ASX 300 CEO fixed remuneration sees largest increase in 10 years

13/02/2023

It is once again time for Guerdon Associates’ annual review of pay increases for Chief Executive Officers (CEOs) and Managing Directors (MDs) who led ASX 300 companies in the past 2 reporting periods.

Summary

Our annual review indicates that incentive targets were “right-sized” after the initial pandemic year wiped out many executive incentives.

The sample consists of 176 ASX 300 CEOs who served two full years over the FY2021 and FY2022 reporting periods. Remuneration data was sourced from GuerdonData®, and data for total shareholder return (TSR) was sourced from Bloomberg®.

The median CEO total remuneration (TR) increased by 13.3%. This can be largely attributed to median increases in total fixed remuneration (TFR) and long term incentives (LTIs) of 4.5% and 14.7% respectively.

ASX 300 CEO fixed remuneration increases were larger than increases for the general population. The median increase in CEO TFR was 4.5% over the 2022 financial year, whereas the Australian Bureau of Statistics Wage Price Index rose by 3.1% over the year to September 2022.

Pay movements did not reflect TSR outcomes this year, with a median TSR outcome of -11.1% and a median increase in TR of 12.5%.

Longitudinal trends

Total remuneration (TR) is the sum of total fixed remuneration (TFR), short-term incentives (STI) and long-term incentives (LTI).

This year saw more than half the CEOs experiencing an increase in TR of more than 13.29%.

Figure 1: Total remuneration median changes since 2013

Both STI and LTI reflect statutory disclosures, which includes the amortised value of deferred compensation and share-based payments expense when incentives are delivered as equity instruments.

The table below shows the median year-on-year change in each remuneration component over the last 3 years (See 2019-20 and 2020-21).

Table 1: Median change in ASX 300 CEO remuneration

|

Reporting Periods |

TFR |

STI |

LTI |

TR |

|

FY2021-22 |

4.5% |

6.1% |

14.7% |

13.3% |

|

FY2020-21 |

0.9% |

24.6% |

19.4% |

15.8% |

|

FY2019-20 |

0.3% |

-17.1% |

0.0% |

-2.3% |

The FY22 median increase in TR of 13.3% is comparable to the 15.8% increase in the previous year.

The increase in TR is attributed to increases in both fixed and variable remuneration. While lower than increases to variable remuneration, the 4.5% median increase in TFR is the largest since 2012 levels and has a multiplicative impact on variable components.

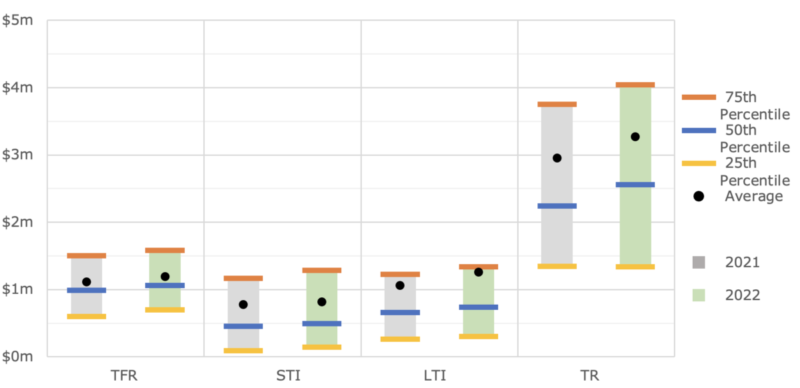

Figure 2 shows the average and quartiles of the dollar value of each CEO remuneration component.

Figure 2: Distribution of ASX 300 CEO remuneration by remuneration component

TFR saw increases across the board for both the average and quartiles. The STI average and median remain largely static, with increases to the upper and lower quartiles. The averages, medians and upper quartiles for LTI and TR have increased while the lower quartiles are relatively unchanged.

Component changes

Figure 3 shows the proportion of CEOs that saw a year-on-year increase or decrease in each remuneration component by more than 1%, or a change within 1%.

Figure 3: Changes by component of pay

Sixty-nine percent of the sample experienced an increase in TFR. This is a significant change from the prior year where only half of sampled CEOs experienced an increase in TFR. Only 7% of CEOs saw a decrease in TFR, compared to 19% in the previous year.

Overall, most CEOs received an increase in variable remuneration.

Approximately half (55%) of CEOs saw an increase in STI, a drop from 71% in the prior year. Decreases increased from 25% in the prior year to 40%.

Most CEOs (60%) saw an increase in LTI, similar to last year (62%).

Two thirds of CEOs saw an increase in their total remuneration with 28% seeing a decrease this year. This differs from last year which saw 75% experience an increase in total remuneration and 19% experience a decrease.

By Company Size

Table 2 shows the median change in remuneration and TSR based on the 30-day market capitalisation quartiles, as at the 30th of September 2022.

Table 2: Median % change in remuneration and TSR by market capitalisation quartiles

|

Market Capitalisation |

TFR |

STI |

LTI |

TR |

TSR |

|

Overall |

4.5% |

6.1% |

14.7% |

13.3% |

-16.1% |

|

Below $914m |

4.2% |

3.5% |

5.7% |

10.7% |

-33.1% |

|

$914m to $2b |

11.6% |

2.9% |

6.5% |

14.2% |

-19.6% |

|

$2b to $7.4b |

3.1% |

20.9% |

19.7% |

14.8% |

-15.1% |

|

Above $7.4b |

1.5% |

0.0% |

22.3% |

9.5% |

-7.8% |

CEOs of companies in the second market cap quartile saw the largest median increase in TFR of 11.6%. This is a significant change from the previous year, where this quartile experienced only a 1.7% increase in TFR.

The overall median increase in STI was 6.1%. CEOs of companies in the third market cap quartile saw a median increase in STI of 20.9% whilst CEOs in the upper quartile experienced a median increase in STI of 0.0%.

The top 50% of CEOs by company size saw the largest median increase in LTI. The upper quartiles saw increases of 19.7% and 22.3% respectively. In contrast, the lower 50% of CEOs saw a median increase in LTI of no more than 6.5%.

Across all quartiles there was a median increase in TR of at least 9.5% with the third market cap quartile seeing the largest median increase of 14.8%.

By Sector

Table 3 shows the median change in remuneration and TSR across the different sectors.

Table 3: ASX 300 GICS sector breakdown of median TSR and change in CEO pay

|

Sector (Number of companies) |

TFR |

STI |

LTI |

TR |

TSR |

|

Overall (176) |

4.5% |

6.1% |

14.7% |

13.3% |

-16.1% |

|

Communication Services (7) |

4.7% |

1.9% |

-4.2% |

0.6% |

-20.9% |

|

Consumer Discretionary (22) |

5.2% |

10.0% |

0.0% |

11.3% |

-31.8% |

|

Consumer Staples (12) |

4.9% |

-11.4% |

-17.7% |

11.9% |

3.0% |

|

Energy (9) |

8.7% |

24.7% |

20.9% |

27.5% |

-3.8% |

|

Financials (25) |

5.2% |

14.3% |

33.4% |

16.3% |

-15.3% |

|

Health Care (14) |

1.3% |

-14.7% |

24.6% |

-1.8% |

-21.2% |

|

Industrials (15) |

1.2% |

-5.4% |

6.2% |

13.7% |

-16.0% |

|

Information Technology (12) |

3.7% |

0.1% |

0.1% |

2.0% |

-11.5% |

|

Materials (43) |

5.1% |

9.4% |

21.5% |

16.0% |

6.0% |

|

Real Estate (15) |

0.5% |

21.2% |

19.8% |

17.8% |

-24.2% |

|

Utilities (2) |

4.4% |

2.8% |

30.2% |

10.8% |

16.2% |

Most sectors saw an increase in TR.

The Energy sector saw the largest median increases in TFR, STI and TR of 8.7%, 24.7% and 27.5% respectively. The sector also experienced the fifth highest median increase in LTI of 20.9%.

The Health Care sector saw a decrease in TR of 1.8% largely due to a median decrease in STI of 14.7%. The sector also had the third largest median TSR decrease of 21.2%. This contrasts with the prior year, where the Heath Care sector saw a median increase of 37.3% in STI and 16.1% in TR.

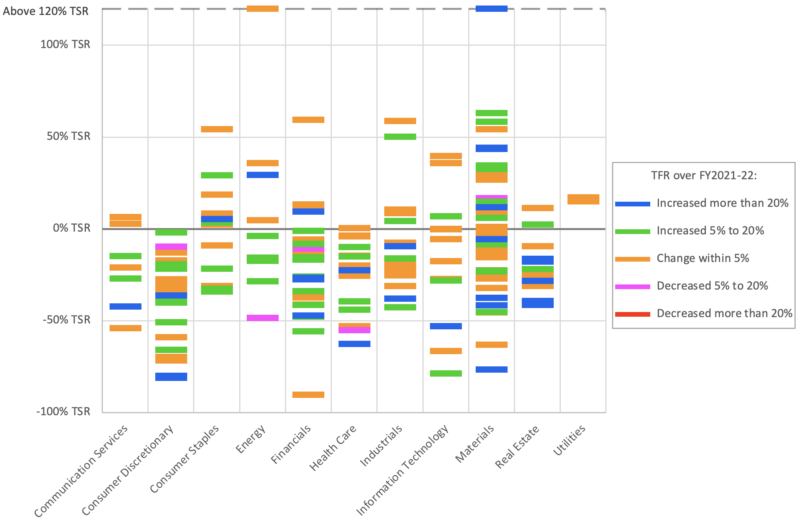

Figure 4 shows ASX 300 company TSR relative to the CEO change in fixed pay, by sector.

Figure 4: ASX 300 GICS sector breakdown of TSR and change in CEO TFR

The graph shows that many increases in CEO TFR over the year were despite a drop in market capitalisation.

Market averages

To reduce the effect of spurious outliers on the average, the data set is truncated at the 5th percentile and 95th percentile for each remuneration component. Table 4 shows the average and quartiles.

Table 4: ASX 300 CEO change in remuneration average and quartiles

|

Statistic |

TFR |

STI |

LTI |

TR |

|

Average |

8.1% |

8.2% |

20.2% |

12.5% |

|

25th percentile |

0.2% |

-17.4% |

-17.2% |

-3.3% |

|

50th percentile |

4.5% |

6.1% |

14.7% |

13.3% |

|

75th percentile |

13.4% |

29.5% |

49.3% |

28.1% |

There are several methods to indicate an average remuneration movement.

An average across the ASX 300 CEOs weighs each incumbent equally. This approach can be skewed by lower paid CEOs in the sample who have highly volatile percentage changes in pay due to:

- Greater growth prospects and re-adjustment of pay to reflect growth in company size and scope

- Significant changes in remuneration outcomes as companies entering the ASX 300 are subject to greater investor scrutiny

Two weighted average remuneration changes were also analysed:

- A total remuneration weighted average, where changes in pay are weighted by the dollar value of the average total remuneration for each CEO. This method puts a higher weighting on incumbents who receive higher overall remuneration.

- A remuneration component weighted average, where changes in pay are weighted by the dollar value of each remuneration component (TFR, STI or LTI) for each CEO. This method puts a higher weighting in incumbents who receive a higher dollar value for each remuneration component.

The remuneration component weighted averages provide a more valid depiction of changes in each component as it accounts for the different incentive leverage of CEOs. This reflects the remuneration policies across companies with some companies paying high fixed remuneration and lower STI or LTI opportunity.

Table 5: Different weighted average percentage changes.

|

|

TFR |

STI |

LTI |

TR |

|

Incumbent Weighted Average |

8.1% |

8.2% |

20.2% |

12.5% |

|

Total Remuneration Weighted Average |

5.0% |

7.1% |

22.2% |

12.2% |

|

Remuneration component Weighted Average |

5.8% |

8.1% |

24.1% |

12.2% |

The total remuneration weighted averages indicate a more conservative increase in TR.

Methodology

The ASX 300 incumbents were taken after the September 2022 index rebalancing. Remuneration figures for the CEOs were obtained from GuerdonData®, a database of remuneration information sourced from the statutory disclosures present in company annual reports.

Companies that have not disclosed their 2022 annual reports at the time of analysis were removed from the sample. Companies that floated on the ASX in 2021 or 2022 were removed, since they have no remuneration disclosures available prior to their listing. Externally managed entities and companies incorporated outside of Australia which do disclose remuneration in accord with Australian accounting standards were also removed.

CEOs who changed position over the 2021-2022 period or served a part-year term were excluded from the analysis. Termination benefits were removed from CEOs leaving at the end of the two reporting periods.

Quartiles are calculated on the full sample of CEOs. To reduce the effect of spurious outliers on the average, the data set is truncated at the 5th percentile and 95th percentile for each remuneration component.

Disclaimers:

The segmenting of results into multiple sectors introduces large variability in the observed values due to small sample sizes.

Some results may be reflective of data-mining effects rather than underling causal factors, due to the limited sample size of 176.

The selection criteria introduces sampling bias as the ASX 300 at a particular point in time excludes companies which have previously fallen out from the index and replacing them with recent additions. This may cause a positive bias if there is a correlation between share price performance and remuneration or market capitalisation and remuneration.

The following abbreviations have been used:

- TFR: Total Fixed Remuneration including cash salary, fringe benefits and superannuation

- STI: Short Term Incentives, which is pay contingent on performance measured within at 12-month period.

- LTI: Long Term Incentives, which is pay contingent on performance over a period greater than 12 months (typically 3 or more years.)

- TR: Total Remuneration, which is the sum of TFR, Total STI and LTI

- TSR: Total Shareholder Return

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter