05/06/2020

As COVID-19 continues to take its toll, companies have bolstered their survival with tough cost-saving measures and/or capital raisings. This includes key management personnel (KMP) remuneration adjustments to save costs and reputation.

For those following these developments closely, there will be an awareness that selected external stakeholders believe some listed company boards are dragging their feet on pay adjustments, while applauding companies that have acted. Some investors, mainly based out of the UK, appear to believe that the great majority of listed companies should be cutting executive and director pay. This is important to investigate.

In this article we try and discern if there appears to be a difference between companies that have made pay adjustments and the others. If there is no difference, then it reflects badly on the majority of companies which have not adjusted director and executive pay.

Specifically, this month we have investigated the market value reduction of ASX 200 companies against whether they have announced director and executive COVID-19 remuneration adjustments. Reductions were compared to market value reductions across others in the ASX 200. Hypothesis tests were performed to see whether the reduction in market value was related to the size of the remuneration reduction and, indeed, if there is any discernible difference between companies that do and companies that do not adjust pay.

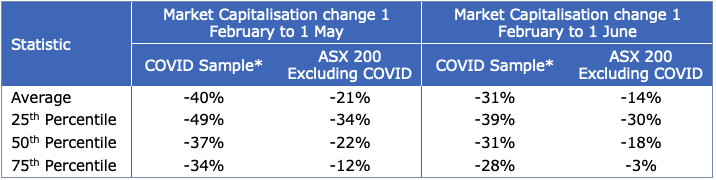

Market capitalisation was taken as the measure for market value. A 30-day average market capitalisation to the 1st of February 2020 was used as our baseline (pre-COVID) market value. The market value reduction was calculated as the percentage difference between the baseline date and the 30 day average market capitalisation to both the 1st of May and 1st of June 2020.

Table 1 below shows that the COVID-19 sample of 44 ASX 200 companies have had larger reductions in market value compared to the ASX 200 excluding these 44 COVID-19 companies.

Table 1: ASX 200 COVID-19 pay reduction compared to others on change in market value

*While 45 ASX 200 companies have made COVID-19 remuneration adjustments, only 44 companies are used in the statistics above. United Malt Group Ltd (UMG) listed on the 24th of March 2020 and as such the 30-day market capitalisation cannot be compared to the pre-COVID basis.

A T-test was used to determine if there was a statistically significant difference between the two groups. This hypothesis test examines if the means of 2 samples are equal. At a 99% confidence level the means of the COVID-19 sample and the ASX 200 excluding the COVID-19 sample are unequal. Therefore, the market value reduction is higher for companies that have made a COVID-19 remuneration adjustment.

In other words, the companies that made pay adjustments do differ from those that did not make adjustments in terms of their loss in shareholder value during COVID 19.

The next step was to dig a bit deeper into the size of adjustments made, and whether they related to the size of the value loss.

CEO total fixed remuneration (TFR) and chairman total fee remuneration reductions were regressed against their respective company’s market value reduction to the 1st of June 2020.

The sample size of 32 CEOs and 38 chairmen showed that there was no statistically significant relationship between the market value reduction and the percentage reduction in TFR or total fees. Similarly, when tested on the dollar values, no statistically significant relationship was found either.

Therefore, the extent of the pay cut taken by the CEO or chairman is unrelated to the market value reduction of their company. The most common pay adjustment was 20%, regardless of size.

The analysis ignores the probable (but yet to be confirmed) loss in long term and short term incentive pay that, in many cases, will be more than the entire fixed pay an executive will receive.

Figure 1 below shows the CEO regression. The r-squared value indicates that less than 0.01% of the variability in y (remuneration dollar amount reduction) is explained by the variation in x (market value dollar amount reduction). The CEO remuneration data is based on ASX announcements as of the 1st of June 2020.

Figure 1: Regression of market value reduction against CEO TFR reduction

Figure 2 below shows the chairman regression. The r-squared value indicates that less than 4.8% of the variability in y (remuneration dollar amount reduction) is explained by the variation in x (market value dollar amount reduction). The Chairman remuneration data is based on ASX announcements as of the 1st of June 2020.

Figure 2: Regression of market value reduction against chairman total fee reduction

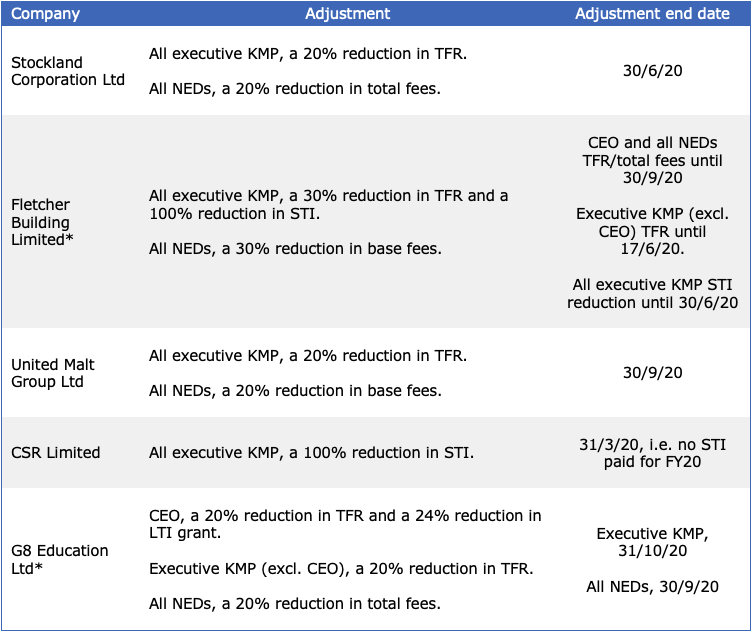

An update of COVID-19 announcements compared to the previous months’ articles (see HERE) and HERE) is in the table below.

Alternatively (see HERE) to view our database with all COVID-19 remuneration adjustments for ASX200 companies.

Note that TFR refers to total fixed remuneration and STI refers to short-term incentive.

Table 2: New ASX200 companies remuneration adjustments since 30 April

* Fletcher Building Limited (FBU) and G8 Education Ltd (GEM) provided further details on their remuneration adjustment this month. The entries here encapsulate the latest remuneration adjustments for KMP.

Other methods to help companies conserve cash and to keep people employed are found HERE.

As Guerdon Associates continues to monitor ASX200 companies for remuneration adjustments, further statistical analyses will be provided in forthcoming articles linked to our monthly GuerdonNews® summary.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter