12/10/2020

Guerdon Associates has been conducting analysis on Long Term Incentive (LTI) vesting outcomes to determine the likelihood that the LTI plan will vest (see HERE). Our research and analysis examined the vesting outcomes for LTI plans with performance periods ending between FY17 and FY19 for the current ASX 200 constituents.

This month we are comparing LTI vesting outcomes for companies in different Global Industry Classification Standards (GICS) sectors.

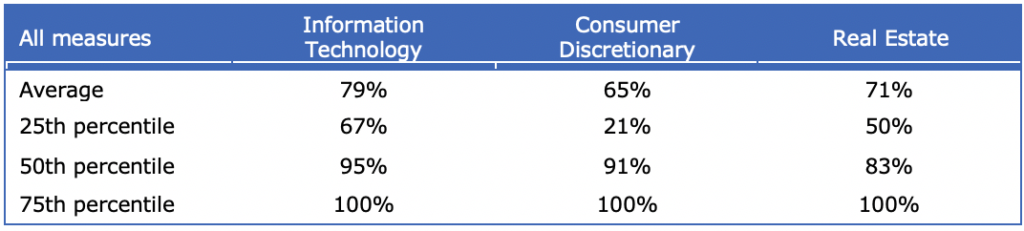

The table below shows the sectors which had the highest LTI vesting outcomes over the analysed period.

Table 1: Sectors with the highest vesting outcomes

Companies in the Technology sector had the highest vesting outcomes between FY17-FY19, with a median vesting outcome of 95% of maximum and average of 79%. This is reflective of the technology boom in recent years and the Australian technology companies racing to list (see HERE).

Companies in the Consumer Discretionary and Real Estate sectors also had high vesting outcomes during this period.

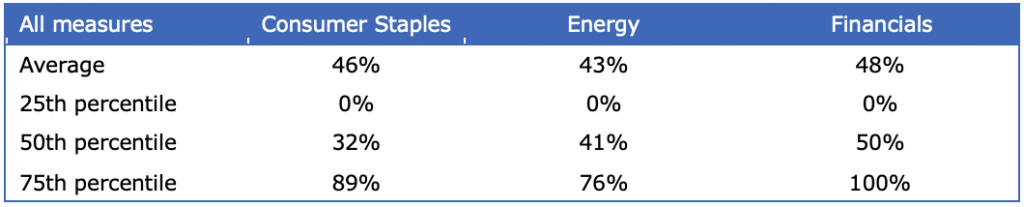

The lowest LTI vesting outcomes were for companies in the Consumer Staples, Energy and Financials sectors.

Table 2: Sectors with the lowest vesting outcomes

It is worth noting that:

- Even before the oil price crash and asset write-downs in 2020 the LTI vesting outcomes in the Energy sector were relatively low;

- Consumer Discretionary had much higher vesting outcomes than the Consumer Staples sector; and

- The Real Estate sector had much higher vesting outcomes than the Financials sector, which prior to 2016 included Real Estate companies as well (see HERE). This difference may be influenced by the focus on banking and their remuneration from the recent royal commission and other related instances (see HERE).

The data suggests that the remuneration an executive may realise may be more a function of luck (in terms of the industry she may work in), rather than her performance.

We expect to continue to release more information over the coming months as we uncover more interesting trends and insights from the data. In the meantime, contact us if you would like assistance in adapting this data and information into your next remuneration plan.

© Guerdon Associates 2024 Back to all articles

Back to all articles

Subscribe to newsletter

Subscribe to newsletter