12/04/2021

Guerdon Associates and CGI Glass Lewis hosted their 15th annual Remuneration and Governance Forum, this COVID time as a webinar, on the 23rd and 30th of March.

This article is one of three that summaries the main sessions.

The Forum opened with CGI Glass Lewis’ debriefing of the 2020 proxy season. While the Forum is conducted under the Chatham House rule, CGI Glass Lewis has allowed us to summarise the discussion.

Votes against Remuneration Reports

The number of strikes in the ASX 300 increased from 24 in 2019 to 25 in 2020. Conversely, the number of strikes for the ASX 100 fell from 9 in 2019 to 8 in 2020. 2 companies were on their second consecutive strike and 2 companies were on their third consecutive strike.

Again CGI Glass Lewis attributed the fall in ASX 100 strikes to the increase in companies paying no cash STI. In the ASX 100 there was an increase from 15 to 37 companies paying no cash STI and in the ASX 300 there was an increase from 53 to 96. The cause of the massive increase in this practice was likely the COVID-19 pandemic and a significant number of companies not paying bonuses while being on JobKeeper.

In CGI Glass Lewis’s view the 25 ASX 300 strikes in 2020 were a function of:

- Unjustified variable outcomes (9) – Variable pay was high, particularly in the absence of performance, proper justification or while receiving government support

- Structural issues (4) – Plan had poor design

- One-off awards (4) – Giving additional one-off bonuses or equity grants to executives, such as retention payments or special incentives

- Excessive equity grants (2): Giving excessively large equity grants to CEO and executive team

- Payrise (2): Significant pay rises or bonus opportunities given to CEO and executive team

Fixed equity grants have received a free pass this year: Companies that have adopted fixed equity grants have not received a strike when half of the equity grant continues to be performance based. This opens up new options for many companies to replace performance measures with fixed equity for a proportion of their incentive.

Guerdon Associates’ views on the prevalence of strikes can be found HERE.

Election of Directors

Protest votes against directors have fallen in the ASX 300 and risen in the ASX 100. There were 24 votes against directors greater than 25% in the ASX 300, down from 29 in 2019. In the ASX 100 there were 11 votes against directors of greater than 25% (although many of these were from non-board endorsed candidates, if these directors did not run, the number of protest votes would have been 4).

In CGI Glass Lewis’s view, the 24 protest votes against directors were a function of:

- Non-board endorsed candidates (9) – elections that were not supported by the board or where a significant shareholder sought to remove directors

- Independence concern (4) – Votes against non-independent directors when board does not have enough independent directors

- Contest by major shareholder (3) – Hostile takeover of company through second strike, board spill and votes to remove directors

- Director controversy (2)

- External directorship accountability (2) – Concerns with accountability due to previous positions

- Remuneration committee chair (2) – Votes against the remuneration committee chair due to continually poor remuneration

- Other (2)

Gender Diversity

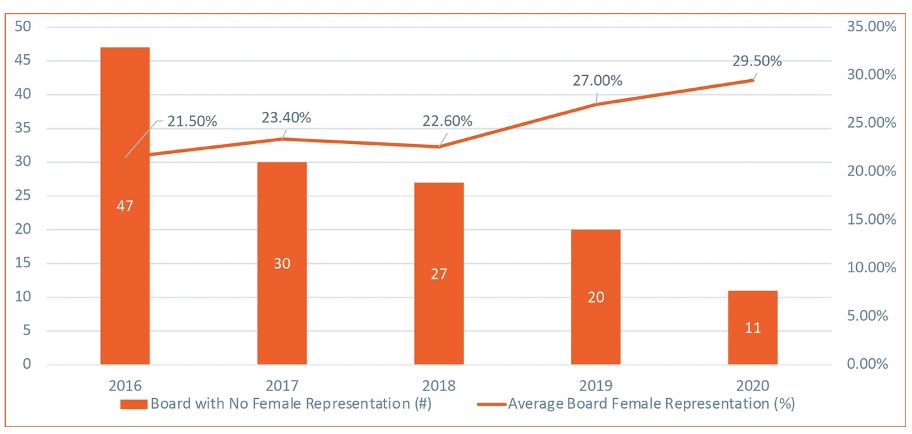

Boards have continued to become more equitable in their gender distribution. The average female representation on ASX 300 boards has risen to 29.5%. The number of boards with no female representation has fallen to 11.

The number of boards with 0 or 1 female directors was 83, with 45 of those boards having 6 or more directors. This will be a problem for these 45 companies going forward, as CGI Glass Lewis stated they have a higher standard for gender diversity in 2021.

Figure 1: Female board representation in the ASX 300

ESG Shareholder Proposals

The number of ESG shareholder proposals continues to rise, with some having significant success. There were 38 shareholder proposals in 2020 up from 31 in 2019. This compares to 2 back in 2016!

The common issues for these shareholder proposals include:

- Climate Change

- Industry Assessment COVID-19 Advocacy Activities

- World Heritage Properties

- Free, Prior and Informed Consent

- Reducing Exposure to Fossil Fuel Assets

Eight resolutions achieved above 25% support, excluding one, all to do with climate change. This is up from 2 achieving above 25% in 2019. The highest vote was a resolution on disclosing a Climate Change and Energy Advocacy Report for Woodside Petroleum, passing at 51.1%.

CGI Glass Lewis has noted that shareholder resolutions have shifted from being concerned with changing companies’ strategies to requiring more disclosure and setting targets. This has in turn caused greater support for these measures.

In the coming years there is going to be a push for more reporting on climate change by the big emitters and Say-On-Climate voting.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter