09/03/2020

During our Remuneration and Governance Forum this week in Sydney, and the following week in Perth (see HERE), we will be considering the role of the board remuneration committee and shareholder expectations for the application of discretion to executive incentives.

Exercise of negative discretion

Many directors and investors attending the Forum will be expecting the main focus of the discussion will be around the application of negative discretion. The absence of the exercise of negative discretion on executive pay outcomes was a feature of the APRA enquiries into CBA (see HERE) and 12 regulated institutions (see HERE) . Inadequate negative discretion was a common component in no votes and “strikes” in 3 of the 4 large bank remuneration reports in 2018. It may also feature in a long-awaited ASIC enquiry report on remuneration and other governance matters for 21 large listed entities (ASIC Commissioner John Price will be on the Forum panel should you attend and want to ask).

Since then, banks, and several other ASX 100 companies, have refined their consequence management policies (see HERE) . These policies aim to ensure there is “less discretion in board discretion” to reduce executive pay, taking into account assessments of materiality, executive culpability, and executive responsibility.

But, what about the exercise of positive discretion?

Some investors might suggest the only time they want to see discretion exercised is when it is negative.

What if management does something of material benefit to stakeholders for which, under the incentive plan measures, they are not entitled to a reward? And to complicate matters, what if the material benefit to shareholders is not a matter of an increase in shareholder value, but less of a loss in value than that suffered by peers?

Some companies are bearing early witness to this phenomenon now, as boards and management wrestle with stemming the impact of the Covid-19 virus.

Here is a range of alternatives for board remuneration committees to consider as the fallout from coronavirus continues.

1 . Tough bikkies – no discretion warranted

STIs

If executives’ annual incentives are only based on EBITDA, then what may be tough luck for the travel industry CEO may be good fortune for the health industry CEO. Additionally, a V-shaped recovery from a pandemic, boosted by fiscal and monetary stimulus, may even result in higher average incentive payments over the trough to peak period.

On this basis, it is argued that an executive’s experience of the swings and roundabouts through a cycle results in fair pay outcomes aligned with the shareholder experience. Many investors support this approach, as it is aligned with their interests, is transparent, and is easy to understand.

Hence, those investors will say that positive discretion is not warranted.

LTIs

LTIs would be regarded in the same way. That is, the hands off, no discretion preference may be based on the view that the LTI performance period incorporates both swings and roundabouts such that an executive, on balance, is no better or worse off. This indeed may the case with coronavirus if quickly brought under control, with a vaccine produced and applied, and follow-up fiscal stimulus by governments in China and elsewhere resulting in quick recovery. In the longer term, some financial targets like EPS growth, may be unaffected.

However, other force majeure events, such as war, may be less accommodating.

Relative performance measures may still retain their validity assuming force majeure events affect all equally. So TSR for a mineral mining company relative to other mineral mining companies may fairly reflect performance and require no discretion.

However, an exception may be appropriate for companies that also have a gateway that requires TSR to be positive for the period. In this case, the exercise of positive discretion may be warranted. See below.

2 . Discretion can be warranted

STIs

Management may have rapidly responded to force majeure events, such as coronavirus, by reducing working capital (inventories, casual employees, shift work), and dividend reduction. The efforts may provide sufficient cash cushion to enable more rapid recovery than competitors, depending on a fine judgement of when to reinvest for recovery.

The board may consider and explain these factors in disclosure for exercising discretion to pay a higher incentive than financial and STI targets for the year would otherwise warrant.

Here is a checklist to determine if discretion on the STI outcome is warranted, permissible, and acceptable:

- Does the STI plan say that the board can exercise discretion in the event performance requirements are not met, or not fully met?

- What has previously been disclosed to shareholders about the board’s ability to exercise discretion?

- How clearly will management’s efforts be recognised by investors as warranting an STI, notwithstanding poor financial performance for the year?

- Can an award of STI be deferred on a discretionary basis, and be subject to a final vesting decision after a reassessment of performance post-crisis? Would investors approve of an STI payment where executives did not meet annual performance targets under such conditions?

- Is the TSR for the annual performance period negative?

- Has performance for the year relative to competitors been top quartile, e.g. production growth, productivity, revenues, earnings, return on capital?

- Has performance for the year been an improvement on the prior year, e.g. bottom quartile to 3rd quartile, market share from 3rd to 1st?

- Would realisable pay outcomes be fair and justified relative to peers?

- Is there a real risk of turnover if discretion to adjust the STI outcomes is not exercised? Remembering that most other companies will be facing the same decisions and STI outcomes as your own.

Bonuses

Bonuses are not STIs. This is not well understood.

Technically, a bonus is a discretionary payment in recognition of past performance. The payments are not the outcome of a measurement of achievement against pre-established goals, targets or KPIs.

STIs are structured incentive plans where a component of the total pay opportunity is known, is variable and is at risk and are the outcome of a measurement of achievement against pre-established goals, targets or KPIs.

The statutory tables in the disclosures of US listed companies actually differentiate between STIs and bonuses.

Payment of a bonus can be cleaner than an overlay of a qualitative assessment of achievements against pre-set STI outcomes. For example, a flood may be the reason that management did not meet production targets. Since production targets were not met there was no STI payment. However, the board may come to a view that management’s performance in evacuating employees and affected community members for no loss of life was so exemplary that a special bonus payment be made. The board’s rationale may also include that their efforts built stronger customer allegiance, increased employee loyalty and engagement, and will position the company for better growth opportunities.

LTIs

TSR for a company relative to the TSR of other mineral mining companies may fairly reflect performance and require no exercise of discretion. An exception may be appropriate for companies that also have a gateway requiring TSR for the period to be positive. So, at the end of a performance period a company may have negative TSR, but management has achieved top quartile performance and conserved more value than peer companies.

Unfortunately, many institutional investors and their proxy advisers will not support LTI vesting when TSR for the period is negative, even if, on a relative basis, performance is top quartile. A lack of support is even more likely if companies have incorporated a positive TSR gateway for vesting in response to prior year investor feedback, which is then over-ridden by the board in an exceptional circumstance.

It is not believed that, even in a crisis of global proportions, institutional investors will stray from their prescriptive guidelines to support incentives for executives in companies that have lost, say, 5% of market value compared to their peer average of, say, 25%.

What if TSR for the period is positive? Can discretion be exercised in extreme circumstances to vest some of the reward if performance warrants it?

Modifications of performance requirements to reflect the new reality of reduced demand, or an extension of the performance period to allow time for recovery, will impact the accounting charge and the statutory disclosures of KMP executive remuneration in the remuneration report. Hence, most companies do nothing, and these remain on foot.

Here is a checklist to determine if the exercise of LTI discretion is warranted, permissible, and acceptable:

- Do the LTI plan rules and/or offer letter say that the board can exercise discretion on vesting?

- For Managing Directors with LTI grants on foot that have been granted following shareholder approval, did the NoM resolution notes state that the board has discretionary powers inclusive of vesting?

- Is TSR for the period negative? Is positive TSR a hard-wired gateway before anything vests?

- Has relative performance been top quartile, e.g. production growth, productivity, revenues, earnings, return on capital, as well as TSR?

- Has relative performance improved, e.g. bottom quartile to 3rd quartile, market share from 3rd to 1st?

- Would realisable pay outcomes relative to peers be fair and justified?

- Is there a real risk or turnover if discretion to vest some of the LTI is not exercised?

- What incremental costs/accounting charges will be incurred?

- Is the exercise of discretion a variation of the terms of the share rights that are not permitted under the ASX Listing Rules?

New grants of equity

Current LTI grants on foot may have no chance of vesting given what has occurred. They could be cancelled, but this would result in an additional remuneration expense, because the accounting standards require the amortised costs to be brought forward.

New grants to accommodate changed circumstances could be considered. Given that most companies grant annually, an out-of-cycle grant would not be considered necessary by most stakeholders.

Retention grants

Remember the GFC? An initial response by many companies was to provide special retention grants. These were to make up for forgone incentive income. Investor response was not supportive, as it was believed that retention grants were not necessary – with such a widespread crisis where were the executives going to go?

However, force majeure events could selectively impact only a few companies in the same industry (e.g. cyclones in the geography of a company and not in others where competitors operate). Generally, boards will have sufficient discretion in such cases under STI plans to consider management response and arrive at a fair outcome, not necessitating a retention grant.

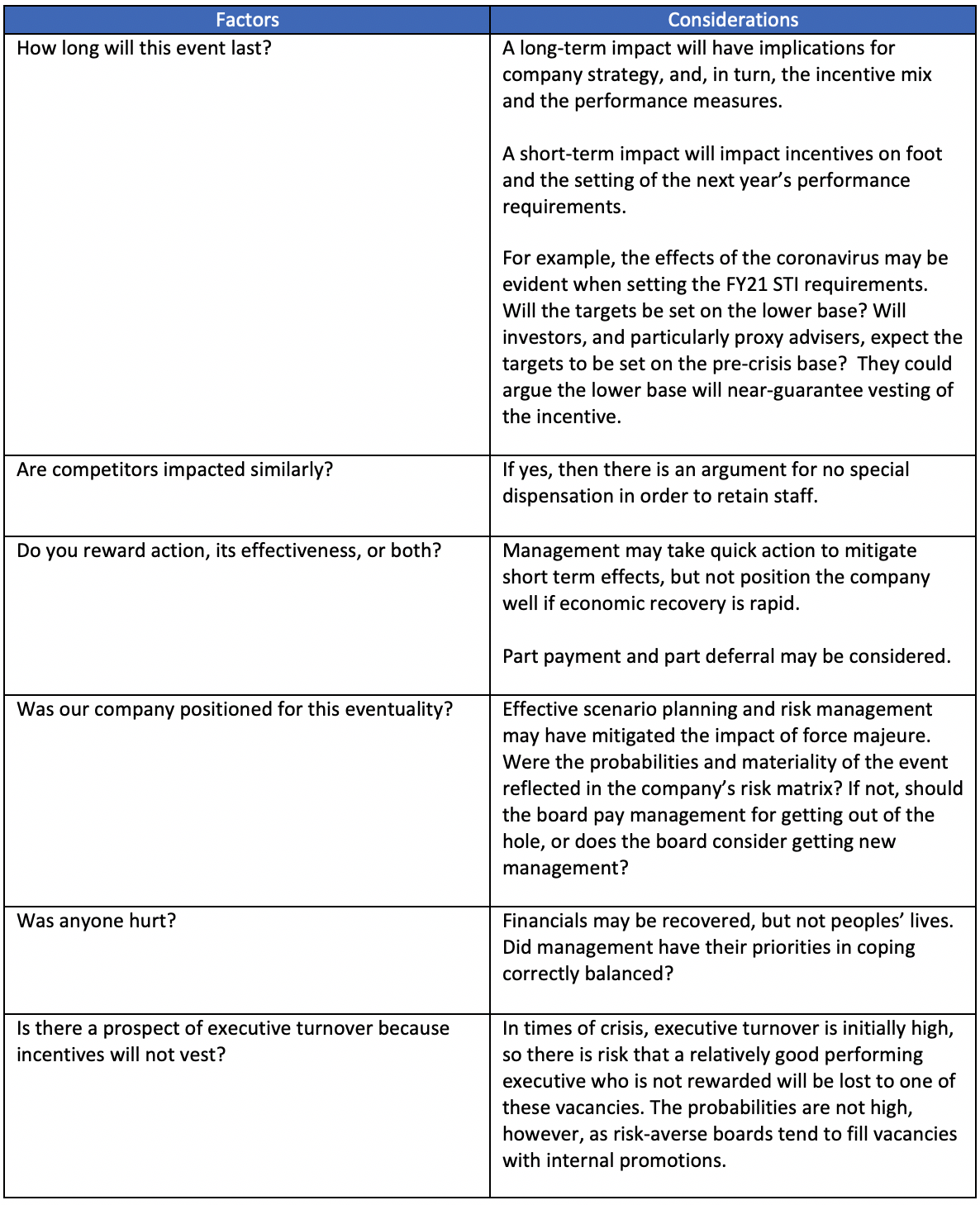

A checklist

Below is a summary checklist of force majeure and executive remuneration considerations

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter