31/08/2015

Options used to be a popular component of long-term incentive plans, with their application growing from the early 1990s. That growth was slowed in favour of share rights with tax changes effected in 1996 that permitted tax deferral for share rights, which are in effect zero exercise price options. Options grant were all but terminated in 2009 when tax law was again amended, such that tax was assessed on options even if they were under water and never exercised.

Following the 1 July taxation changes that effectively reversed the 2009 amendments, some boards are assessing whether or not to include options as a component of their executive and director equity plans.

To many boards and their company’s management and investors this could be considered courageous. However to others it may be considered a well timed counter cyclical adjustment to the remuneration framework to encourage management to seek out growth.

The people who think it would be courageous have in mind the market’s current infatuation with dividend yield. Options, by encouraging growth, necessarily will curtail yield because retained earnings are needed for re-investment in the business. Australia’s Reserve Bank and the Department of Treasury would be part of this, albeit small, cheer squad. But, like most aspects of business, it may be just a matter of timing. For example, the Reserve Bank board’s last minutes indicated that Australia’s lowering exchange rate might take a load off quantitative easing. The implication is that interest rates may move up instead of down. More broadly, the recent Jackson Hole, Wyoming meeting of central bankers indicated that inflation is expected to rise in major Western economies in the medium term.

These factors indicate that, for companies in the right sectors, options (or their near alternative, Share Appreciation Rights – see HERE) may be well worth considering. As this article shows, in a low interest rate and relatively low volatility environment, a company does not have to grow much for options to deliver substantial rewards.

Option valuations

If options are to be substituted for share rights or shares, then a valuation is required to determine the number of options that will result in an equivalent grant value.

Option values are significantly lower than share price, so face value cannot be used when determining grant size. The value of an option is typically determined using the Black-Scholes formula and depends on various input values used. The calculations that follow are based on the following assumptions:

- Share price $1.00

- Options exercise price $10.00

- Exercise price $1.00

- Volatility 15% to 30%

- Risk free rate 2%

- Performance period 3 years

- Term 5 years

- Yield 3%

Using the Black-Scholes formula (excluding the probability of vesting based on performance hurdles) the values range from $0.097 to $0.210, for volatilities ranging from 15% to 30%. The equivalent share rights value is $0.914.

The combination of low volatility and a low risk free rate, produces very low option valuations. Low risk free rates also produce lower option values for high volatility companies, but the difference is much smaller.

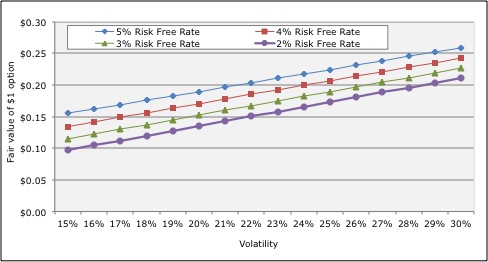

Current risk free rates around 2% are significantly lower than the 5% of 2010. Figure 1 shows the impact of lower risk free rates on option valuations.

Figure 1: Option valuations for risk free rates from 2% to 5%

Equivalent options and share rights grants

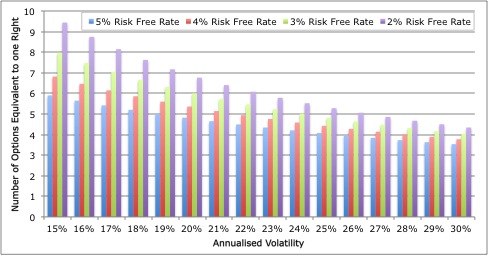

Figure 2 shows the number of options required to match the grant of one share right for share price volatilities from 15% to 30% and risk free rates from 2% to 5%.

Figure 2: Number of options that are equivalent to one share right

For companies with share price volatilities lower than 20% (including most infrastructure, banking, utility and property companies) more than 7 options are required to match the value of each right.

Since the option values are relatively low, a high number of options are required to match an equivalent grant of share rights. Consequently only a modest rate of share price appreciation is required for options to deliver higher rewards than share rights. For example, at 20% volatility, 6.765 options are equivalent to the grant of one share right. Compound average growth in share price of 5.5% produces higher returns for executives from an equivalent grant of options than rights, over three years. This increases to 7.3% if share price volatility increases to 25% and 9.2% if share price volatility increases to 30%.

Realisable pay outcomes – an example

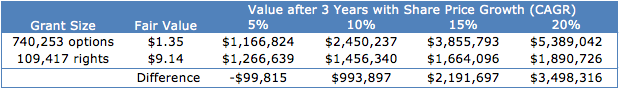

The following example illustrates the difference in value to the recipient for various share price appreciation values. It assumes a grant value of $1m and the number of share rights and options determined using a Black-Scholes valuation, that is, a fair value that has been discounted for foregone dividends, but not for any performance hurdles that may apply. The $1m therefore represents the maximum LTI opportunity because it assumes full vesting. The Black Scholes valuations are based on the following assumptions:

- Share price $10.00

- Option exercise price $10.00

- Share rights exercise price $0.00

- Volatility 20%

- Risk free rate 2%

- Performance period 3 years

- Term 5 years

- Yield 3%

Table 1: Comparison of the value delivered by $1m grant of shares rights and options

The fair values determined above also represent the accounting value of the grants, provided vesting is dependent on non-market performance criteria, like ROE or EPS growth. Therefore the expensed value for both grants is equivalent, at $1m. Of course options have a built in share appreciation criterion by virtue of the exercise price, so they in effect can provide a dual hurdle of both shareholder returns and accounting or operational performance measures. In addition, and unlike share rights, option value can only be realised when share price growth is positive, providing good optics for shareholder alignment.

If the performance criteria are market related, like absolute or relative TSR, the difference in the accounting fair values is significantly smaller.

Conclusions

We conclude that if growth prospects are reasonable, then options are a viable alternative or addition to share rights, particularly for companies with low share price volatility. When making this decision, boards will need to consider other issues including:

- Risk management, which can be mitigated with malus and clawback provisions;

- Dilution, which can be reduced using SARs instead of options; and

- The treatment of dividends, although there is no reason that dividends cannot accrue in relation to options that ultimately vest.

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter