13/12/2021

There is pressure on boards for the disclosure of STI hurdles in remuneration reports from proxy advisers. There is an investor desire to have Short Term Incentive (STI) hurdles disclosed alongside the scorecard outcomes. It provides proxy advisers and investors a basis to evaluate and assess the outcomes achieved against the targets set by the board. This may seem strange to some. That is, why cannot investors look at the results achieved and judge for themselves as to whether in an absolute sense that it is worth paying for?

Guerdon Associates has researched ASX STI hurdle disclosure. This article considers the ASX 50. It analyses the disclosure of qualitative measures and the results in the STI from the previous financial year.

Forty-eight of the ASX 50 companies have STI plans. All have quantitative measures. Thirty-three of the 48 (69%) companies have qualitative measures as well.

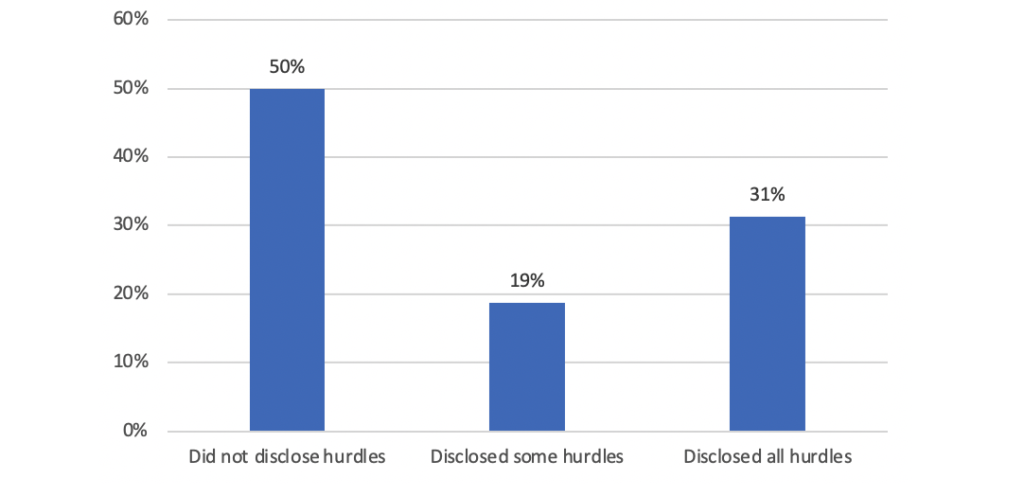

Fifteen of the 48 (31%) disclosed all the target hurdles as part of the remuneration report. Twenty-four of the 48 (50%) did not provide any details on the hurdles for the quantitative measures. The remaining 9 companies (19%) disclosed only some of the STI quantitative measure hurdles.

Figure 1: Quantitative measures with hurdles disclosed

In conclusion, boards feeling the heat from proxy advisers and investors to disclose more on the specific requirements of STI hurdles they set can take some comfort from market practices in the larger ASX-listed companies.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter