04/02/2022

Companies are including performance measures based on environmental, social and governance (ESG) factors in remuneration frameworks. There are several mechanisms for incorporating ESG metrics in determining incentive outcomes:

- A balanced scorecard with weightings for each ESG metric;

- A modifier adjusting the outcome of a scorecard based on ESG outcomes;

- A gateway requiring ESG targets to be met before any incentives are paid out;

- A discretionary adjustment based on a holistic assessment of ESG performance

A balanced scorecard approach awards a portion of the incentive opportunity based on ESG performance irrespective of financial performance. If ESG performance is poor, an incentive payout could still be received for non-ESG performance. The weightings of ESG metrics and financial metrics signal to executives the relative importance of each strategy priority.

A modifier approach adjusts the scorecard outcome based on ESG performance. If the ESG performance is poor, it impacts the outcomes on all other measures, including financial. A modifier approach is suitable for business-as-usual measures, such as safety or behaviour. In this case, the modifier would act as a way to implement malus and reduce incentive payouts where ESG performance was insufficient.

A gateway can be appropriate for business hygiene metrics. It ensures that incentive outcomes are not paid out if the minimum requirements for business operations, such as nil fatalities or minimum customer satisfaction targets, are not met.

A discretionary adjustments approach recognises the difficulty in setting ESG targets and anticipating material issues that may arise. It involves setting a non-formulaic process for the board to consider a holistic overview of company ESG performance. The adjustments can be applied immediately prior to the equity grant and/or at vesting.

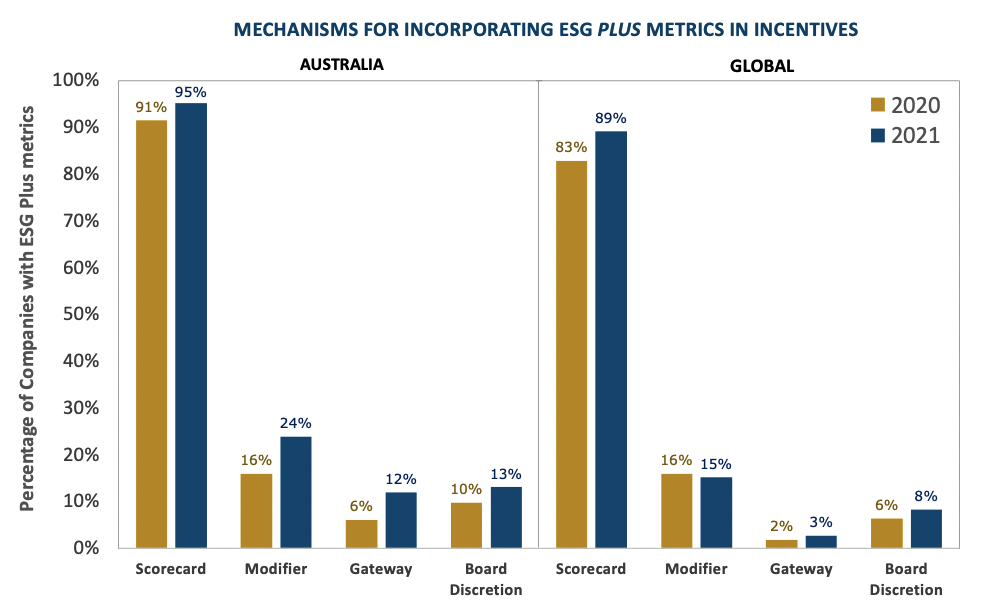

Guerdon Associates’ GECN Group research showed that a balanced scorecard approach remains as the predominant mechanism for incorporating ESG Plus (ESG and other-related non-financial metrics) measures into executive incentive plans.

Over the past year in Australia, the proportion of companies with ESG-related modifiers increased to 24% from 16%, while the usage of gateways doubled to 12%. Global market practice differs significantly from Australia with only 3% of companies using gateways.

Figure 1: Mechanisms for incorporating ESG Plus measures in incentives

The report became available to our clients last month. It is now available, at no charge, to all our newsletter subscribers.

To read the report, which describes the cross-border trends of ESG Plus metrics used in executive incentives, see HERE.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter