11/05/2020

With companies announcing capital raisings, dividend deferrals/cancellations, hiring freezes, forced annual leave taking and staff reductions, we researched if the extent of CEO ownership made a difference?

We performed a hypothesis test to see whether a CEO’s shareholding value was related to more sacrifice. Were those with higher ownership, and hence greater loss, less inclined to sacrifice pay? Or was it the other way, with higher ownership indicating these CEOs were better off and could afford to sacrifice more, or were more empathic with their shareholders?

Founders were excluded due to their disproportionate shareholding amounts. Regardless, the results remain consistent with their inclusion.

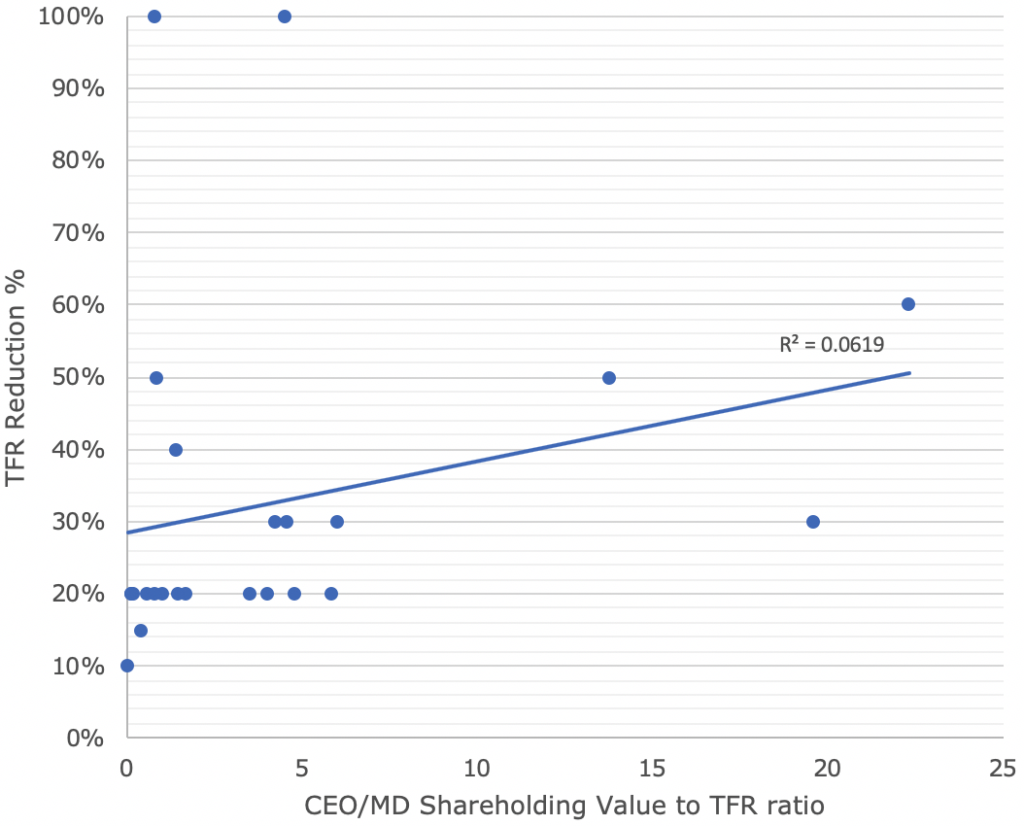

CEOs and Managing Directors (MDs) had the ratio of their shareholding value to TFR regressed against the size of their remuneration reduction.

We found zip. That is how much the amount a CEO owned bore no relation to the proportion of TFR they sacrificed.

The sample size of 24 CEOs and/or MDs revealed that there was no statistically significant relationship between the ratio and the percentage reduction in TFR.

This would imply that the proportion of the pay cut taken by the CEO or MD is unrelated to their ownership value in the company.

Figure 1 below shows this regression. The r-squared value indicates that less than 6.2% of the variability in y (remuneration reduction) is explained by the variation in x (shareholding value to TFR ratio). The data is based on CEO remuneration data as of the 8th of May 2020 based on ASX announcements.

Figure 1: Regression of shareholding value to TFR ratio against TFR reduction

Analysis conducted on the remuneration adjustments announced so far revealed that the most common pay reduction of a CEO has been 20% of their total fixed remuneration (TFR) (see HERE).

To view our database with all COVID 19 remuneration adjustments for ASX200 companies, click HERE.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter