More STI measures results in greater certainty but lower upside

12/09/2022

Generally, adding more measures to a balanced scorecard diversifies vesting risk for executives. The more measures there are in a scorecard, the greater the probability that some hurdles will be met and at least a portion of the scorecard will vest.

On the other hand, more measures can also increase the difficulty of achieving maximum vesting and meeting stretch hurdles across all measures.

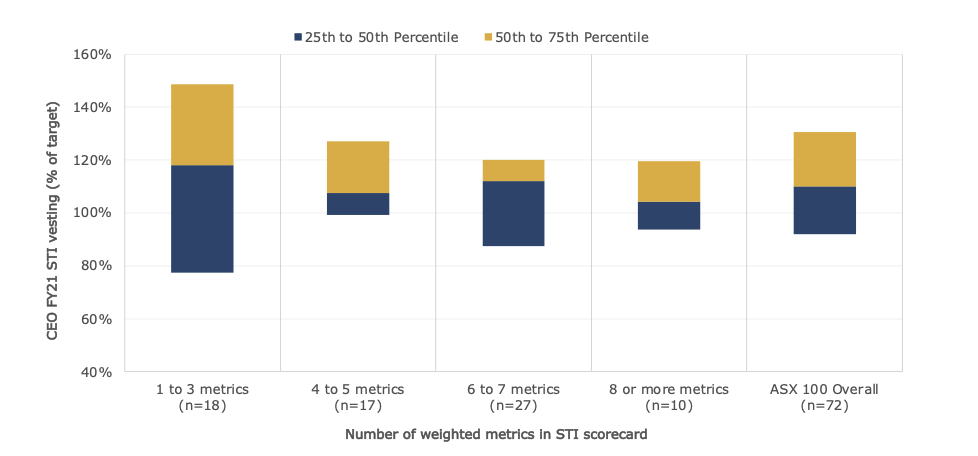

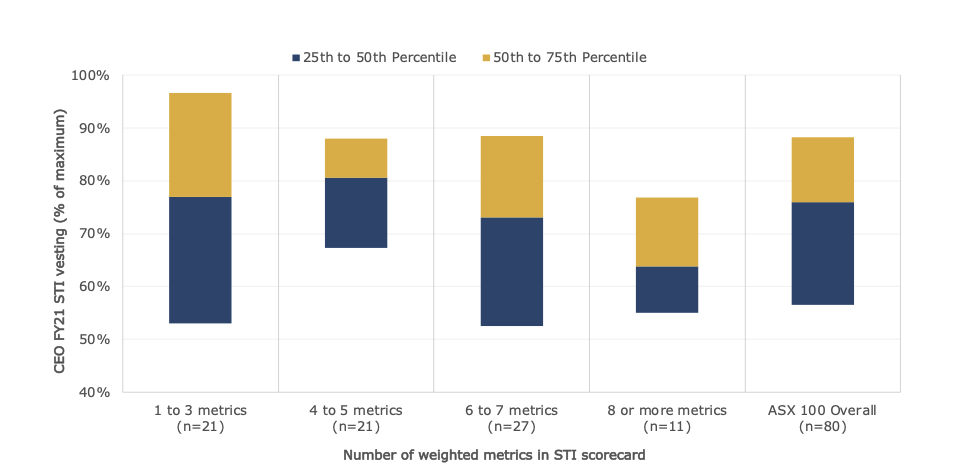

Guerdon Associates analysed FY21 STI payouts for ASX 100 companies which disclosed the number of weighted metrics in their balanced scorecard. The figures below shows the ASX 100 CEO’s FY21 STI vesting outcome, as a percentage of their target and maximum STI opportunity, relative to the disclosed number of weighted metrics in their STI scorecard.

Figure 1: FY21 STI vesting outcome (% of target) relative to number of scorecard metrics

Figure 2: FY21 STI vesting outcome (% of maximum) relative to number of scorecard metrics

The data shows companies with one to three STI measures had the greatest variation in STI vesting outcomes. Companies with four or more STI measures had greater certainty of vesting but also a lower upside in the 75th percentile STI vesting outcome. The same trend was not observed for the 25th or 50th percentile STI vesting outcomes.

There are also other considerations in STI scorecard design, for example:

- Multiple measures provide a more holistic view of performance, increasing pay-for-performance alignment and dissuading executives from focusing on one measure to the detriment of others.

- Proxy advisers like variability in STI outcomes among KMP executives. Boards on the blunt end of a poor proxy advisor STI review may want to consider sharpening it up by using fewer measures.

- Additional measures increase complexity and dilutes the weighting and importance of each individual measure.

- Failure to meet hurdles in select measures is less detrimental to the overall vesting as executives, to some extent, can cherry-pick measures to maximise their overall vesting outcome.

Conclusion

Boards should review the company’s STI scorecard and consider whether:

- The number of metrics are appropriate to capture the true performance of the company and/or individual given the complexity of the business;

- The number of metrics and weightings over-complicate or dilute measures such that the scorecard no longer incentivises desirable executive behaviour;

- STI vesting outcomes vary with performance, or ultimately “averages” out across multiple measures.

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter