11/05/2020

Options or Share Appreciation Rights (see HERE) provide employees the right to buy shares at a pre-determined price, known as the exercise price, or receive the gain in share price from grant. They are typically granted ‘at-the-money’ where the exercise price equals the share price at grant. Thus, they only deliver value when there is share price growth. This creates alignment between management and shareholders’ interests.

An option has less value than a share, so face value cannot be used to determine the number of instruments to grant. Options are typically valued using the Black-Scholes model in determining the number to grant.

As shown in our previous analysis (see HERE) time to expiry, interest rates and volatility are the main drivers of option value. Decreasing interest rates decrease the likelihood of share price growth and drive the value of options downwards. Conversely, increasing volatility drives the option value upwards. On balance, the current environment of low interest rates and high volatility results in higher option values compared to the previous analysis.

Choice of incentive instruments

For a given grant value, the number of options granted will be much higher than the equivalent number of shares or rights. Options provide upside leverage and deliver more value to executives when there is share price growth. This comes at the cost of having no payout when there is no growth or a decline. Arithmetically speaking, this decreases alignment between management and shareholders. However, when factoring in that executives with unvested equity in their employers are typically much less diversified than the average shareholder, the upside leverage of options can be appropriate to motivate the higher undiversifiable risk.

Options are more attractive for executives who like taking risks and seek growth. However, they are less effective at being retentive when there is no prospect for growth.

The choice of incentive instrument may consider the balance of attracting, retaining and rewarding outcomes for executives. The grant value is equivalent for both options and rights, and share price should not impact this decision. Certain cyclical industries, such as oil and gas, often employ options and SARs as cost effective vehicles for attraction, retention and focus during downturns, often as a supplement to, or replacement of, reduced annual cash remuneration.

Proxy advisor considerations

Some external stakeholders may argue that option holders may receive a windfall due to rapid market recovery rather than management action. Given the uncertainty of long-term impact from COVID-19, it could be more of an L-shaped recovery (if, indeed, “recovery” is the appropriate noun) instead of a V-shaped one.

Market expectations of future economic recovery are reflected by the increase in volatility and option value. The ratio of options to zero exercise price share rights of the same value will be less now than the ratio prior to COVID-19. If options made sense then, they should make even more sense now.

Performance conditions can be also set to ensure share price growth is a result of management actions rather than general market movements.

Out-of-the-money options

At-the-money options only deliver value when there is share price growth. Another possibility is to grant out-of-the-money options, where the exercise price is set to be above the share price at grant. Some board remuneration committees, sensitive to the views of some external stakeholders who believe there will be a v-shaped recovery, and/or executives should not benefit from a pandemic, may want to set a premium exercise price reflecting pre-COVID-19 or pre-oil price slump share prices.

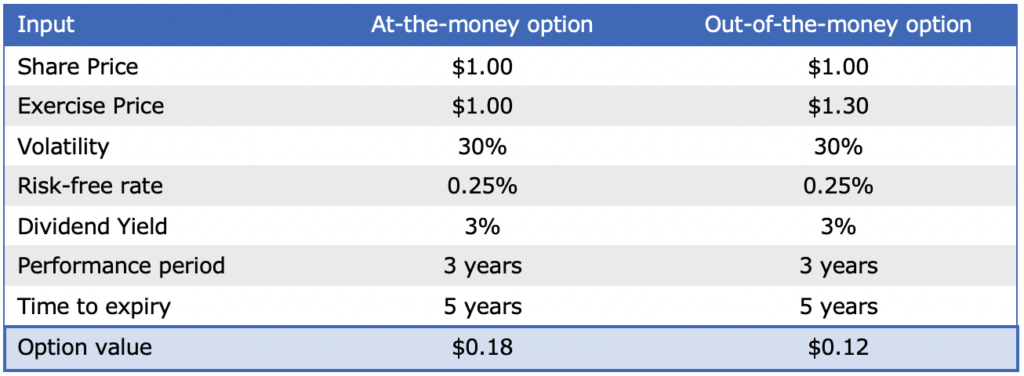

Table 1 shows the option values for an at-the-money option and an option with the exercise price equal to 130% of the share price.

Table 1: At-the-money and out-of-the-money options

Setting the exercise price to be the share price prior to COVID-19 can avoid any windfalls due to V-shaped recoveries. However, there are potential issues that reduce the effectiveness of this approach:

- For an equivalent grant value, out-of-the-money option grants will deliver 50% more options and will be more dilutive than at-the-money options;

- It is less effective for attracting or retaining executives, as they do not reward management for restoring the company but for growing beyond recovery; and

- Economic recovery is outside of management’s control and should not be built into the expectations for incentive outcomes.

Conclusion

Options only reward executives when there is share price growth. They provide more upside leverage than shares or rights. This aligns their pay outcomes with shareholders’ interests. However, options are only an instrument for delivering value and not the end-all when designing effective incentive frameworks.

Some considerations have to be made on whether options are the right choice for incentivising outcomes through COVID-19:

- What is the most effective way to attract, retain and reward executives?

- How to best align management and shareholder interests?

- How to account for economic recoveries?

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter