08/02/2021

COVID-19 had a devastating impact on people and companies all over the world. As lockdowns were enacted, decreased demand for goods and services hurt employees and companies bottom line.

In response to COVID-19, companies that were heavily impacted (or expected to be) implemented cost reduction measures to preserve cash flow. Common methods included standing down staff (temporarily or permanently), cancelling or deferring dividends, receiving government assistance, embarking on debt or equity raises or reducing remuneration.

Remuneration Adjustments

We monitored remuneration adjustments for the ASX 200. Ninety-five out of 200 (48%) of companies in the ASX 200 made some sort of remuneration adjustment. This includes reductions to fixed or incentive remuneration, or a change in instruments (typically cash to equity).

Executive remuneration reductions were mainly to total fixed remuneration (TFR), short term incentives (STI) or a combination of both. Non-executive director reductions were also to TFR.

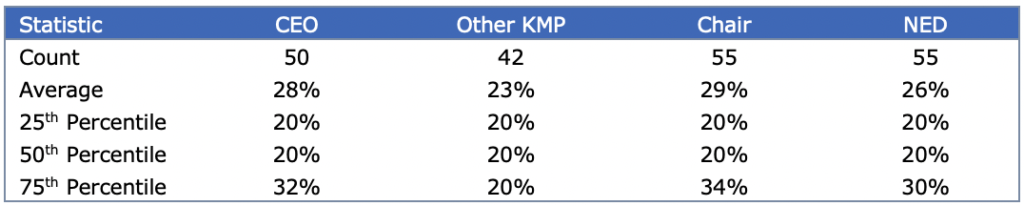

Table 1: ASX 200 TFR COVID-19 remuneration reduction percentages

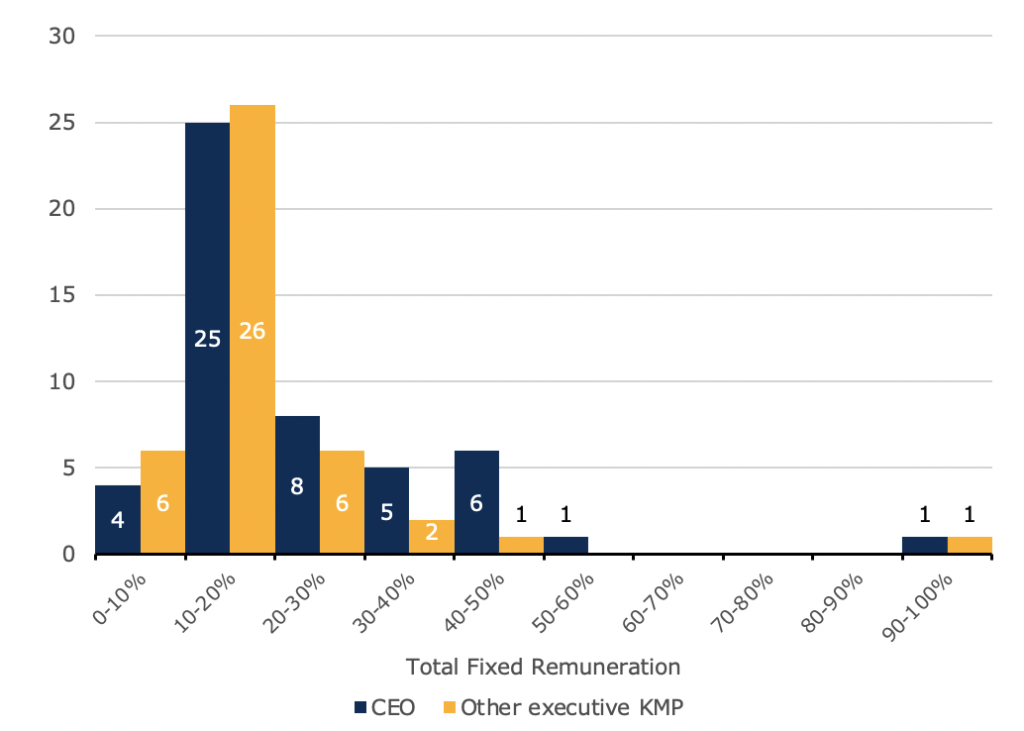

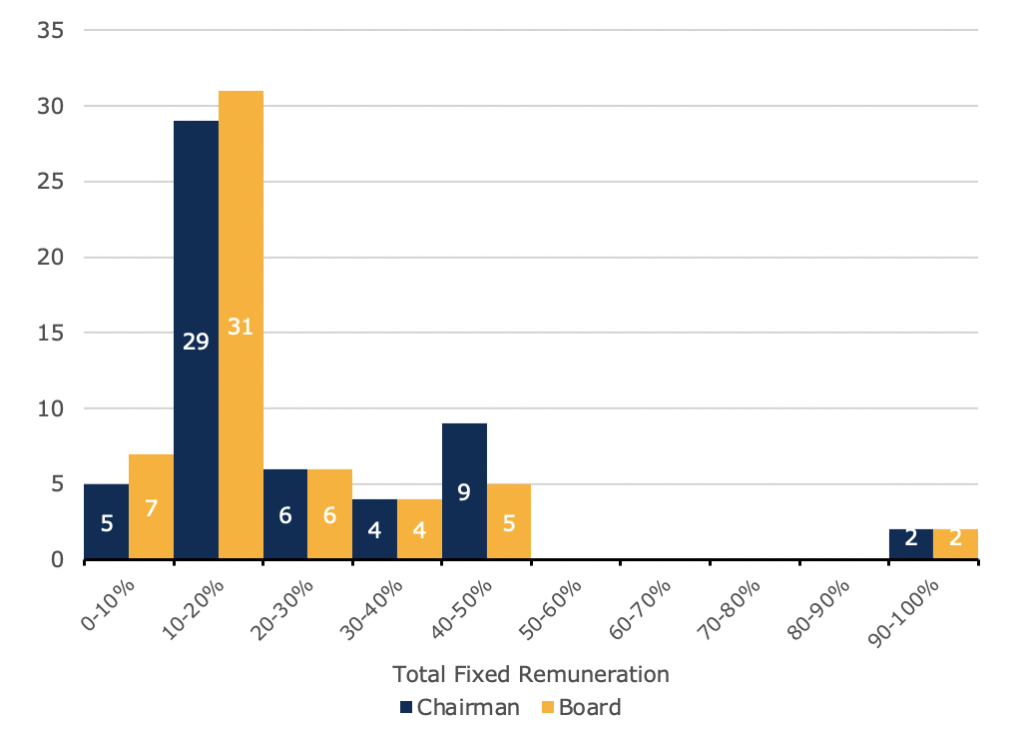

CEOs and the board chairman led by example. Their TFR remuneration reductions were equal to or greater than the reductions of other executive key management personnel (KMP) and other NEDs.

The most frequent reduction in TFR for executive KMP and NEDs was a 20% reduction in TFR. This reduction was usually for 3 months.

Figure 1: Executive KMP TFR reductions

Figure 2: NED TFR reductions

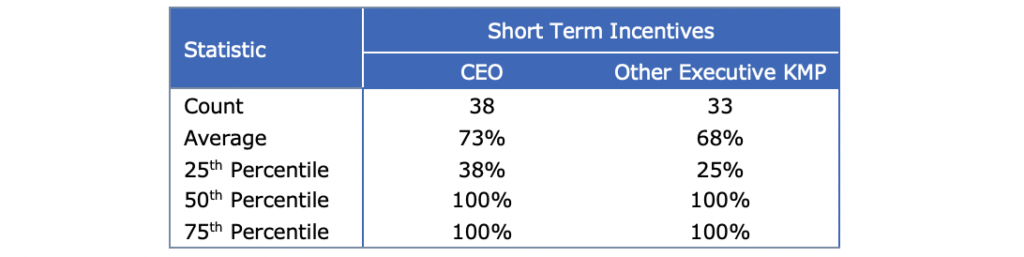

CEOs also took a larger reduction than other executive KMP for STIs.

Table 2: ASX 200 STI COVID-19 remuneration reduction percentages

The majority of STI reductions were 100% reductions. For CEOs, 23 of 38 (61%) were 100% reductions. For other executive KMP, 19 of 33 (58%) were also 100% reductions.

Long term incentive adjustments mainly focused on new grants. Earnings targets were replaced with total shareholder return (TSR). Some companies have deferred setting targets. Others have made equity grants with service conditions only.

For further breakdown on the KMP remuneration affected by COVID-19, see HERE and see HERE to view our full database on remuneration adjustments across the ASX 200.

Annual General Meetings and COVID-19 Remuneration Adjustments

We performed a hypothesis test to see whether ASX 200 companies with COVID-19 related remuneration adjustments were getting lower votes against on their remuneration report compared to companies that did not make a remuneration adjustment.

This prompts the question, were COVID-19 remuneration adjustments a sure fire way to reduce votes against the remuneration report?

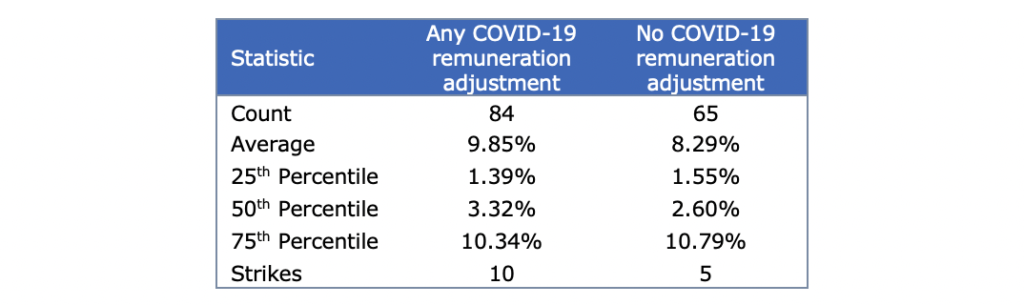

Table 3 looks at the FY20 votes against the remuneration report, split based on whether the ASX 200 company had a COVID-19 related remuneration adjustment. This excludes companies that are yet to have their FY20 AGM.

Table 3: ASX 200 votes against the remuneration report by COVID-19 remuneration adjustments

Companies which have made remuneration adjustments have attracted more strikes. This could be biased by the larger sample size or the fact that those companies were affected more by COVID-19.

A T-test was used to determine if there was a statistically significant difference between the two groups. This hypothesis test examines if the means of 2 samples are equal. The test was conducted using the no votes of ASX 200 companies who had a COVID-19 remuneration adjustment against those with no remuneration adjustment.

At a 95% confidence level, the means of the 2 samples are considered equal. This result is statistically significant which means there is less than a 5% chance that the conclusion of the means being equal is incorrect.

Companies that adjusted remuneration for COVID-19 were unlikely to receive a different percentage of votes against the remuneration report compared to those companies that did not adjust.

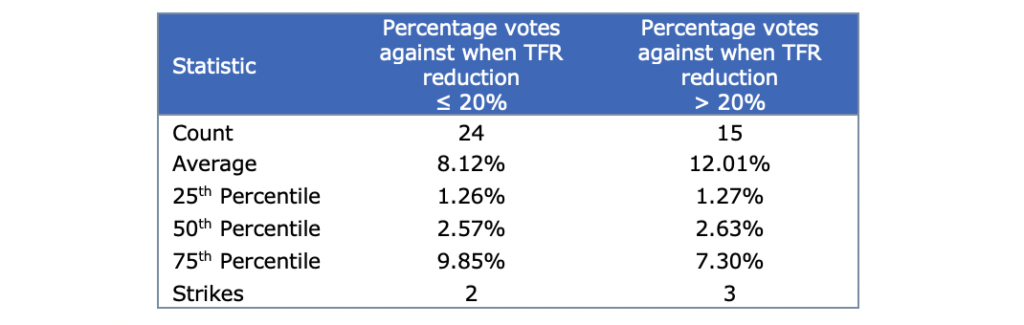

We used another T-test to see if the size of the remuneration reduction influenced the votes against the remuneration report.

Table 4: ASX 200 votes against the remuneration report based on CEO TFR COVID-19 remuneration reduction percentage

At a 95% confidence level the means of the 2 samples are equal. Companies that reduced CEO TFR by more than 20% were unlikely to receive a difference in the percentage of votes against compared to those companies that adjusted by less.

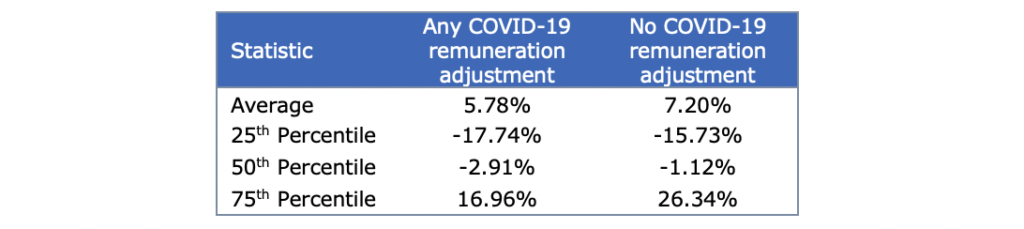

Does this mean that almost half of the ASX 200 adjusted KMP remuneration for no reason? Unlikely. Companies which made a COVID-19 remuneration adjustment had a worse total shareholder return (TSR) from 1 January 2020 to 31 December 2020.

Table 5: ASX 200 TSR based on COVID-19 remuneration adjustment

Previous analysis by Guerdon Associates indicates that there is a statistically significant relationship between TSR and votes against (see HERE). That is, a lower TSR will increase the chance of a vote against the remuneration report.

Therefore, companies with COVID-19 remuneration adjustments were able to receive similar levels of support for remuneration reports despite being impacted more severely in terms of TSR. While the tests suggest there is no significant difference between the two samples, statistical tests have not yet been undertaken to determine if the companies that did make those adjustments will have had similar outcomes. After all, they were more heavily impacted by the pandemic and so they had to make a change to bolster shareholder support.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter