12/04/2021

Mandatory post-vesting holding requirements for executives are becoming more prevalent on the ASX. Companies that require executives to retain shares that have been awarded on vesting of equity incentives can show continued alignment with shareholders beyond the typical LTI vesting period of 3-4 years.

These restrictions do not impact the nature of “vesting” itself – the awarded shares are owned by the executive, but they cannot yet be sold. Post-vesting restriction periods typically range from 1-3 years, and in some cases they can stretch to retirement.

While many executives may complain, the reality is that many are not able to trade in any case due to insider knowledge.

Another benefit is tax deferral for the executive until the restriction ceases.

Post-vesting restrictions have another benefit in addition to showing continued alignment between executives and shareholders: they reduce the fair value of equity grants that companies need to amortise over the vesting period in accordance with AASB 2. That is, the share-based expense in the income statement will be lower with these restrictions, all else being equal.

Yet on reading company pay policies for decades, and the valuations in the notes to the financial report, it seems few companies take advantage of these benefits.

There are a couple of definitions to note. First, a ‘vesting condition’ is either a service or performance condition that determines whether the entity receives the services that entitle the employee to the share-based payment. The discount for the sale restriction is not applicable during the vesting period; it can only be applied to sale restrictions once the employee is entitled to the share-based payment (that is, post-vesting).

The logic behind the discount is that a share that has a limitation on trading or transferability after vesting is worth less than a share without such restrictions. This discount is typically referred to as a Discount for Lack of Marketability (DLOM).

There are three broad methods used to estimate the size of the DLOM:

- Initial Public Offering studies: Studies comparing prices pre-IPO and post-IPO

- Restricted share studies: Studies comparing prices of registered shares (which are freely traded) with prices of unregistered shares.

- Option pricing models: The restriction to sell shares can be described as the value of a forgone put option (i.e. the right, but not obligation, to sell a share). Variations of put option models can therefore be used to quantify the DLOM.

Below we provide an example of using a put option pricing model (the Ghaidarov model) to quantify the size of the DLOM. The main drivers of the put option value are the length of the restriction period (the option term) and the volatility of the shares.

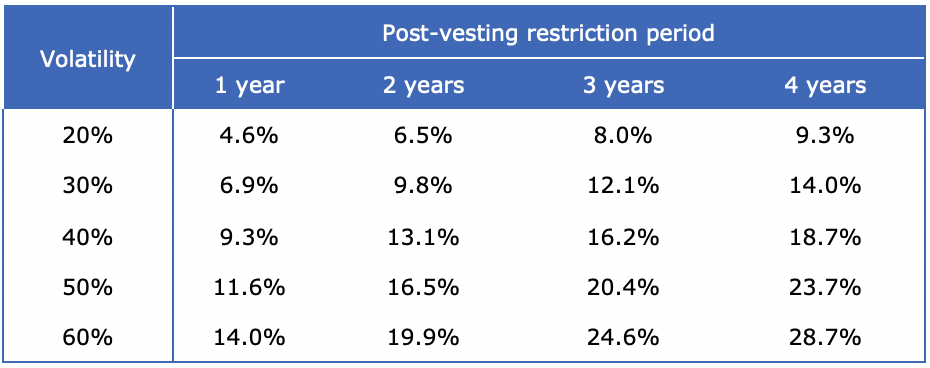

The table below shows the discount on the fair value of equity grants for various post-vesting restriction periods and share price volatilities. This discount is applied to reach a fair value for equity valuations under AASB 2.

Table 1: Fair value discount of equity grants

The longer the restriction period, and the higher the share price volatility, the larger the discount. For example, a post-vesting restriction period of 3 years for shares with an estimated volatility of 40% would mean a discount of 16% to be applied to the value of granted equity. The share-based expense in the income statement will be reduced by 16% over the vesting period compared to equity without post-vesting restrictions.

Something to consider for boards and CFOs alike.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter