09/03/2018

Once again, it’s time for our annual review of changes in board director fees.

We compared the remuneration paid to 961 same incumbent non-executive directors (NEDs) from ASX 300 companies in 2016 and 2017. The median increase (including both directors and chairmen) was 2.5%. This is very close to the 2016 median increase of 2.3% though 25% higher than the 2.0% increase experienced by CEOs. (See our CEO pay increase analysis HERE.)

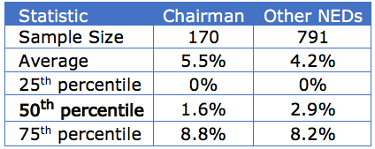

Table 1: Non-executive director remuneration adjustments

Relative to the prior period, there was an increase in both the proportion of NEDs receiving an increase in 2017 and also in the proportion of NEDs experiencing a decrease in fees.

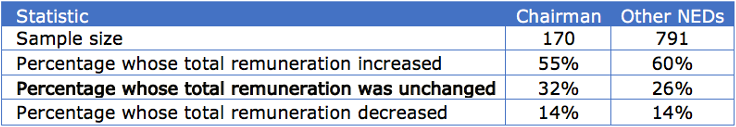

Table 2 below shows the proportion of chairman and directors that received increases and decreases.

Table 2: Median change in total remuneration and percentage receiving an increase/decrease

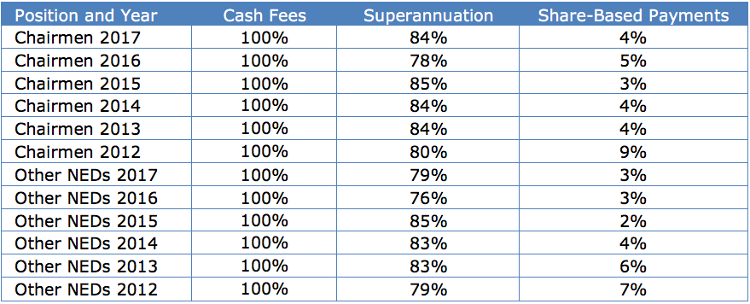

Table 3 below shows the breakdown of NEDs’ remuneration and the proportion of NEDs that receive each component over a number of years.

Table 3: Percentage receiving each remuneration component

These percentages are based on statutory disclosures that have been subject to audit. They may seem surprising because superannuation contributions are not made in respect of a proportion of directors.

The reason why superannuation contributions are made in respect of less than 100% of directors is most likely because of the basis on which they are engaged by the company. Many directors have contractual arrangements with the company whereby the company contracts with an associated entity of the director. The company pays a gross contracted amount to the associated entity for it to provide the services of the director. Under this arrangement, the company is not liable for the SGC as it is not paying the fees to an individual.

Changes by Sector

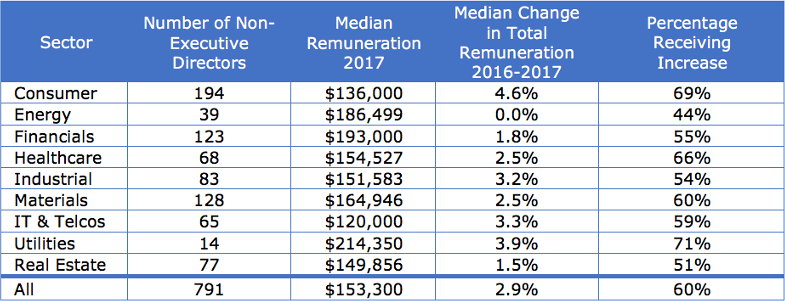

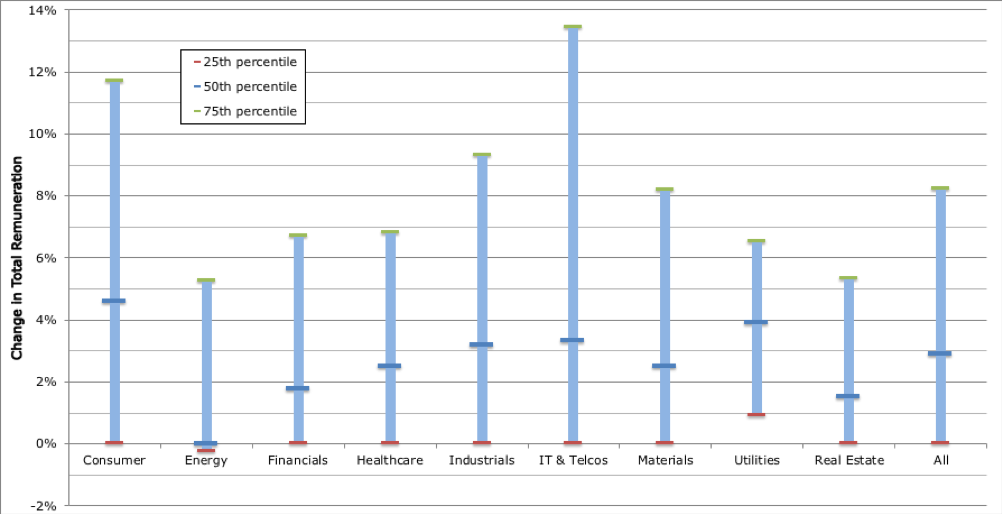

Over the last few years, the sectors with the highest fee increases have been Utilities and Healthcare. While utilities now has the highest median remuneration of all the sectors, this year the Consumer sector has seen the largest fee increases, recording a median increase in total remuneration of 4.6%. The consumer sector was also the sector with the second highest proportion of NEDs receiving an increase.

These figures exclude chairmen but include deputy chairmen. Due to exclusions and small sample sizes for some sectors, the chairmen statistics have not been reported.

Table 4: Median change in total remuneration for directors by industry (excluding chairmen)

2016 saw the creation of a new GICS sector. Real Estate was moved out from under the Financials sector and promoted to its own sector.

Within the energy sector, several directors experienced either no change (33%) or a reduction (23%) in fees received. On average, this sector saw no increase in remuneration, that is, a median change in remuneration of 0% – the lowest median of all the sectors. This may reflect the challenging climate with regard to the oil industry over 2016 and 2017. Additionally, most of the companies in this sector (11 out of 14) make up the upper quartile of market capitalisation, where large fee increases are rare.

The average fee increase of 11% within the IT & telcos sector was higher than the median increase and this was due to some significant increases in NED fees among these companies.

Figure 1 below shows the interquartile range for the increases in fees in 2017 by sector (the median increase is shown by the dark blue horizontal line).

Figure 1: Inter-quartile range of percentage change in total remuneration by sector

Changes by size

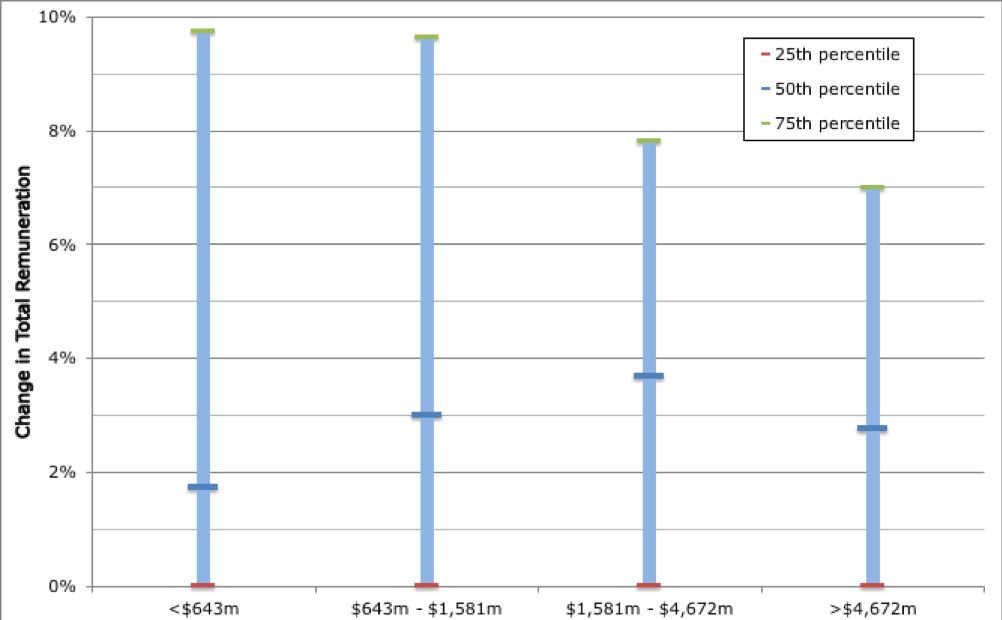

The 240 companies used in the analysis were split into quartiles based on market capitalisation. Since larger companies tend to have larger boards, the number of NEDs in the top quartile companies is higher.

Table 5: Median change in total remuneration for directors by company size

NEDs of companies in the third quartile received the largest median increase in total remuneration, and were, along with the top quartile, most likely to receive an increase. The companies in this third quartile comprise a large number of consumer companies whose median fee increases are the largest.

The inter-quartile range for the increase in total remuneration by company size is shown in Figure 2 below.

Figure 2: Inter-quartile range of percentage change in total remuneration by company size

Directors of larger companies tend to have more consistent increases in fees over time. That is, there are fewer very large increases or decreases in fees among larger companies. This may be due to the higher regularity of fee increases in this group, the high degree of scrutiny of this group of companies and the mature stage of modest growth at which most now operate.

Methodology

The 961 NEDs (791 NEDs excluding chairmen) were drawn from 240 ASX 300 companies from all industries. Newly listed companies and companies listed on foreign exchanges that do not disclose remuneration in Australia were excluded. The market capitalisation of these companies ranged from $124 million to $156 billion, based on a 30-day average to 22 January 2018.

We derived our results by analysing the change in non-executive director remuneration from 2016 to 2017 with data downloaded from GuerdonData®., Guerdon Associates’ proprietary database of executive and director remuneration data for ASX 300 companies. (Now available for client subscription – a demo of the database in action is Here. For enquiries contact us on info@www.guerdonassociates.com).

Directors who were not in the same position for all of 2016 and 2017 were excluded from the analysis. In addition to this, we disregarded directors who were based overseas on the basis that their remuneration would include travel perquisites and other emoluments that would not be representative of remuneration of locally based directors.

To validly determine the rate of increase, we calculated the change in fees for each individual NED (this is the ‘incumbent-weighted’ increase). An alternative would be the remuneration-weighted change, which examines the change in aggregated statistics.

© Guerdon Associates 2024

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter