 35% to 90% for other executives. The most common non-financial STI weighting was 50%. Though there is no guidance number for the recommended non-financial measure, a 50% STI non-financial weighting should constitute a “material” weighting. Of the 14 SFIs, three had a non-financial LTI measure, with weighting varying from 30% to 50% of total LTI.

SFI CEOs’ proportion of non-financial weighting to total performance variable remuneration (STI and LTI combined) ranged from 18% to 50%.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter