11/05/2020

We have been closely monitoring ASX200 remuneration adjustments in light of COVID-19.

As of close of business on the 8th of May 2020, there have been 42 ASX200 companies which have announced a remuneration adjustment for key management personnel (KMP).

Press releases where there has not been an official ASX company release for verification have not been included in the data analysis below.

Whose remuneration has been impacted?

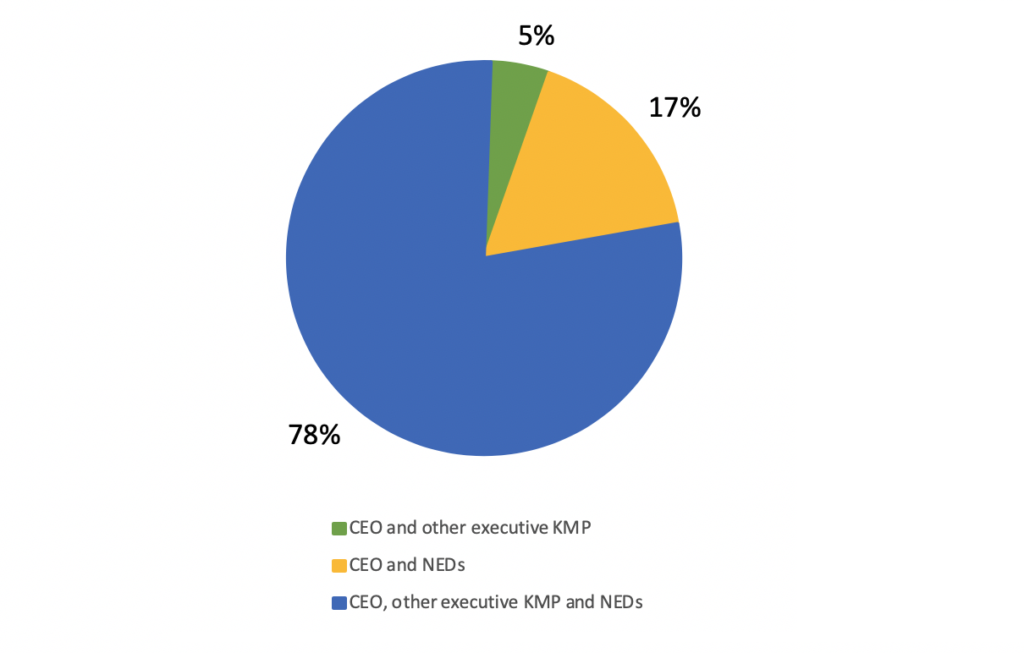

The majority of remuneration adjustments have been for both executive KMP and directors.

All announcements have revolved around a CEO’s remuneration adjustment with no announcements being for a CEO solely. There have also been no remuneration adjustments for executive KMP (excluding the CEO) or the board only.

Additionally, all announcements but one that included the board have been for both the chairman and the other board members. The remaining one was for both the executive chairman and CEO.

Figure 1: KMP impacted by remuneration adjustments

The size of remuneration reductions

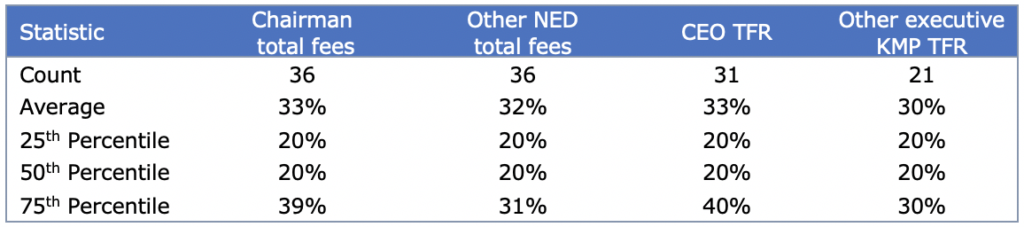

Table 1 shows the quartiles and averages of the company responses for NED fees, CEO total fixed remuneration (TFR), and other executive KMP TFR. Companies that did not announce the size of the TFR reduction have not been included in the count.

Table 1: ASX200 COVID-19 NED, CEO and other executive KMP remuneration reductions

The board fee reductions are almost identical. Only 1 chairman is taking a larger fee reduction than the rest of their board.

Executive fee reductions were more varied, with more CEOs taking larger reductions than the other executive KMP. The difference in the count of CEOs and other executive KMP reflects companies making reductions for CEOs and NEDs only.

Almost all short term incentive (STI) and long term incentive (LTI) adjustments announced were for a 100% reduction. For CEOs, this relates to 11 STIs and 3 LTIs. One CEO had a 75% reduction in STI, which is the only incentive reduction that is not 100%. For other executive KMP, it is for 8 STIs and 2 LTIs.

LTI reductions are in the form of no new grants being made in the coming year.

A few companies announced adjustments to total remuneration. For CEOs, the adjustments to total remuneration ranged from a 20%-46% while for executive KMP it ranged from a 20%-50% reduction.

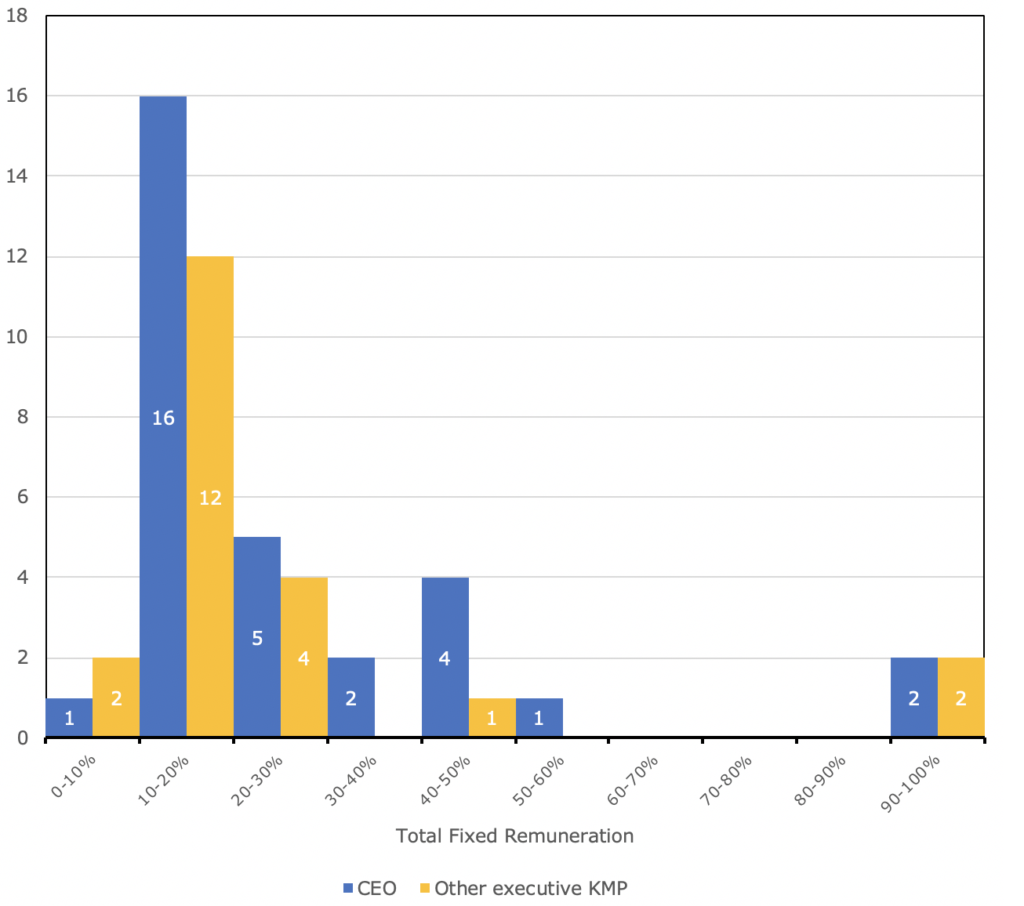

The majority of CEO and other executive KMP reductions were between 10-30% of TFR. The most frequent reduction was 20%. The distribution of CEO and other executive KMP TFR reductions are shown below.

Figure 2: CEO and other executive KMP remuneration reduction breakdown

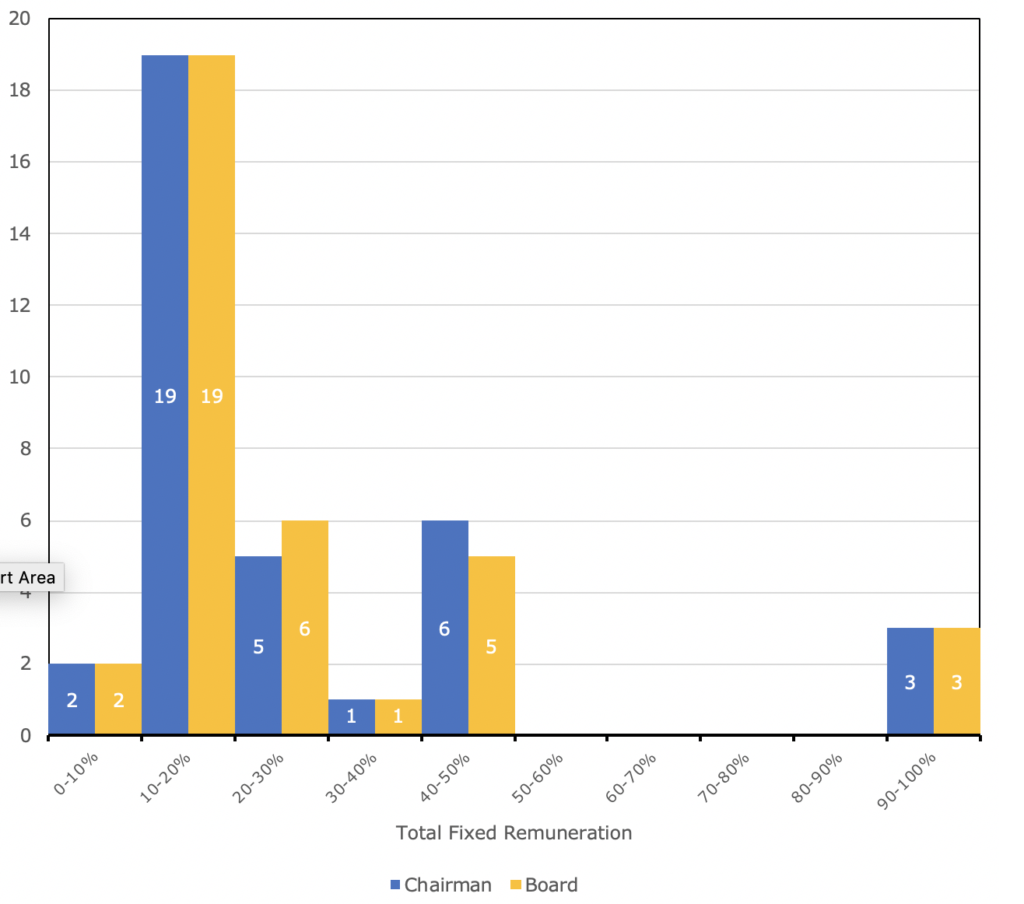

The majority of chairman and other NED fee reductions were between 10%-50% reductions. The most frequent reduction was 20%. The distribution of chairman and other NED fee reductions is shown below.

Figure 3: Chairman and other NED fee reduction breakdown

Sector breakdown

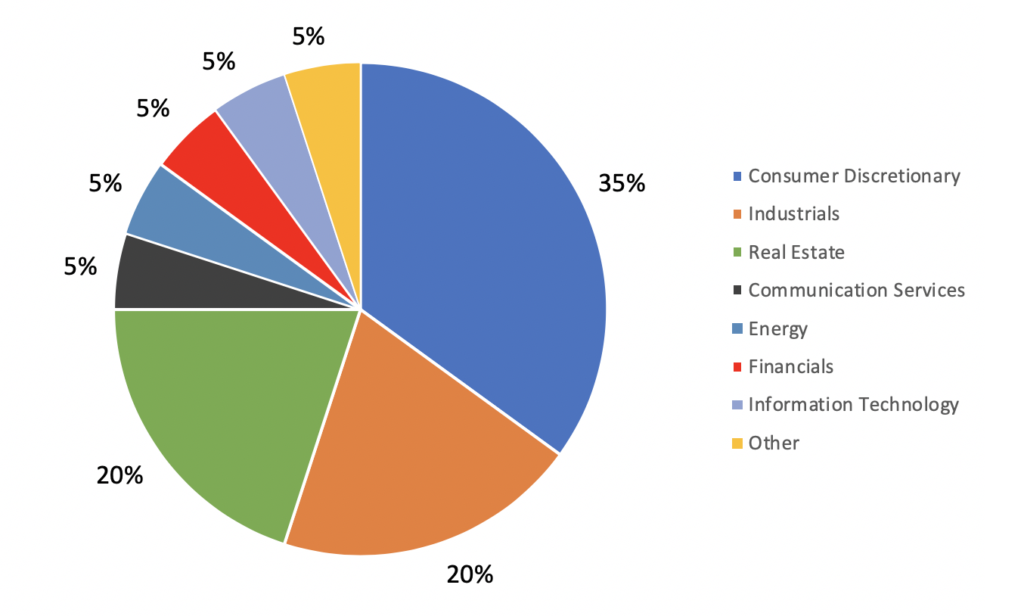

The Global Industry Classification Standard (GICS) sectors most heavily impacted by COVID-19 have also been most prominent in remuneration adjustments.

Consumer Discretionary, Industrials and Real Estate sectors make up 75% of all remuneration adjustments so far. These are followed by Communication Services, Energy, Financials and Information Technology sectors making up 5% each. Other includes Health Care and Materials sectors. Utilities and Consumer Staples companies have not reported any remuneration adjustments.

Figure 4: GICS Sector breakdown of ASX200 COVID 19 remuneration adjustments

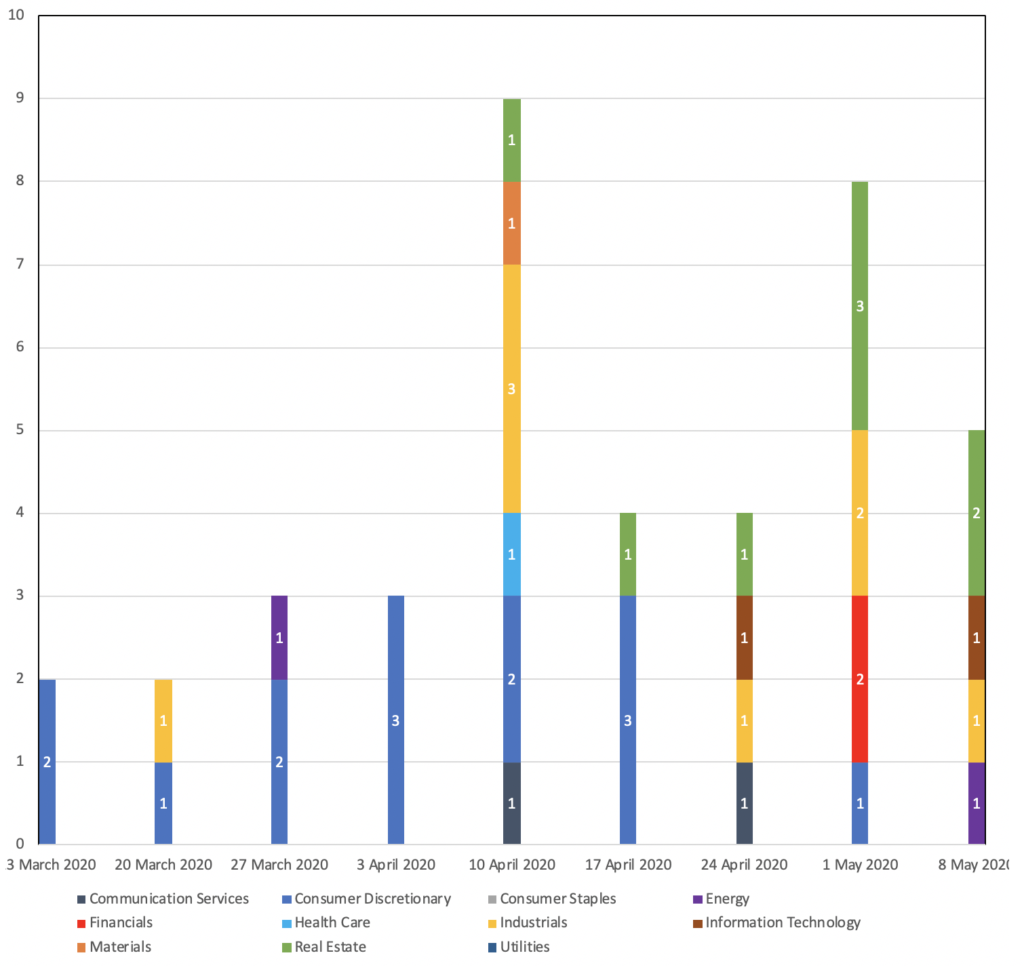

Figure 5 shows the timing of the remuneration adjustments each week, with companies split into their respective GICS sectors.

Figure 5: Timing of remuneration adjustments by sector

Consumer discretionary announcements dominated the first 4 weeks. Week 5 saw the most announcements thus far. Since then, Consumer Discretionary announcements have decreased while Real Estate ones have increased.

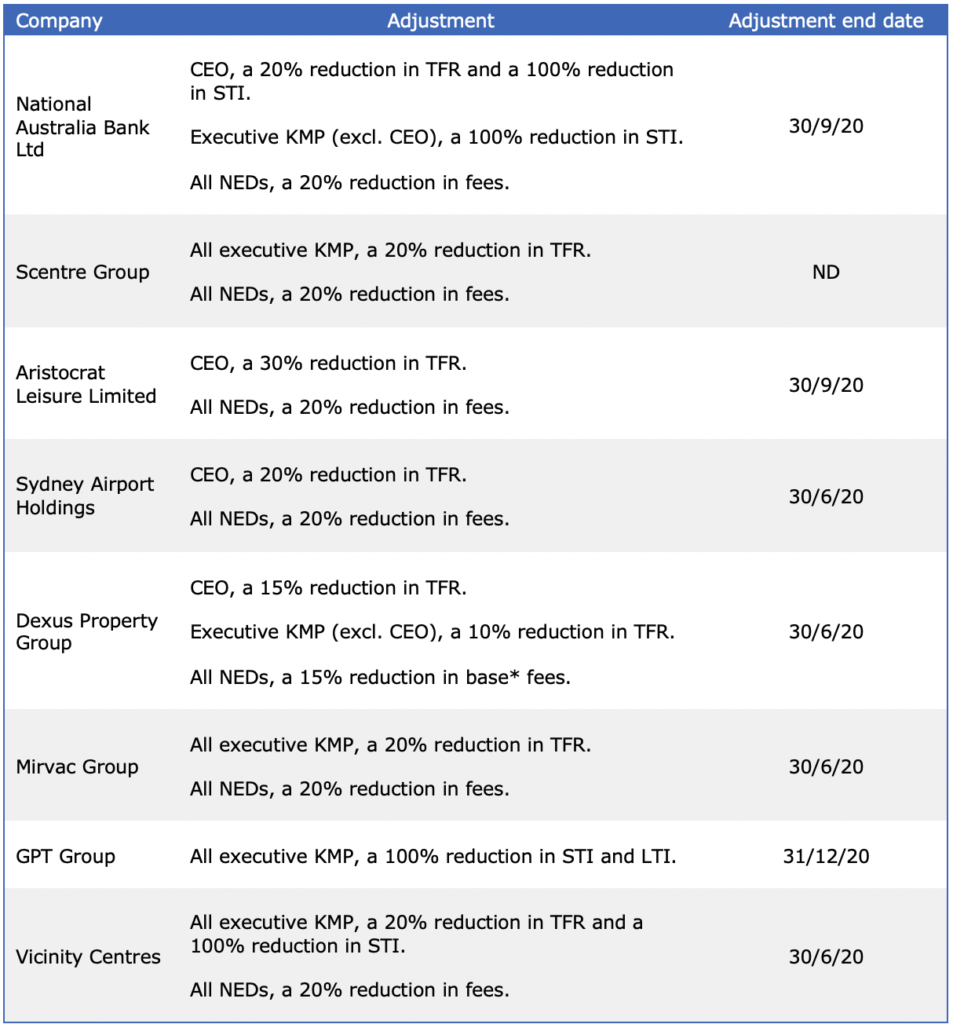

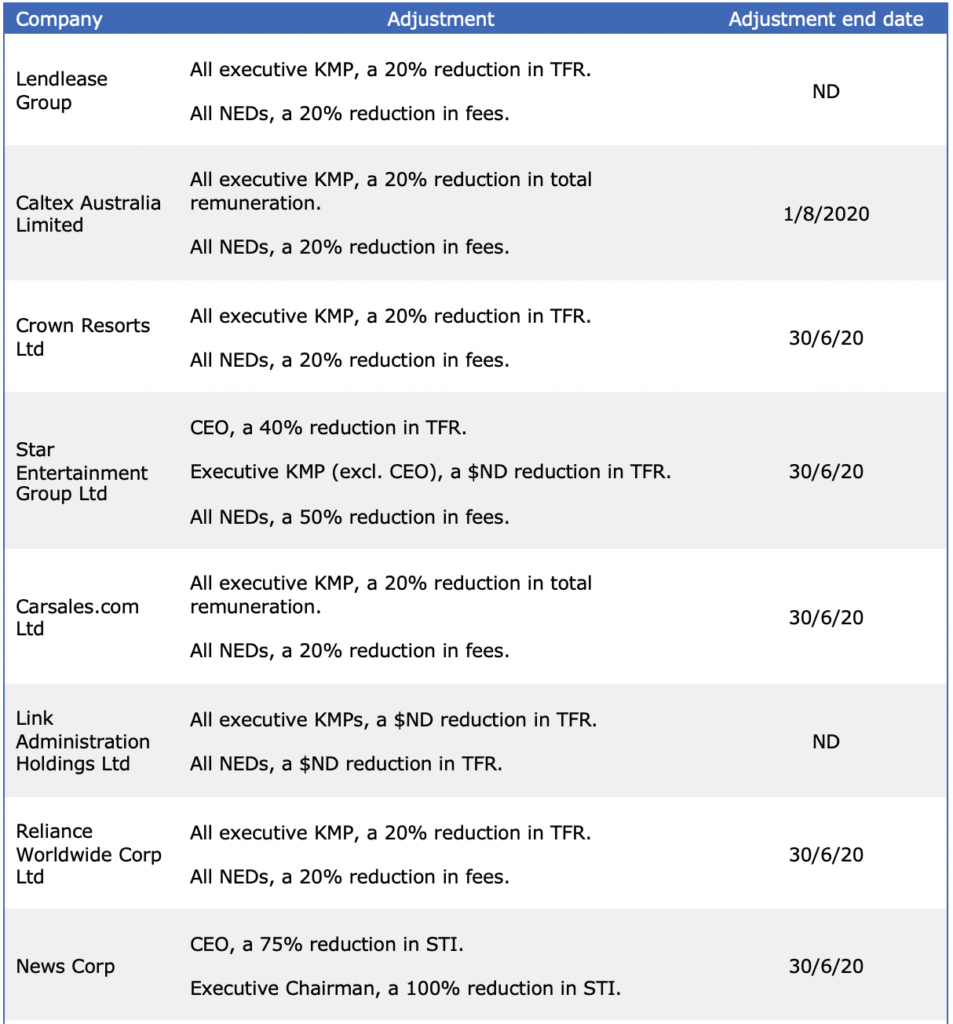

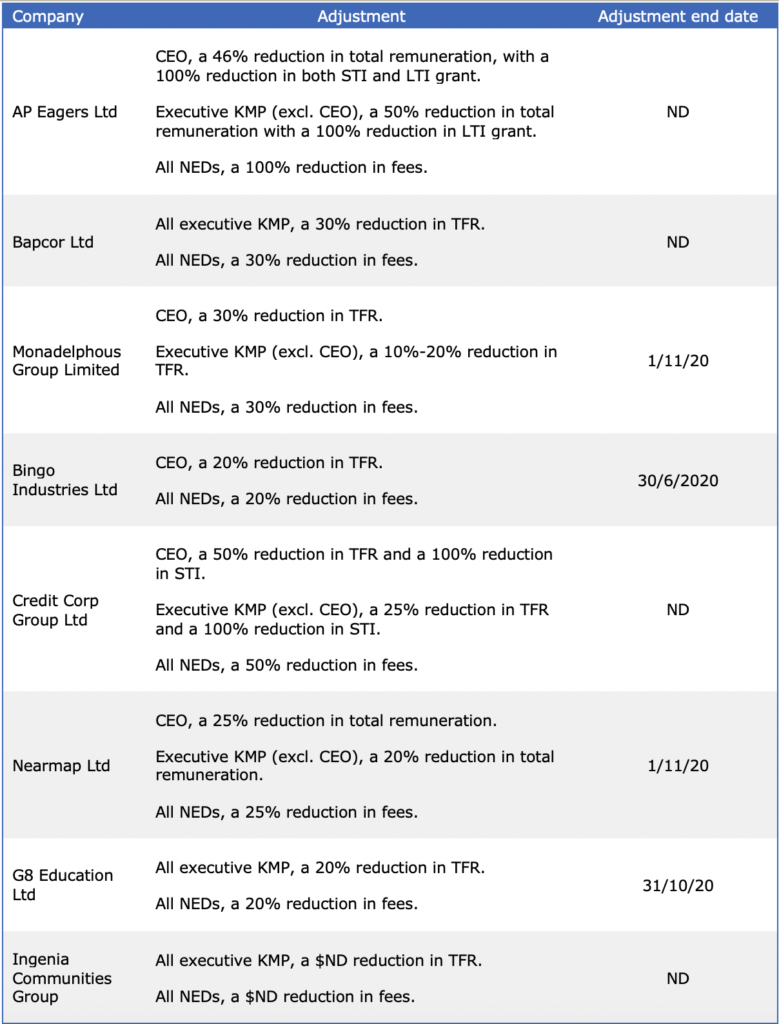

An update of COVID-19 announcements compared to the previous article (see HERE) is in the table below.

Alternatively, click HERE to view our database with all COVID 19 remuneration adjustments for ASX200 companies.

Note that TFR refers to total fixed remuneration, STI refers to short-term incentive and LTI refers to long-term incentive. ‘$ND’ refers to a remuneration adjustment that was disclosed without its magnitude and ‘ND” refers to not disclosed.

Table 2: New ASX200 companies remuneration adjustments

* The remuneration adjustment for the Dexus Property Group NEDs (excluding the Chairman) appears to be for main board fees only. As all other boards have had reductions to total board fees, a conversion to total fees was required. The 15% reduction in base fees was converted into an equivalent reduction in total fees of 11.71%, which was used for calculations.

As Guerdon Associates continues to monitor ASX 200 companies for remuneration adjustments, further statistical analyses will be provided in forthcoming articles linked to our monthly GuerdonNews® summary.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter