07/09/2020

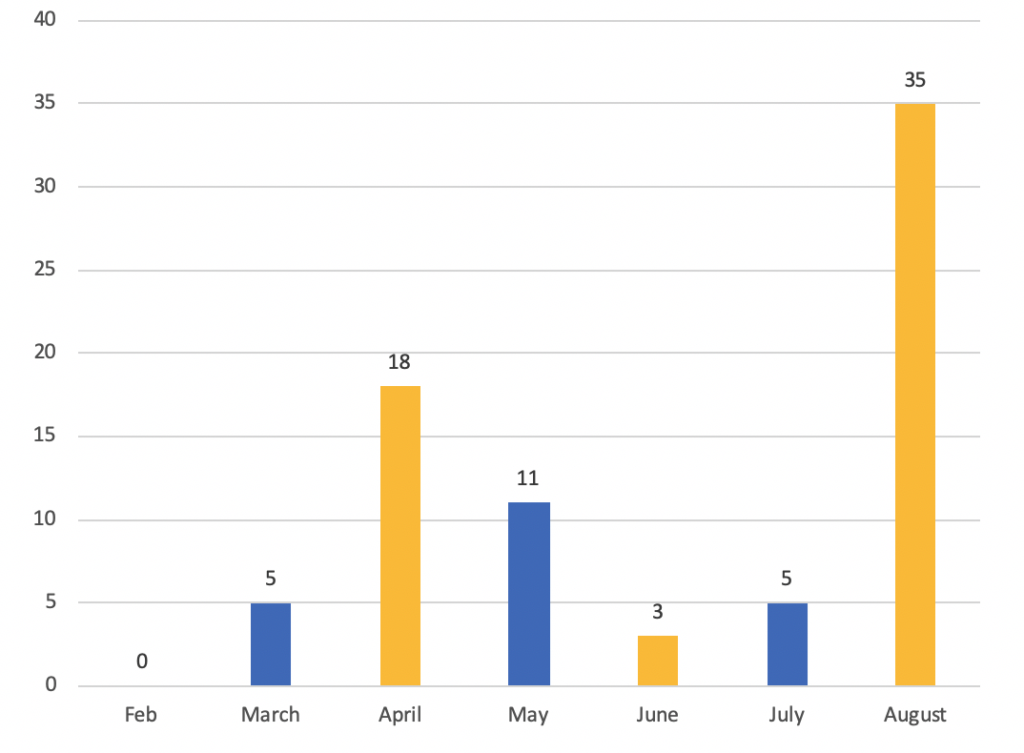

A second wave of remuneration adjustment disclosures have emerged during the August results season. Judging from the numbers, it is something like a tidal wave.

In total, there have been 77 ASX 200 companies which have announced a negative remuneration adjustment for key management personnel (KMP) due to the COVID-19 pandemic or oil price fall.

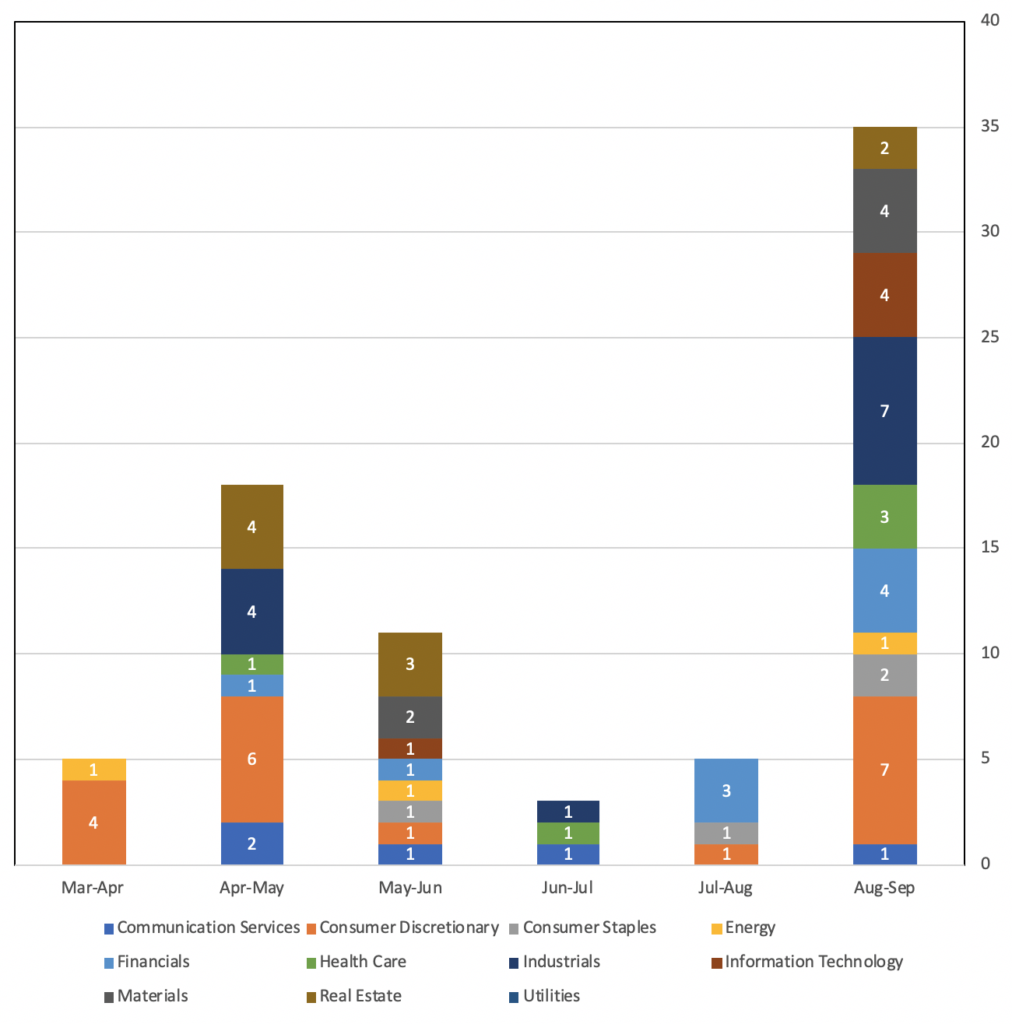

Figure 1: COVID-19 remuneration adjustments per month

Press releases which are not accompanied by an official ASX company release have not been included in the data analysis below.

Whose remuneration has been impacted?

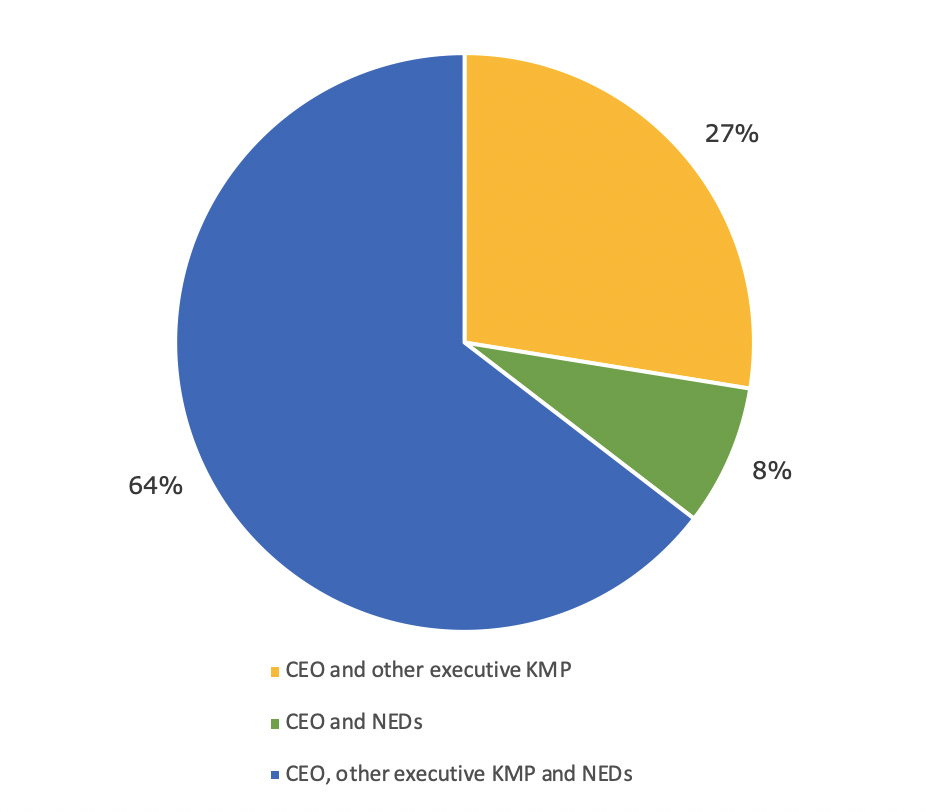

The majority of companies making remuneration adjustments applied them both to executive KMP and non-executive directors (NEDs).

All non-executive director-related adjustments were applied to both the chairman and other NEDs of the company.

Figure 2: KMP impacted by remuneration adjustments

The size of remuneration reductions

Companies that did not announce the size of their remuneration reduction were not included in the following analysis.

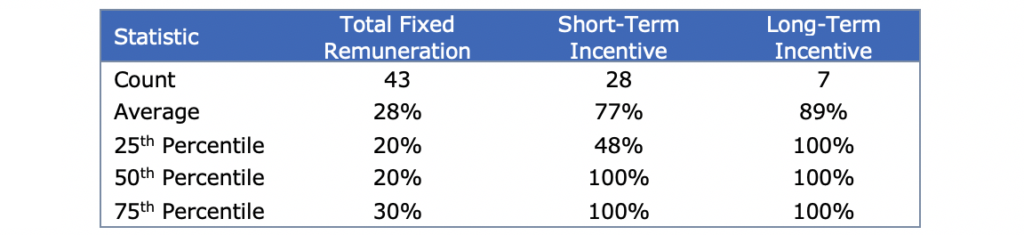

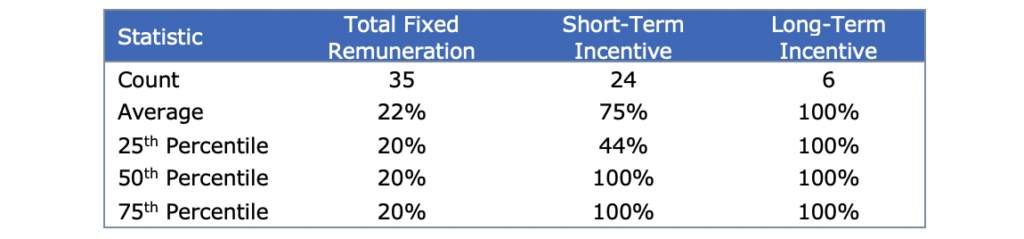

Tables 1 and 2 show the average and quartiles of the adjustments in each remuneration component for CEOs and other executive KMP.

Table 1: ASX 200 CEO COVID-19 remuneration reduction percentages

Table 2: ASX 200 other executive KMP remuneration reduction percentages

Not shown in the tables above are six companies that announced adjustments to For executive KMP, the adjustments to total remuneration ranged from 20% to 50%.

Eight companies announced fixed pay reductions for the CEOs only. The remaining 35 companies announced fixed pay reductions for all executive KMP. Of those 35 companies, 13 CEOs took a larger pay reduction than the other executive KMP.

Most of the short-term incentive (STI) and long-term incentive (LTI) adjustments were executive KMP For CEOs, this was the case for 19 of 28 (68%) STI adjustments and 6 of 7 (86%) LTI adjustments. For other executive KMP, this was the case for 16 of 24 (67%) STI adjustments and 6 of 6 (100%) LTI adjustments.

Six of 7 LTI adjustments (86%) were applied to all executive KMP. Three companies decreased the LTI vesting outcome for executive KMP in the year. The other three companies reduced the LTI grant size for executive KMP for the upcoming financial year. One company reduced the LTI grant size for the CEO only.

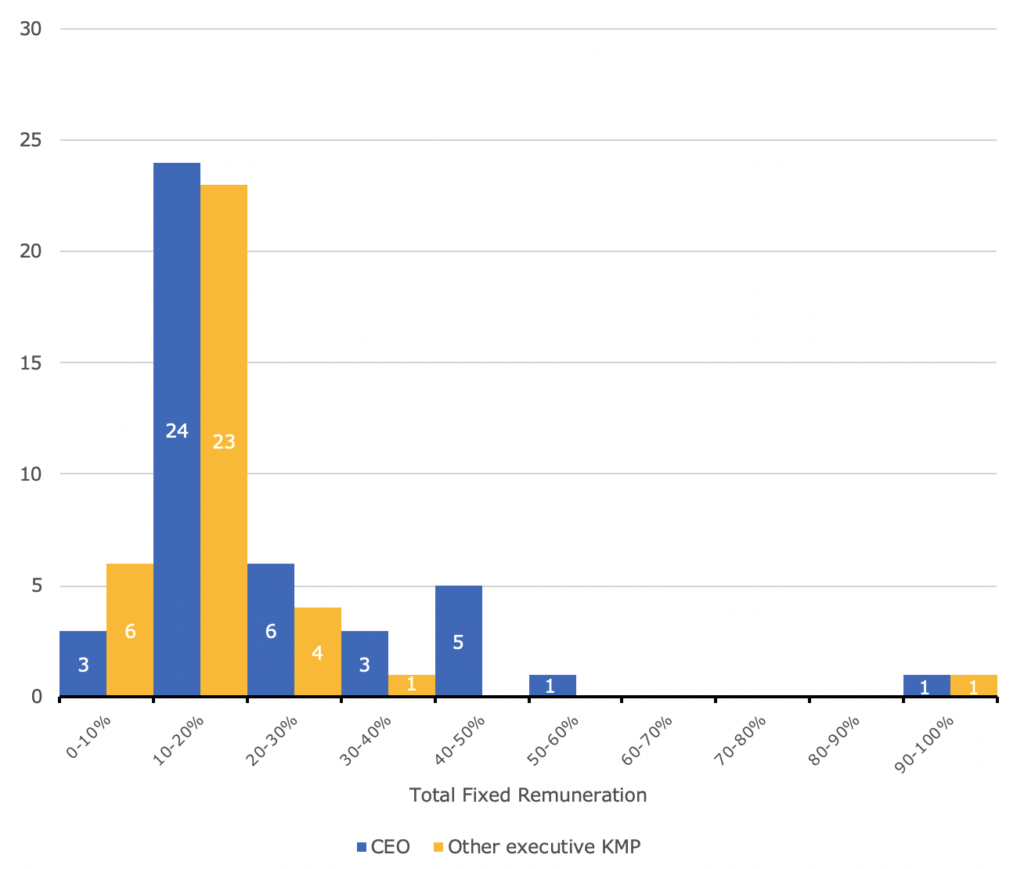

The majority of executive KMP reductions were between 10% to 30% of TFR. The most frequent reduction to TFR remains at 20%. The distribution of executive KMP TFR reductions is shown below.

Figure 3: Executive KMP remuneration reduction breakdown

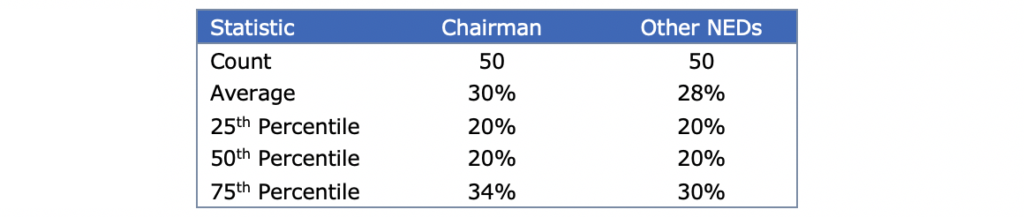

Table 3 shows the average and quartiles of the adjustments in total fees (board fees plus committee fees) for the chairman and other NEDs.

Table 3: ASX 200 NED COVID-19 remuneration adjustments

The total fee reductions were predominantly equal for both the chairman and other NEDs on the same board. There were 6 instances of chairmen taking a larger fee reduction than other NEDs on the board. This is an increase from one company during the previous analysis in May.

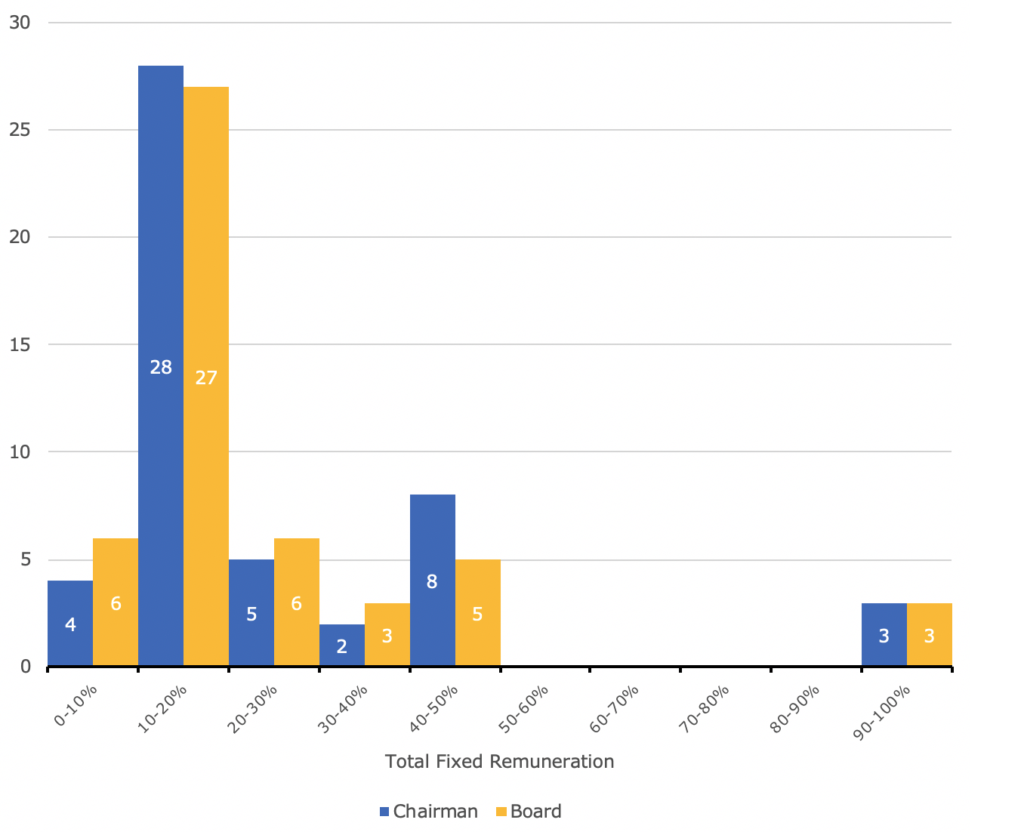

The majority of NED fee reductions were also between 10% and 30% of total fees. The most frequent reduction remains at 20% of total fees. The distribution of NED fee reductions is shown below.

Figure 4: NED total fee reduction breakdown

Sector breakdown

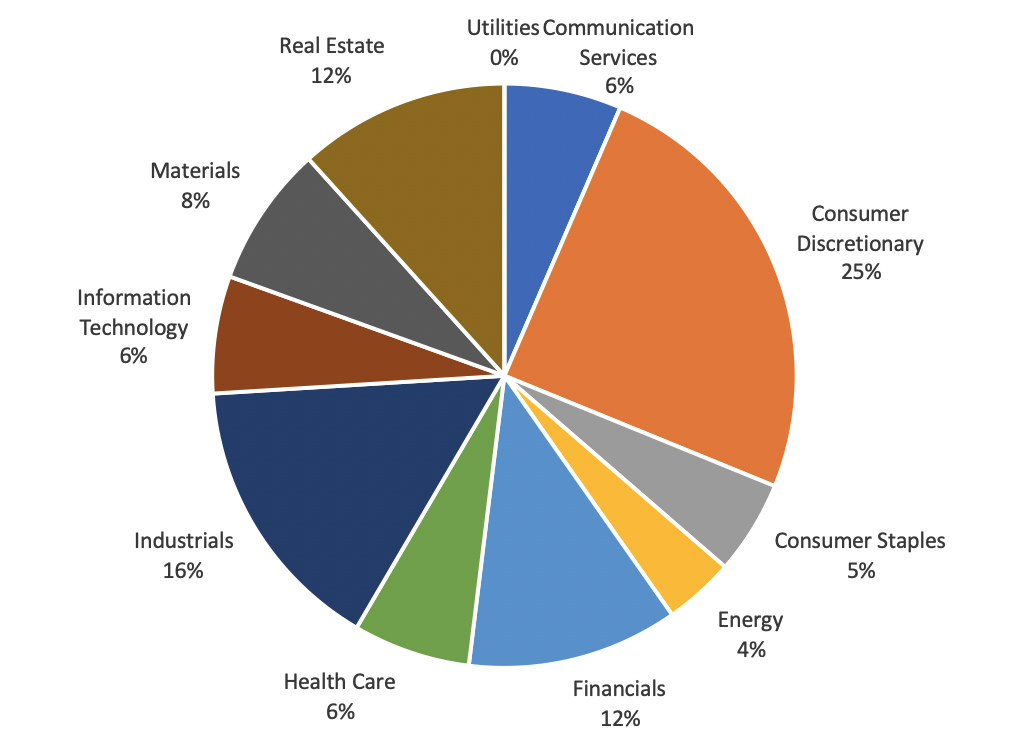

The Consumer Discretionary and Industrials Global Industry Classification Standard (GICS) sectors continue to be the most prominent in remuneration adjustments.

Consumer Discretionary, Financials, Industrials and Real Estate sectors make up 65% of all remuneration adjustments in the ASX 200. Energy and Utilities have had the least adjustments, with 3 and zero, respectively.

Figure 5: GICS Sector breakdown of ASX200 remuneration adjustments

Figure 6 shows the timing of the remuneration adjustments for each GICS sector.

Figure 6: Timing of remuneration adjustments by sector

Consumer Discretionary announcements dominated March to May and have surged in August. Financials only had 2 announcements from March to June but have had 7 announcements since July. While Real Estate dominated from April to June, there have only been 2 announcements thereafter. Industrials has also had a resurgence in August.

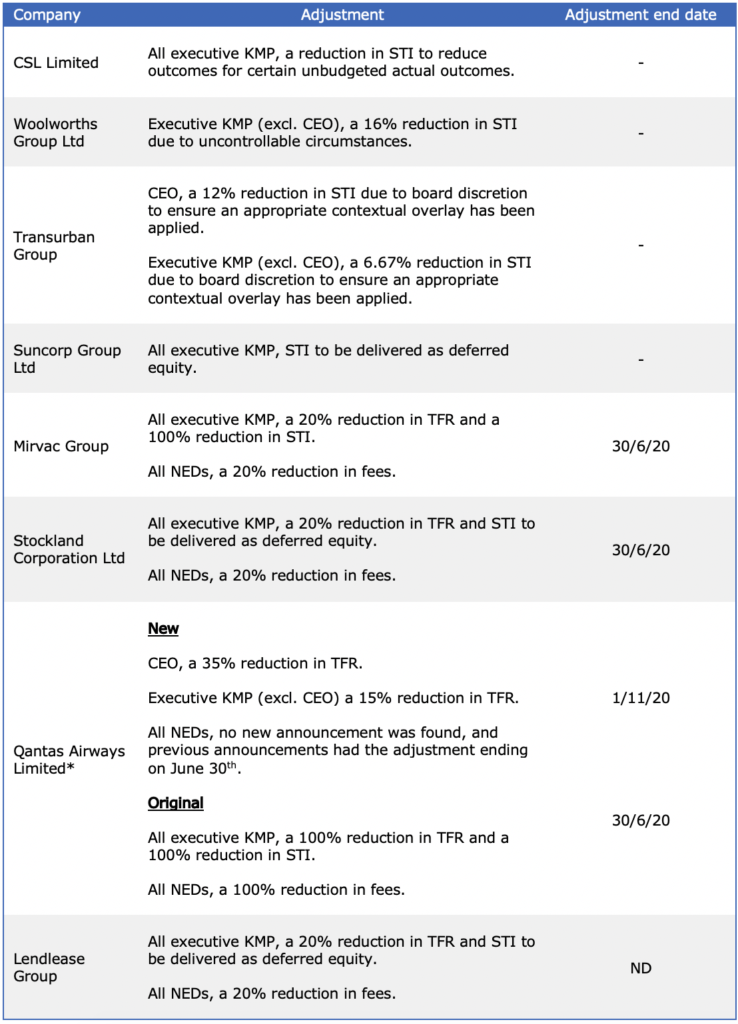

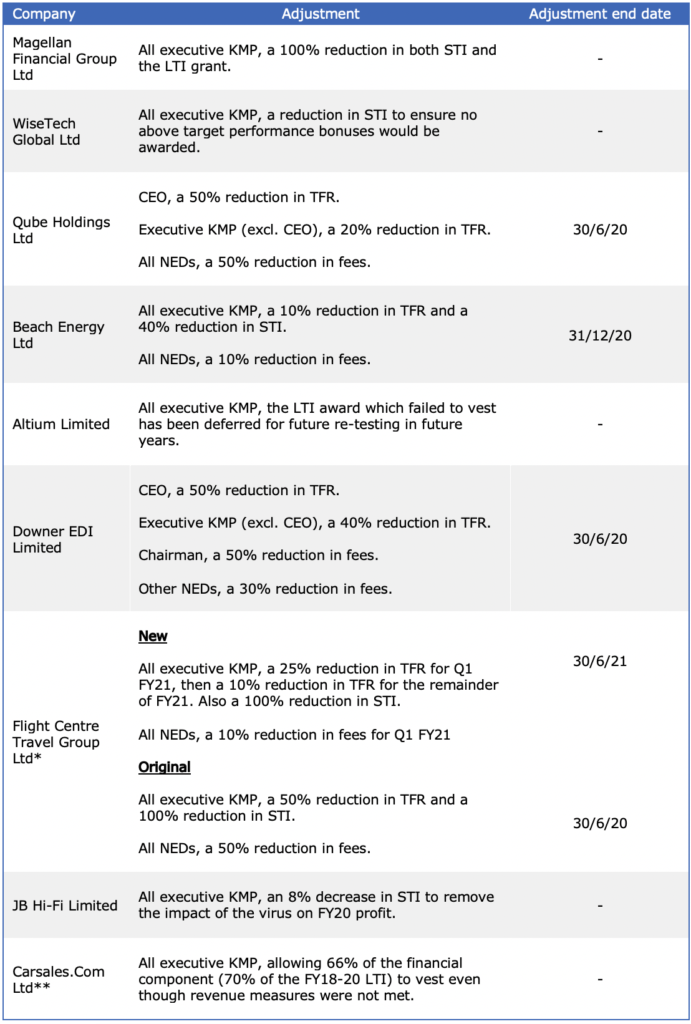

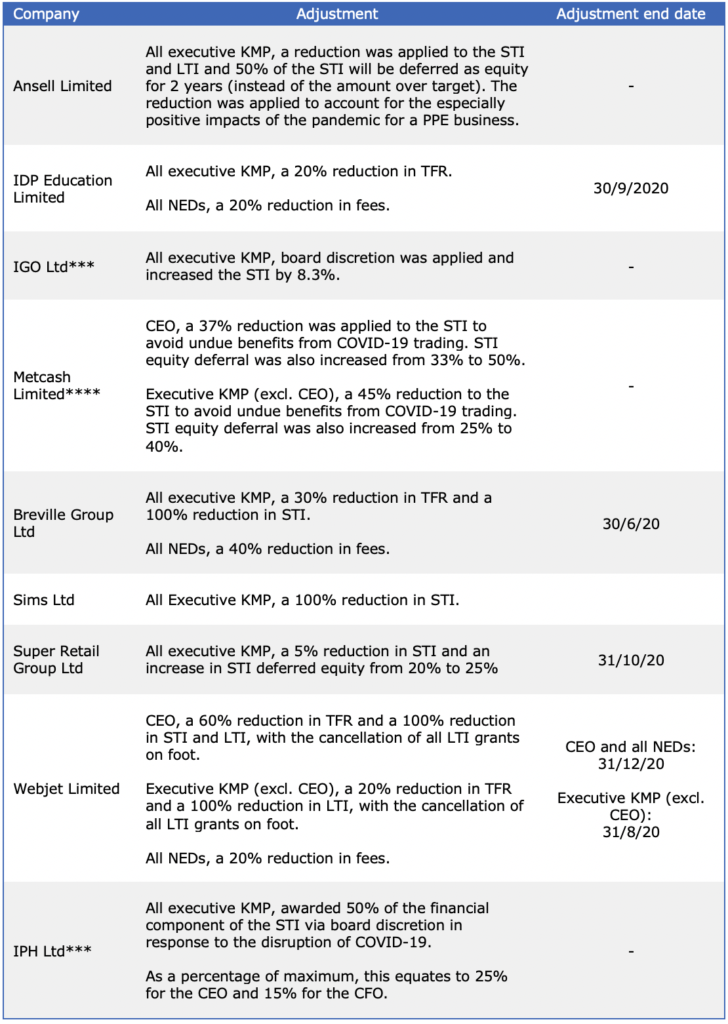

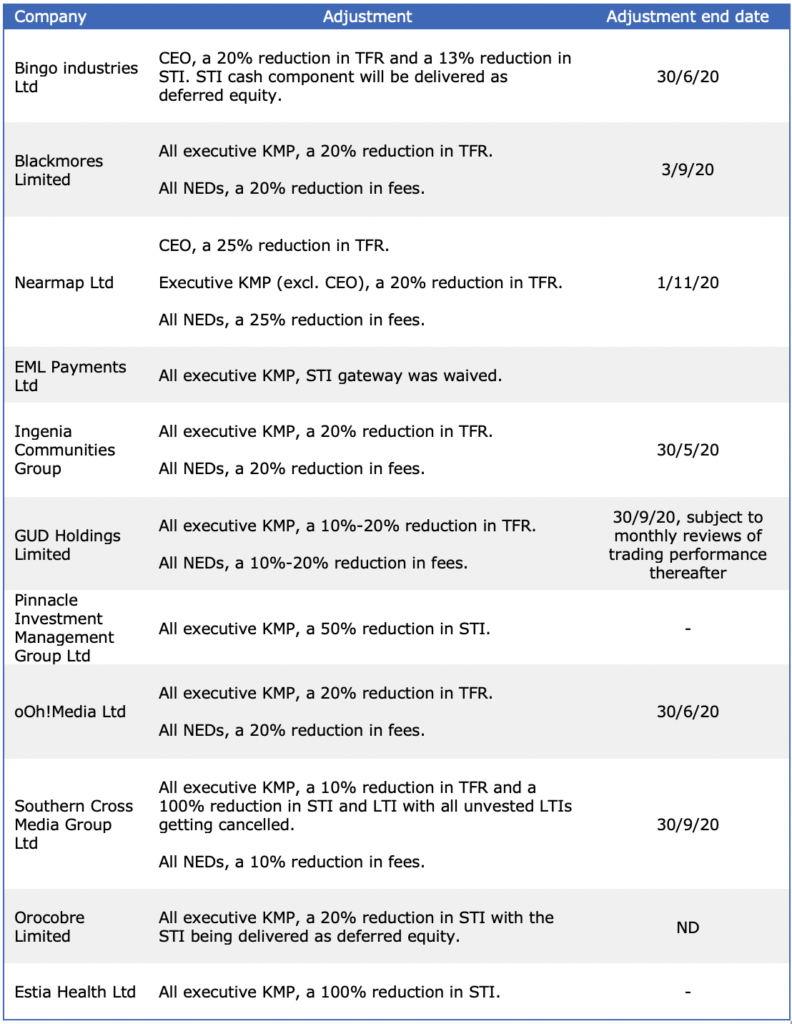

An update of COVID-19 announcements compared to the previous articles see HERE and HERE is in the table below.

Alternatively, click HERE to view our database with all COVID-19 remuneration adjustments for ASX200 companies.

Note that TFR refers to total fixed remuneration, STI refers to short-term incentive and LTI refers to long-term incentive. ‘$ND’ refers to a remuneration adjustment that was disclosed without its magnitude and ‘ND” refers to not disclosed.

Table 2: New ASX 200 companies remuneration adjustments

© Guerdon Associates 2024

Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter