09/04/2020

Guerdon Associates and CGI Glass Lewis presented their 14th annual Remuneration and Governance Forum in Sydney on 12 March.

The Forum opened with CGI Glass Lewis’ debriefing of the 2019 proxy season. While the Forum is conducted under the Chatham House rule, CGI Glass Lewis has allowed us to summarise the discussion on:

- Votes against Remuneration Reports

- Protest votes against directors

- Gender Diversity of ASX 200 boards

- ESG shareholder proposals, in particular those backed by ACCR and Market Forces

Votes against Remuneration Reports

The number of strikes in the ASX 300 increased from 20 in 2018 to 24 in 2019. Conversely, the number of strikes for the ASX 100 fell from 10 in 2018 to 9 in 2019.

CGI Glass Lewis noted the decrease across the ASX 100 may be due to the increased number of no STI payments in 2019 (see HERE), and the reduction in the number of combined incentive (or hybrid) plans. Both of these factors were points of disagreement with shareholders in 2018.

In CGI GL’s view, the 24 ASX 300 strikes in 2019 were a function of:

- Unjustified variable outcomes: 7

- Variable pay was high, particularly in the absence of performance or proper justification

- Structural issues: 5

- Plan had poor design, such as a combined incentive without rationale or a lack of appropriately challenging performance hurdles

- Pay rises: 3

- Significant pay rises or bonus opportunities given to CEO and executive team

- Severance: 3

- Unjustified severance payments like automatic vesting of on-foot securities

- Other reasons: 6

Guerdon Associates’ views on the prevalence of strikes can be found HERE .

Election of Directors

Protest votes against director elections continue to climb.

The number of directors up for election with more than 25% of the votes against them rose from 26 in 2018 to 29 in 2019 (noting that less than majority support for a director election is rare. If that becomes apparent, a director will often generally resign before the vote and avoid risking failure). Only 3 directors received more than 50% votes against their election. Of these, two of the director nominations were opposed by the board in contested elections.

In CGI GL’s view, the 29 protest votes against directors were a function of:

- Contested elections: 5

- Being a) elections that were not supported by the board and b) elections where a significant shareholder sought to remove directors

- Board independence: 3

- Directors not considered to be independent where overall board or key sub-committee independence was lacking

- Over-boarding: 3

- Directors serving on too many boards

- Prior directorship concern: 3

- Concerns around the director’s prior management or board roles

- Regulator action: 3

- Action taken by a regulator against the company which results in shareholder protest against directors

- Performance: 2

- No female directors along with problematic company performance (this was a single AGM)

- Takeover handling: 2

- Related party transactions: 2

- Other: 6

There is a growing trend of shareholders being more willing to vote against director elections. However, only 3 director elections were actually voted down (two of which did not have board support). More may have withdrawn.

The latest Glass Lewis press release in response to COVID-19 indicates they expect there may be more directors that Glass Lewis may not consider up to the task (primarily from being over-boarded during a crisis hitting multiple companies at once). See HERE .

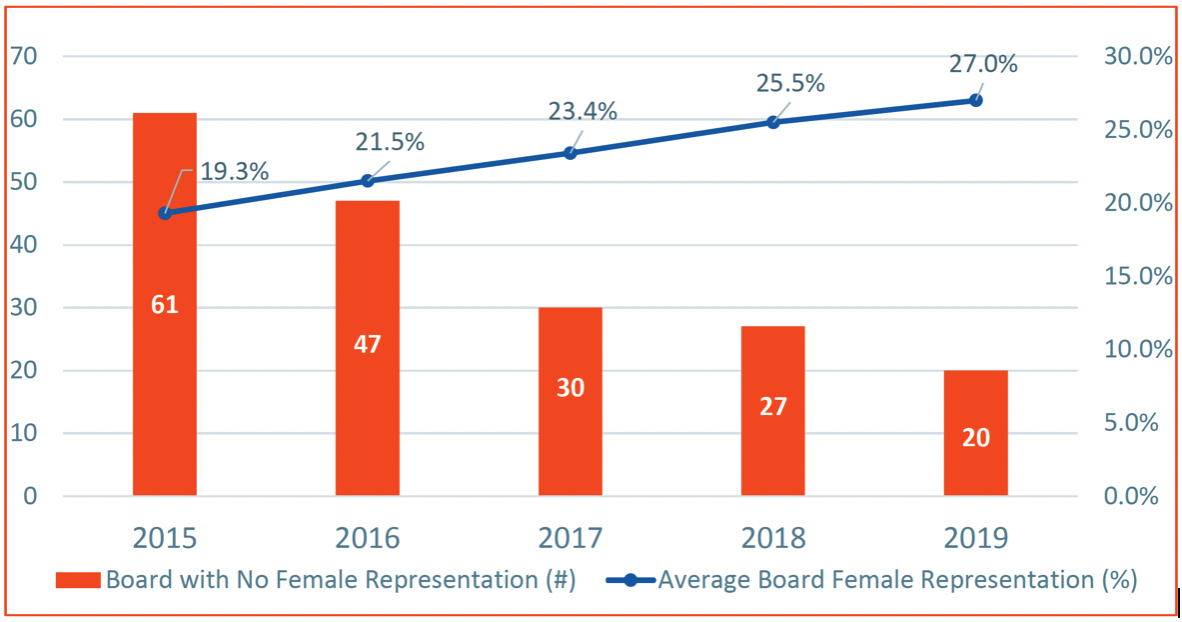

Gender Diversity

Boards have become more equitable in their gender distribution. The average female representation on ASX 300 boards has risen to 27%. The number of boards in the ASX 300 with no female representation has fallen to 20.

CGI GL has indicated that it will vote against boards without female members on the basis of its view that a more diverse board allows for differing opinions. CGI GL’s view is that a more diverse board protects against groupthink and promotes access to wider pools of talent.

ESG Shareholder Proposals

The number of shareholder proposals relating to ESG rose from 18 in 2018 to 31 in 2019. There has been a 72% increase in ESG proposals by ACCR and Market Forces. And, this is up from 2 proposals in 2016!

The common issues for these shareholder proposals included:

- Climate Change

- Aboriginal Land Rights

- Suspension of Lobbying Funding

- Labour Abuses

Twelve resolutions received more than 10% of shareholder support in 2019. This is an increase from 4 in the prior year. To date, no ESG shareholder proposal has received a majority. The highest vote continues to be Origin Energy where, in 2018, 44% votes were cast for a climate change and energy advocacy report. This year the company with the highest percentage of votes for a shareholder ESG proposal was AGL’s climate change transition plan vote, with 31.4% voting for the proposal.

CGI GL noted that the influence of Market Forces and ACCR will continue to become more significant in future. Market Forces appears to be focusing on financial institutions whereas ACCR will be focusing on extractive entities, being mining and oil and gas.

In 2020 Market Forces will focus on issues in respect of funding, investing in, subsidising or insuring fossil fuel projects. ACCR will focus on issues in respect of climate change and energy, human rights and workers rights.

CGI GL consider engagement with shareholders on these resolutions is the best policy, stating that when a resolution comes up, companies should attempt to explain any opposition they have to the ask of the resolution.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter